- Japan

- /

- Semiconductors

- /

- TSE:6963

ROHM (TSE:6963) Valuation in Focus as New Diode Tackles Technical Barriers for Automotive and Imaging Markets

Reviewed by Simply Wall St

ROHM (TSE:6963) attracted attention after announcing a new Schottky barrier diode that solves a tricky industry challenge, improving reliability for automotive cameras and advanced imaging systems. This innovative approach could impact future demand dynamics.

See our latest analysis for ROHM.

ROHM's recent product breakthroughs appear to have revived enthusiasm in its shares, with a 1-day share price return of 2.18% and a strong 7-day run of 5.77%. This positive momentum builds on a robust 27.05% gain over the past 90 days and a year-to-date share price return of 62.5%. Long-term holders have seen a 46.12% total shareholder return over the last year and 31.28% over five years. This reflects renewed confidence after a slow stretch. The latest surge suggests investors are increasingly optimistic about the company’s growth path and technical leadership.

If you’re searching for the next breakout, now is an ideal time to broaden your horizons and discover fast growing stocks with high insider ownership

With shares on a sharp upward streak and innovative products hitting the market, investors might wonder whether ROHM is trading at a bargain today or if future growth is already fully reflected in its share price.

Most Popular Narrative: 7% Overvalued

The narrative consensus price target for ROHM sits below its current share price, with analysts sticking to a steady outlook. The valuation debate now centers on whether growth strategies can turbocharge future returns.

ROHM is planning to increase its production capacity and efficiency for SiC (silicon carbide) power devices, correlating with expected battery EV market growth, which should enhance revenue and earnings as demand eventually picks up. The company is implementing a new organizational structure to better cater to customer needs and market applications. This aims to improve sales and potentially increase net margins by offering more integrated, solution-based proposals.

Curious about the aggressive growth plan fueling this valuation? The key is in bold assumptions about profits swinging from losses to strong margins, and a projected profit multiple that stands out among sector peers. Want to see the precise forecasts driving this target? The full narrative exposes the factors tipping the value scale.

Result: Fair Value of ¥2,275 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in the industrial segment and continued negative operating profit could undermine confidence in ROHM’s projected turnaround.

Find out about the key risks to this ROHM narrative.

Another View: Multiples in Focus

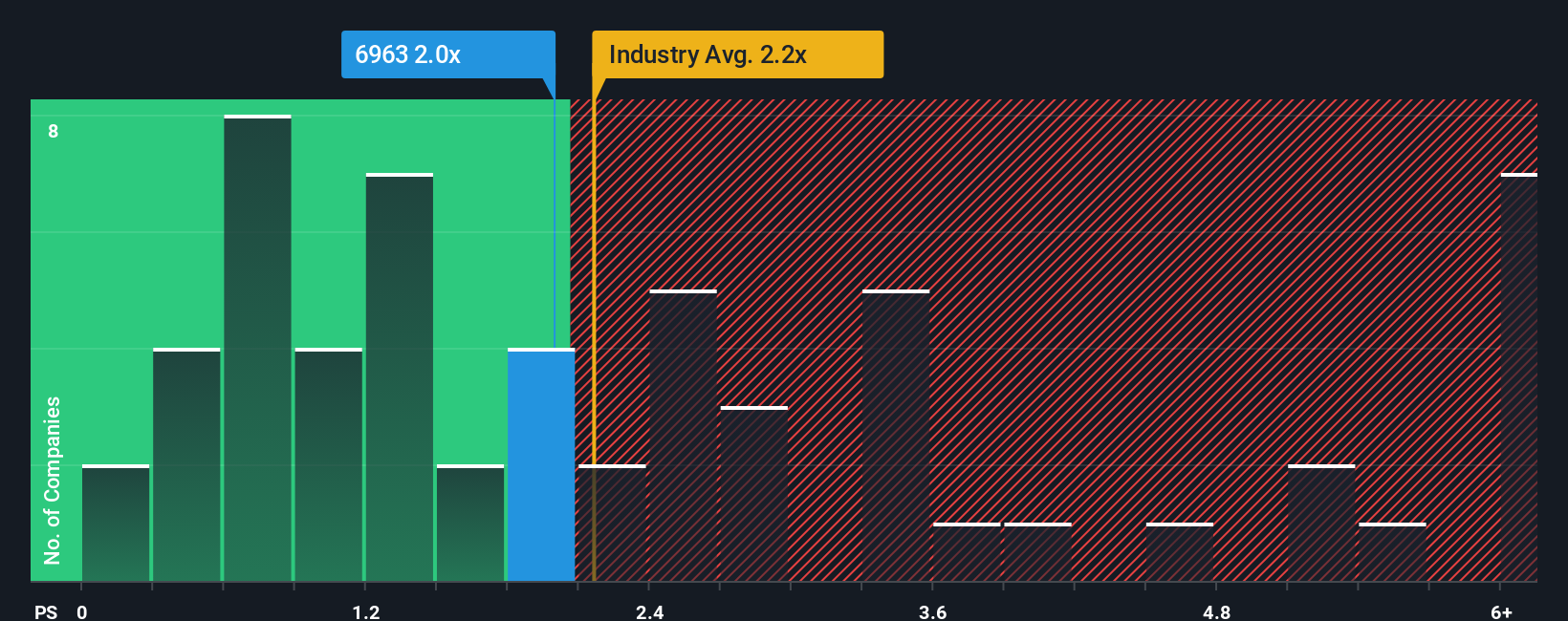

Taking a look at value through the lens of the price-to-sales ratio, ROHM trades at 2.1 times sales. This nearly matches its industry average at 2.1 but is noticeably below the 2.7 peer average. However, it remains above the fair ratio of 1.7, indicating that while peers might be more expensive, the market could adjust downward if sentiment shifts. So is this slim margin enough to protect investors if growth stalls?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ROHM Narrative

If you see things differently or want to dig deeper, you can shape your own story from the data in just a few minutes. Do it your way

A great starting point for your ROHM research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock new opportunities and broaden your strategy by tapping into emerging sectors, innovation, and reliable income streams. The next big winner could be just a click away.

- Tap into breakthrough patient treatments and advanced medical tech by checking out these 34 healthcare AI stocks, which could lead the way in tomorrow’s healthcare solutions.

- Accelerate your search for steady returns and smart income by exploring these 21 dividend stocks with yields > 3%, offering attractive yield potential beyond today’s favorites.

- Catalyze your portfolio with companies powering tomorrow’s internet, payments, and security. See the future with these 81 cryptocurrency and blockchain stocks, paving the way in blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6963

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives