NS Solutions (TSE:2327): A Fresh Look at Valuation After Recent Stock Movements

Reviewed by Simply Wall St

NS Solutions (TSE:2327) has seen its share price make some subtle moves recently, and for investors eyeing the stock, these shifts might be enough to spark some new questions. While there isn’t a specific event dominating the headlines today, the stock’s recent activity could be a signal, whether of a changing outlook or simply renewed curiosity in its long-term positioning. Either way, investors looking to make a call on NS Solutions may be wondering if now is a time to act or wait for clearer signs.

Stepping back, NS Solutions has experienced moderate gains over the past year, with a 2% return that stands in stark contrast to the strong three-year result of 120%. The momentum has cooled off lately, with the stock down 7% year-to-date and showing a negative trend over the past three months. Despite this, pockets of short-term strength, such as this past week’s 6% climb, hint at shifting sentiment. While revenue and net income continue to post mid- to high-single digit yearly growth, these developments come as the larger sector landscape also evolves.

So after a year of quietly drifting performance, is NS Solutions undervalued at this level, or does the stock’s price already anticipate more growth ahead?

Price-to-Earnings of 25.2x: Is it justified?

NS Solutions is currently valued at a Price-to-Earnings (P/E) ratio of 25.2x. This level is considered high both compared to the Japanese IT industry average of 17.8x and the peer average of 23.2x. This suggests the market has priced in higher growth or views the company as lower risk relative to its sector.

The P/E ratio measures how much investors are willing to pay for each unit of earnings and is often used as a quick benchmark to compare stock valuations within an industry. For tech and IT companies, a higher P/E can reflect optimism about future growth, but it can also mean expectations are already factored into the current price.

With earnings growth now lagging both its five-year average and wider sector peers, the elevated multiple may give potential buyers pause. Unless the company can reignite rapid profit growth, the current valuation appears somewhat high compared to rivals.

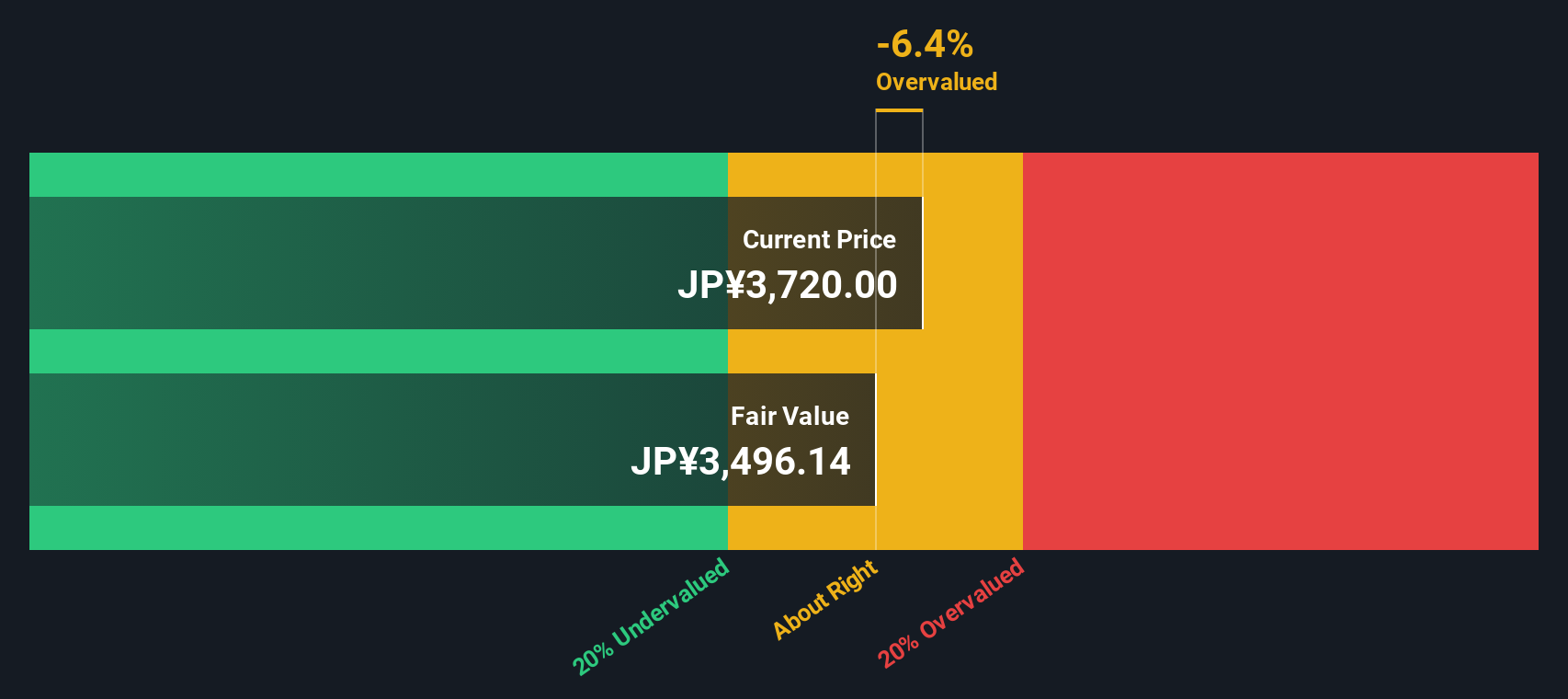

Result: Fair Value of ¥3,518.4 (OVERVALUED)

See our latest analysis for NS Solutions.However, softer earnings growth and persistent price volatility could quickly alter investor sentiment. These factors can act as catalysts that invalidate the current valuation narrative.

Find out about the key risks to this NS Solutions narrative.Another View: SWS DCF Model Says Overvalued Too

Looking from a different angle, the SWS DCF model also points toward NS Solutions being overvalued at current prices. This supports what the market's valuation multiples already suggest. But what could shift this outcome?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NS Solutions Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, it only takes a few minutes to build your own view. Do it your way

A great starting point for your NS Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunity pass you by. Use the Simply Wall Street Screener to find not just similar stocks, but game-changing alternatives you might be overlooking.

- Spot emerging leaders among artificial intelligence innovators by starting with AI penny stocks.

- Unlock undervalued gems with robust fundamentals by browsing our picks for undervalued stocks based on cash flows.

- Tap into steady cash flows from companies offering reliable yields by checking out dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NS Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2327

NS Solutions

Provides information technology solutions in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives