- Japan

- /

- Semiconductors

- /

- TSE:7725

Read This Before Considering Inter Action Corporation (TSE:7725) For Its Upcoming JP¥25.00 Dividend

Inter Action Corporation (TSE:7725) is about to trade ex-dividend in the next 3 days. The ex-dividend date is commonly two business days before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Meaning, you will need to purchase Inter Action's shares before the 29th of May to receive the dividend, which will be paid on the 26th of August.

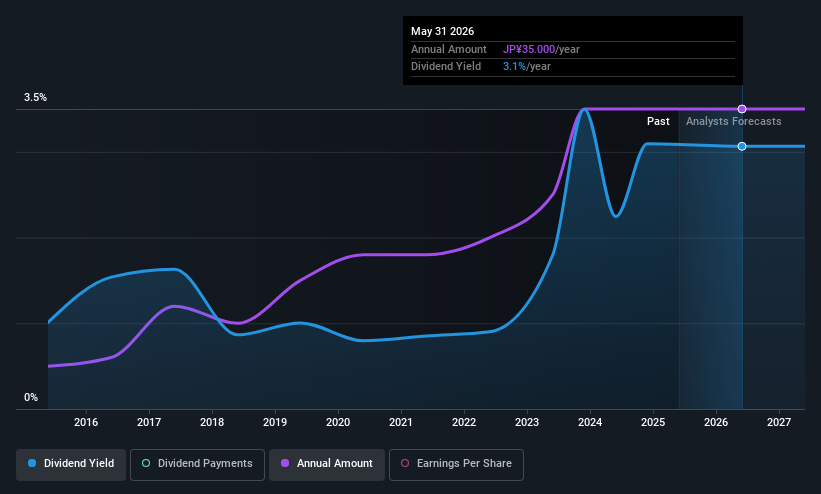

The company's next dividend payment will be JP¥25.00 per share, on the back of last year when the company paid a total of JP¥35.00 to shareholders. Last year's total dividend payments show that Inter Action has a trailing yield of 3.1% on the current share price of JP¥1142.00. If you buy this business for its dividend, you should have an idea of whether Inter Action's dividend is reliable and sustainable. So we need to investigate whether Inter Action can afford its dividend, and if the dividend could grow.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Inter Action paid out a comfortable 26% of its profit last year. A useful secondary check can be to evaluate whether Inter Action generated enough free cash flow to afford its dividend. What's good is that dividends were well covered by free cash flow, with the company paying out 22% of its cash flow last year.

It's positive to see that Inter Action's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Check out our latest analysis for Inter Action

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That explains why we're not overly excited about Inter Action's flat earnings over the past five years. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last 10 years, Inter Action has lifted its dividend by approximately 21% a year on average.

To Sum It Up

Is Inter Action an attractive dividend stock, or better left on the shelf? Earnings per share have been flat, although at least the company is paying out a low and conservative percentage of both its earnings and cash flow. It's definitely not great to see earnings falling, but at least there may be some buffer before the dividend gets cut. To summarise, Inter Action looks okay on this analysis, although it doesn't appear a stand-out opportunity.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. Our analysis shows 3 warning signs for Inter Action that we strongly recommend you have a look at before investing in the company.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7725

Inter Action

Engages in the development, manufacturing, and sells inspection illuminators for applications in imaging semiconductor manufacturing processes in Japan.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion