- Japan

- /

- Semiconductors

- /

- TSE:7735

Is SCREEN Holdings Still Attractive After a 39% Surge Amid Semiconductor Boom?

Reviewed by Bailey Pemberton

If you’re keeping an eye on the Japanese tech sector, SCREEN Holdings is probably hard to ignore. Investors who jumped in over the past five years have seen the stock climb an astonishing 437.2%, and the numbers from just the past month alone are eye-catching, with a 39.4% jump. Even in the last week, SCREEN Holdings delivered a robust 12.1% return, a pace that would perk up anyone’s ears. Clearly, this isn’t your average market mover.

Much of the momentum traces back to evolving demand across the semiconductor industry and a flurry of optimism in the broader tech market. Growing confidence in tech manufacturing, paired with global supply chain shifts, have driven risk appetites higher, and SCREEN Holdings appears to be reaping the rewards. The question, as always, is whether these gains are sustainable, or if the market’s excitement has pushed the stock ahead of its fundamental value.

To help answer that, it’s worth taking a closer look at the numbers behind the stock. When we assess SCREEN Holdings through a range of valuation lenses, the company looks undervalued in three out of six standard checks, giving it a value score of 3. That puts SCREEN Holdings somewhere in the middle: interesting, but not necessarily an automatic buy for value hunters. So, what do these different valuation methods say about the stock’s true worth? Let’s dig into those approaches, and at the end, I’ll share an even smarter way to think about whether SCREEN Holdings is still a buy right now.

Approach 1: SCREEN Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model projects a company’s expected free cash flows over future years and then discounts those amounts back to today’s value. The goal is to estimate what the business is truly worth at present. It is one of the most thorough and widely used valuation tools, because it goes beyond surface numbers to assess the actual cash SCREEN Holdings will likely generate for shareholders.

For SCREEN Holdings, the latest reported Free Cash Flow is ¥75.26 billion. Analysts provide direct estimates for the next five years, projecting steady growth, with year-ten free cash flow expected to reach around ¥104.04 billion. These longer-range figures are mainly extrapolated from trends, rather than direct analyst forecasts.

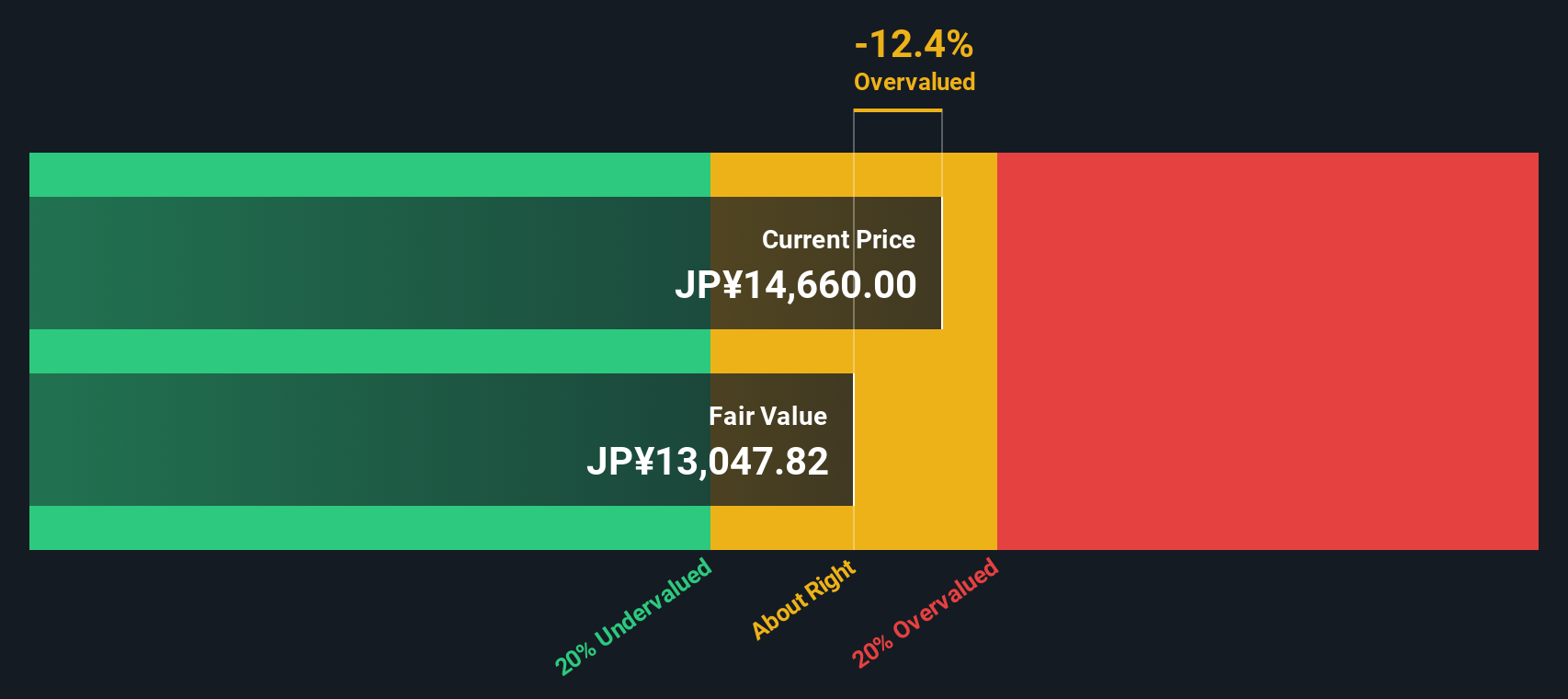

Based on the 2 Stage Free Cash Flow to Equity model, the intrinsic value calculated for SCREEN Holdings is ¥13,048 per share. However, this DCF model suggests the current stock price is roughly 15.4% above this intrinsic value, indicating the shares are overvalued according to future cash flow expectations.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SCREEN Holdings may be overvalued by 15.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: SCREEN Holdings Price vs Earnings

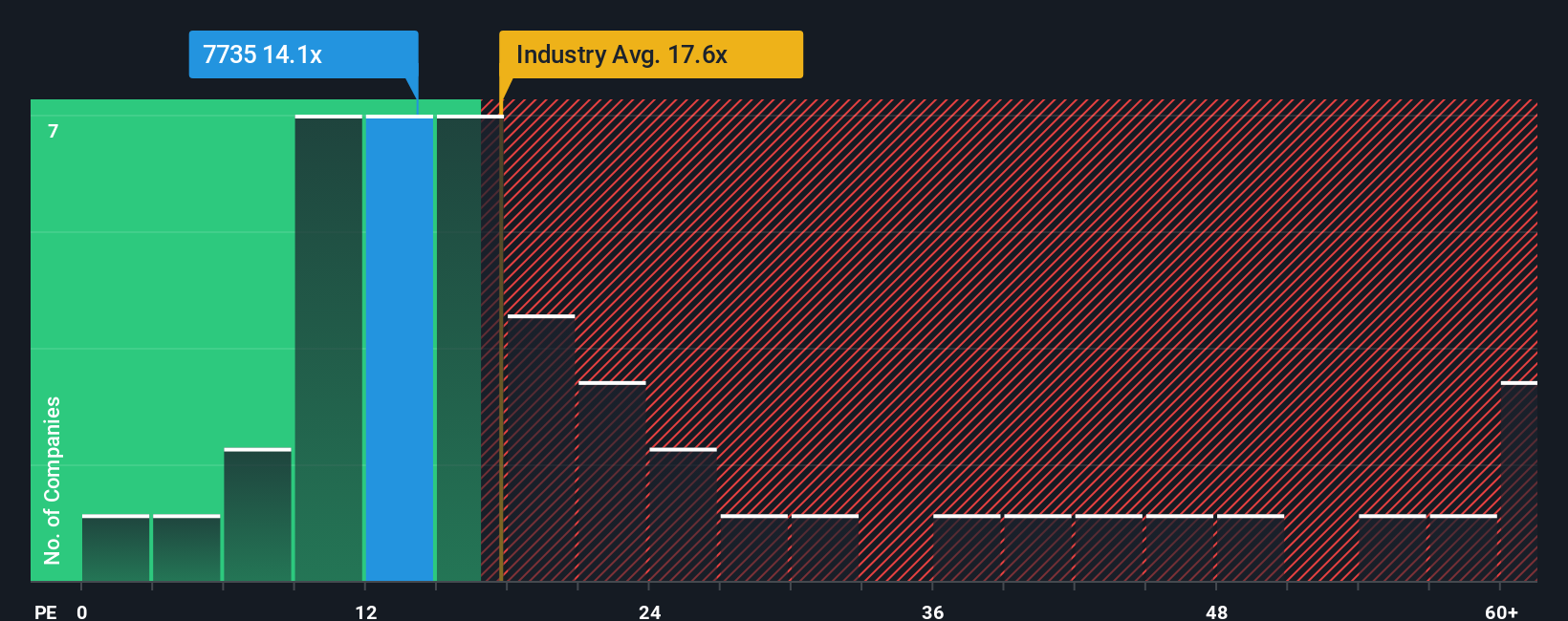

The Price-to-Earnings (PE) ratio is the go-to valuation tool for profitable companies like SCREEN Holdings, because it helps investors gauge what the market is willing to pay for each yen of earnings. A company’s PE ratio reflects both growth prospects and risk, so higher-growth or lower-risk firms usually command higher PE multiples, while slower-growing or riskier companies tend to have lower multiples.

Right now, SCREEN Holdings trades at a PE of 14.5x. That is comfortably below the Semiconductor industry average of 17.1x and well under the 35.2x average of its listed peers. However, just comparing to averages can be misleading, since companies within the same industry may have vastly different growth profiles, profitability, or risk factors.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio for SCREEN Holdings sits at 21.2x. This proprietary measure blends together not just earnings growth, but also factors in industry trends, profit margins, market cap and company-specific risks. Unlike a simple peer or industry comparison, the Fair Ratio offers a more nuanced and tailored view of what a fair valuation should be for SCREEN Holdings right now.

With SCREEN Holdings trading at 14.5x, and the Fair Ratio suggesting 21.2x, the stock looks undervalued using this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SCREEN Holdings Narrative

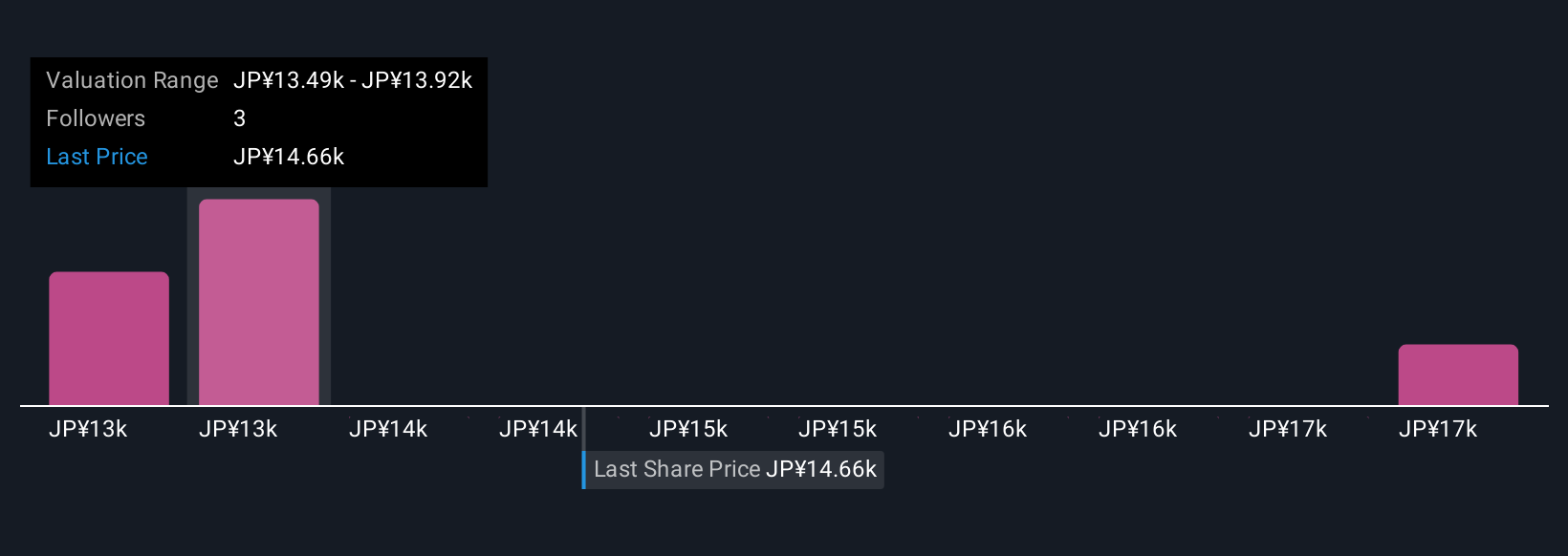

Earlier, we hinted at a smarter way to value companies beyond classic valuation ratios. That’s where Narratives come in, an intuitive approach that lets you combine your own story about SCREEN Holdings with specific financial forecasts like future revenue, earnings, and margins. Essentially, a Narrative connects a company’s big-picture outlook to a concrete set of forecasts, which then drives your calculation of a fair value.

This method is available to everyone on Simply Wall St’s Community page, used by millions of investors looking to tie the “why” behind a stock to the “how much” it is worth. With Narratives, you can easily compare your view of fair value for SCREEN Holdings to its market price, helping guide your buy or sell decisions based on your own convictions, not just consensus numbers.

Best of all, Narratives update in real time whenever important news, earnings, or events happen, keeping your story and valuation current. For example, some investors see SCREEN Holdings reaching as high as ¥17,800 per share thanks to booming AI equipment demand and stable margins, while others set their fair value closer to ¥11,500 based on concerns over competition and weaker market growth. Narratives make it easy to see, adjust, and defend your perspective on where the company should trade now and in the future.

Do you think there's more to the story for SCREEN Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7735

SCREEN Holdings

Develops, manufactures, sells, and maintains semiconductor production equipment in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives