- Japan

- /

- Food and Staples Retail

- /

- TSE:3148

Uncovering Hidden Gems With Strong Potential In None

Reviewed by Simply Wall St

As global markets continue to react positively to potential trade negotiations and AI innovations, the S&P 500 has reached new heights, while small-cap indices like the Russell 2000 have shown solid gains. This environment of optimism and technological advancement provides a fertile ground for identifying undiscovered gems—stocks that may not yet be on every investor's radar but possess strong fundamentals and growth potential in sectors poised for expansion.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 46.58% | 6.59% | 23.75% | ★★★★★★ |

| Korea Ratings | NA | 0.84% | 0.92% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 7.52% | 53.96% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| An Phat Bioplastics | 58.77% | 10.41% | -1.47% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Hansae Yes24 Holdings | 80.77% | 1.28% | 9.02% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Systena (TSE:2317)

Simply Wall St Value Rating: ★★★★★★

Overview: Systena Corporation operates in the solution and framework design, IT service, business solution, and cloud sectors within Japan and has a market capitalization of approximately ¥127.25 billion.

Operations: Systena Corporation generates revenue primarily from its Business Solution, Solution Design, and Framework Design segments, with the Business Solution segment contributing ¥28.61 billion. The net profit margin shows a notable trend at 7.5%.

Trading at 38.2% below its estimated fair value, Systena seems like a promising opportunity in the tech sector. Over the past five years, earnings have grown by an average of 10% annually. Despite not outpacing the software industry's recent growth of 12%, it maintains high-quality earnings and positive free cash flow. The company has reduced its debt-to-equity ratio from 7% to 5%, indicating prudent financial management. Upcoming projections suggest net sales between ¥85 billion and ¥90 billion for fiscal year ending March 2025, with dividends increased to ¥6 per share from last year's ¥5, reflecting confidence in future prospects.

- Click to explore a detailed breakdown of our findings in Systena's health report.

Assess Systena's past performance with our detailed historical performance reports.

Create SD Holdings (TSE:3148)

Simply Wall St Value Rating: ★★★★★★

Overview: Create SD Holdings Co., Ltd. operates in Japan through its subsidiaries, focusing on drug stores, dispensing pharmacies, and nursing care services with a market cap of ¥183.60 billion.

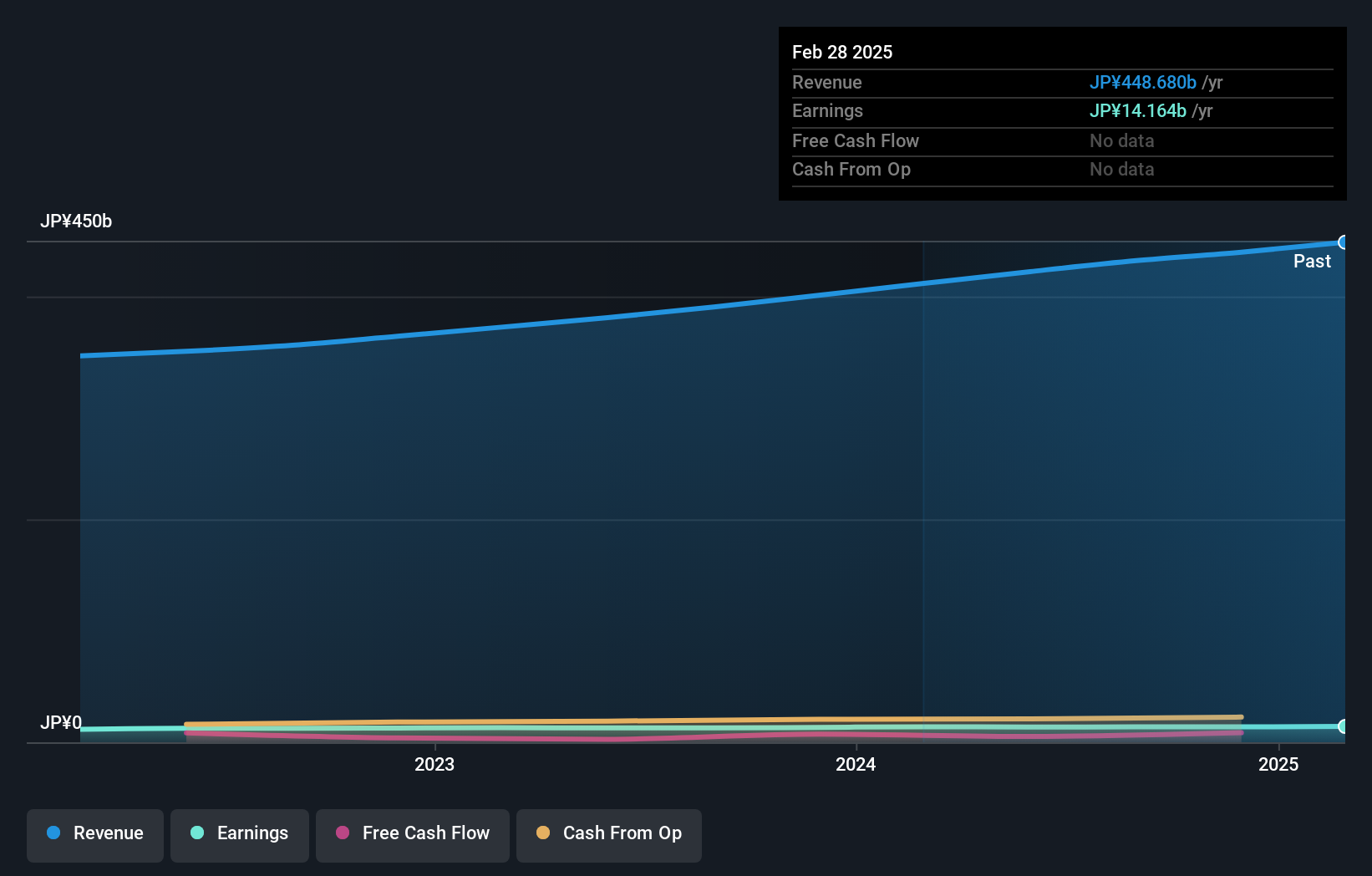

Operations: Create SD Holdings generates revenue primarily from its drug store, dispensing pharmacy, and nursing care businesses. The company's financial performance is highlighted by a net profit margin of 3.5%, reflecting its efficiency in converting revenue into profit.

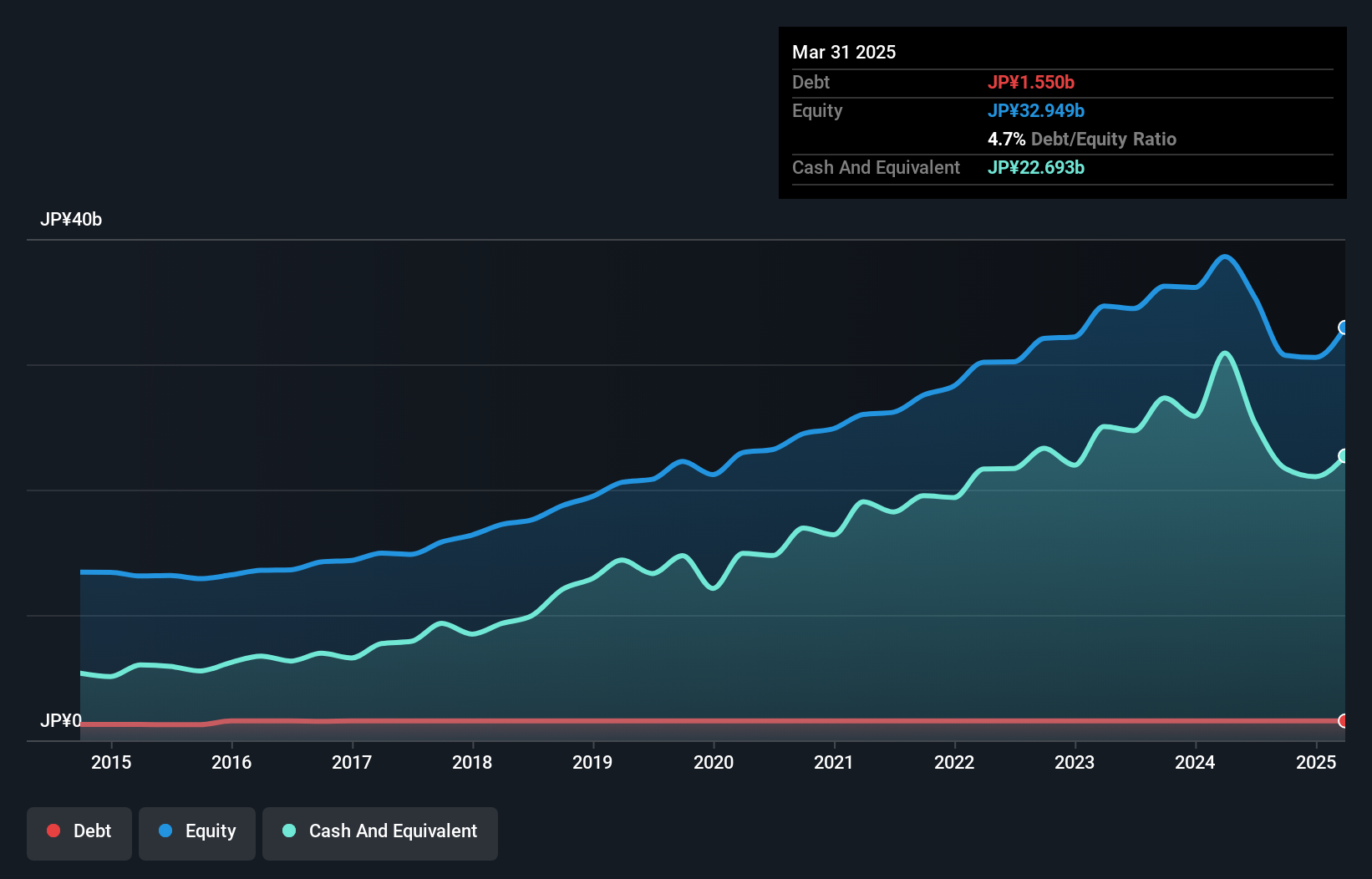

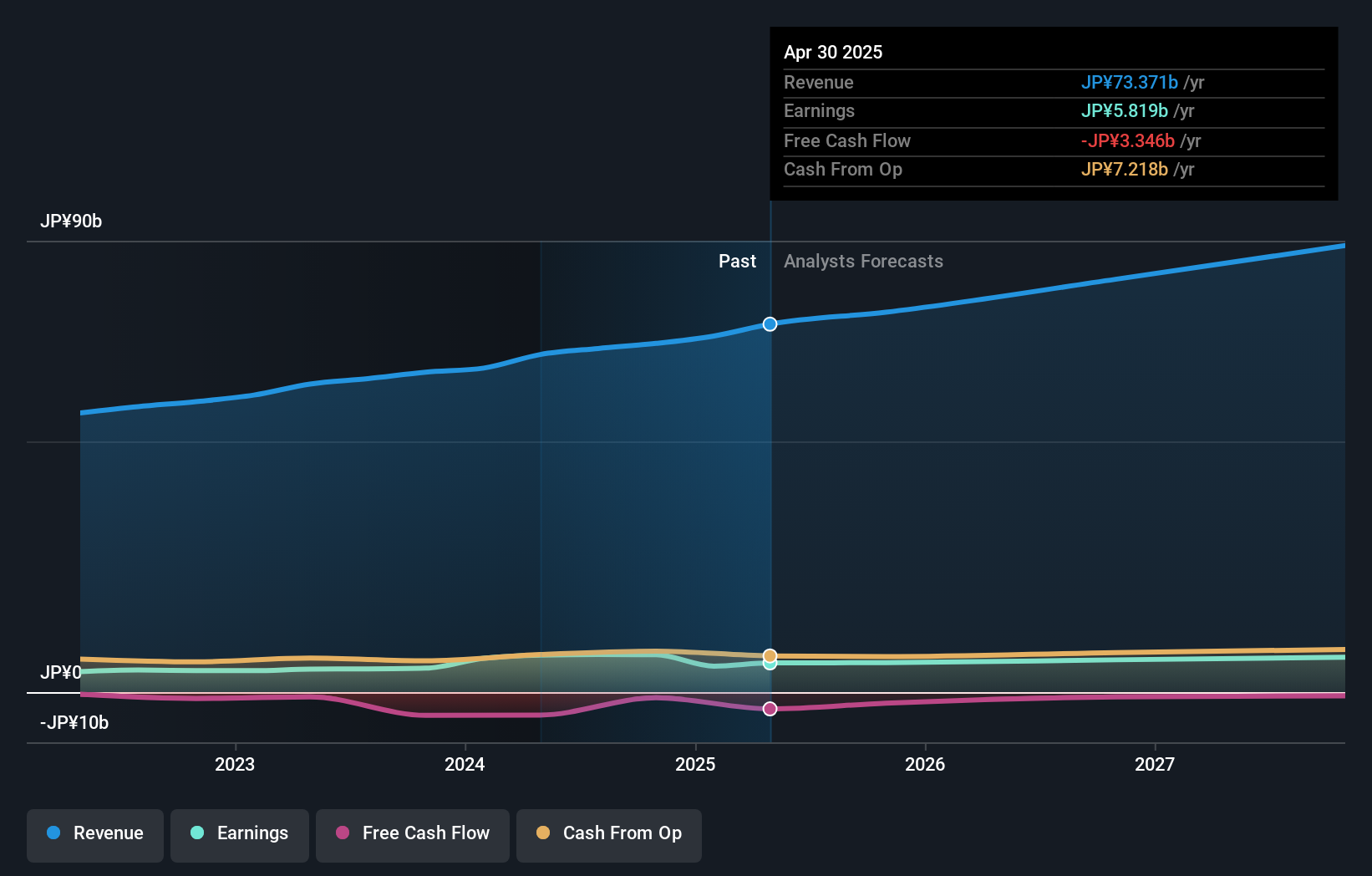

Create SD Holdings, a promising player in the consumer retailing sector, is trading at 17.7% below its estimated fair value, suggesting potential undervaluation. Despite earnings growth of 3.2% annually over the past five years, it has not outpaced the industry average of 11.5%. The company boasts high-quality earnings and remains debt-free, eliminating concerns about interest coverage. Recent guidance projects net sales of ¥457.6 billion with an operating profit of ¥22 billion for fiscal year ending May 2025, alongside a dividend increase to ¥34 per share from last year's ¥27 per share, indicating solid shareholder returns.

- Click here to discover the nuances of Create SD Holdings with our detailed analytical health report.

Explore historical data to track Create SD Holdings' performance over time in our Past section.

J.S.B.Co.Ltd (TSE:3480)

Simply Wall St Value Rating: ★★★★★☆

Overview: J.S.B.Co., Ltd. is involved in the planning, development, brokerage, and management of condominiums in Japan with a market cap of ¥64.02 billion.

Operations: The company's primary revenue streams include condominium planning, development, brokerage, and management. Its cost structure primarily involves expenses related to real estate development and operations. The net profit margin has shown variability over recent periods without a consistent trend.

J.S.B. Co. Ltd., a small player in the market, has shown impressive earnings growth of 56.1% over the past year, outpacing the Real Estate industry average of 25.8%. Despite a notable one-off gain of ¥3.1 billion impacting its recent financial results, it trades at an attractive price-to-earnings ratio of 8.6x compared to Japan's market average of 13.6x. The company's debt management appears prudent with a net debt to equity ratio at a satisfactory 22.9%, and interest payments are well covered by EBIT at 61 times coverage, indicating robust financial health despite challenges ahead with forecasted earnings decline.

- Click here and access our complete health analysis report to understand the dynamics of J.S.B.Co.Ltd.

Examine J.S.B.Co.Ltd's past performance report to understand how it has performed in the past.

Summing It All Up

- Click through to start exploring the rest of the 4664 Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3148

Create SD Holdings

Through its subsidiaries, engages in the drug store, dispensing pharmacy, nursing care, and related businesses in Japan.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion