- Japan

- /

- Semiconductors

- /

- TSE:8035

Tokyo Electron (TSE:8035) Faces Profit Margin Challenges Amid AI Growth and Chinese Market Dependency

Reviewed by Simply Wall St

Tokyo Electron (TSE:8035) continues to solidify its leadership in the semiconductor industry, evidenced by a recent 2.1% increase in net sales to ¥566.5 billion, driven by strong demand for high-k film deposition and NAND cleaning systems. However, the company faces challenges such as a decline in gross profit margin and a dependency on the Chinese market, necessitating strategic diversification and cost management. The company report will explore Tokyo Electron's market positioning, financial performance, growth opportunities, and the strategic initiatives being undertaken to navigate industry challenges.

Take a closer look at Tokyo Electron's potential here.

Unique Capabilities Enhancing Tokyo Electron's Market Position

Tokyo Electron's recent financial performance has been marked by impressive growth metrics, underscoring its market positioning. In the latest earnings call, Hiroshi Kawamoto, Senior Vice President, noted a 2.1% increase in net sales to ¥566.5 billion, reflecting the company's strategic execution and strong demand across its product lines. CEO Toshiki Kawai highlighted record highs in net sales, gross profit, and earnings per share, further cementing the company's leadership in the semiconductor industry. The firm's innovative prowess is evident in its successful product orders for high-k film deposition systems and NAND cleaning systems, demonstrating its capacity to meet advanced technological demands. Additionally, the surging demand for AI and advanced logic products is a critical growth driver, aligning with industry trends and fueling Tokyo Electron's expansion.

Critical Issues Affecting the Performance of Tokyo Electron and Areas for Growth

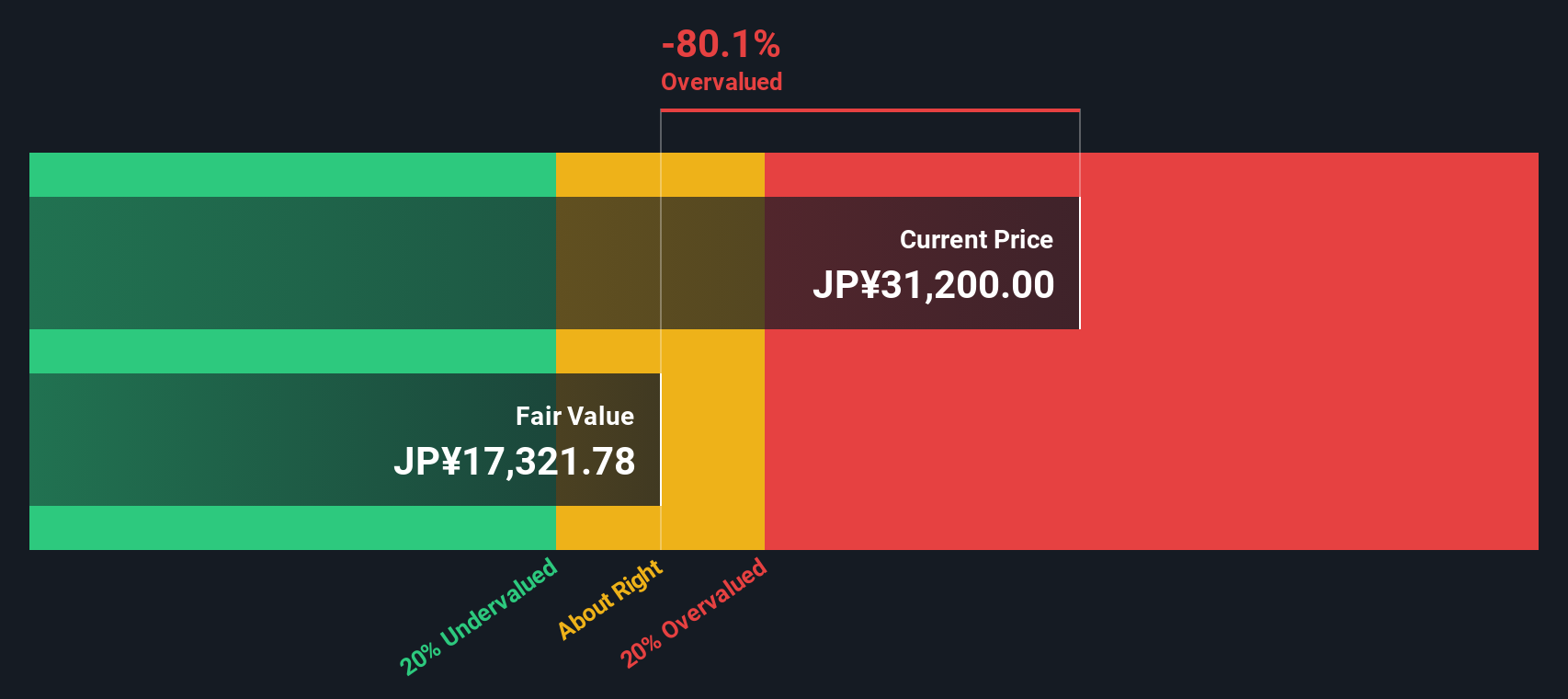

Tokyo Electron faces challenges that require attention. The recent decline in gross profit margin to 45.9%, as reported by Kawamoto, highlights difficulties in managing product mix and inventory. This decline, coupled with a 10.6% drop in operating income, suggests rising costs that could impact profitability. The company's dependency on the Chinese market, which is expected to see a reduction in sales proportion, poses a risk to revenue stability. These issues underscore the need for strategic diversification and cost management to sustain financial health. Furthermore, the company's current valuation, with a Price-To-Earnings Ratio of 24.2x, is higher than the industry average of 13.6x, reflecting its premium positioning but also indicating potential investor caution regarding its growth sustainability.

Potential Strategies for Leveraging Growth and Competitive Advantage

Opportunities abound for Tokyo Electron, particularly in the expanding AI and semiconductor sectors. Kawai's projection that AI semiconductor tools will constitute 40% of the WFE market underscores the vast potential for growth. The company's commitment to investing ¥254 billion in R&D and a planned ¥1.5 trillion over five years for R&D and CapEx signifies a strategic focus on innovation and capacity expansion. This investment is poised to enhance Tokyo Electron's competitive edge and long-term growth prospects. Additionally, the company's efforts to broaden its market presence in Taiwan, Korea, and the US are strategic moves to mitigate risks associated with the Chinese market and capitalize on diverse regional opportunities.

Key Risks and Challenges That Could Impact Tokyo Electron's Success

Tokyo Electron must navigate several external challenges to maintain its market position. Geopolitical tensions and regulatory changes, particularly those related to export controls as mentioned by Kawai, pose significant risks to its operations. The semiconductor industry is characterized by rapid technological advancements and intense competition, necessitating continuous innovation to stay ahead. Furthermore, the expected decline in the Chinese market's contribution to sales could necessitate strategic adjustments to offset potential revenue losses. These factors highlight the importance of agility and strategic foresight in Tokyo Electron's ongoing success.

Conclusion

Tokyo Electron's impressive growth in net sales and earnings highlights its strategic prowess and leadership in the semiconductor industry, driven by strong demand for its advanced technological products. However, the company faces challenges such as declining profit margins and dependency on the Chinese market, necessitating strategic diversification and cost management to maintain profitability. The company's commitment to significant R&D investments and expansion into new markets positions it well for future growth, particularly in the AI semiconductor sector. Despite being priced higher than the industry average, its premium valuation reflects investor confidence in its innovative capabilities and long-term growth potential, though it also suggests caution about sustaining this growth trajectory.

Key Takeaways

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

```If you're looking to trade Tokyo Electron, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tokyo Electron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8035

Tokyo Electron

Develops, manufactures, and sells semiconductor and flat panel display (FPD) production equipment in Japan, Europe, North America, Taiwan, China, South Korea, Southeast Asia, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives