- Japan

- /

- Professional Services

- /

- TSE:2493

Imagine Owning E-SUPPORTLINK (TYO:2493) While The Price Tanked 57%

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. Zooming in on an example, the E-SUPPORTLINK, Ltd. (TYO:2493) share price dropped 57% in the last half decade. That is extremely sub-optimal, to say the least. It's up 4.8% in the last seven days.

View our latest analysis for E-SUPPORTLINK

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

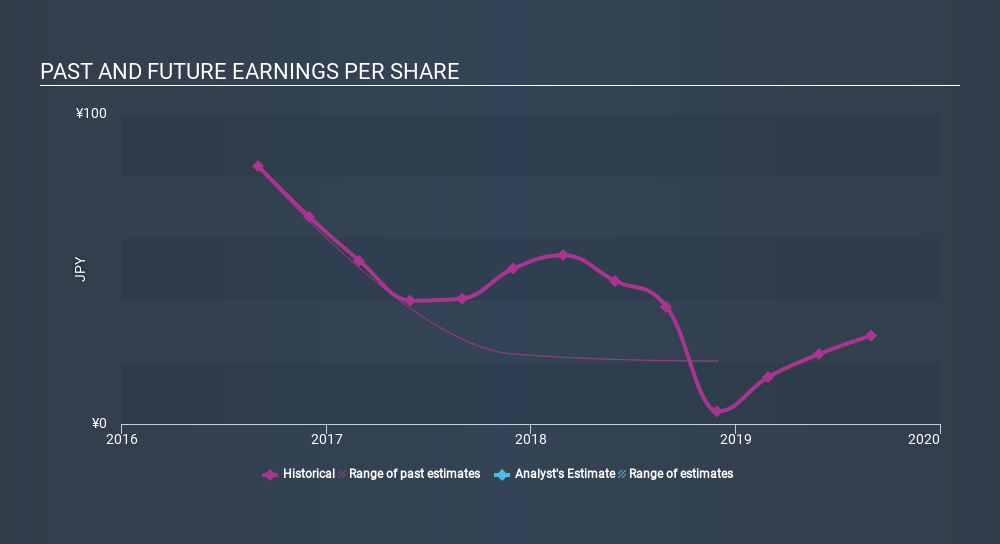

During the five years over which the share price declined, E-SUPPORTLINK's earnings per share (EPS) dropped by 19% each year. The share price decline of 16% per year isn't as bad as the EPS decline. The relatively muted share price reaction might be because the market expects the business to turn around.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on E-SUPPORTLINK's earnings, revenue and cash flow.

A Different Perspective

It's good to see that E-SUPPORTLINK has rewarded shareholders with a total shareholder return of 18% in the last twelve months. That's including the dividend. Notably the five-year annualised TSR loss of 15% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for E-SUPPORTLINK (1 doesn't sit too well with us!) that you should be aware of before investing here.

But note: E-SUPPORTLINK may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on JP exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSE:2493

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives