Stock Analysis

- Japan

- /

- Commercial Services

- /

- TSE:6544

High Insider Ownership Growth Companies On The Japanese Exchange For May 2024

Reviewed by Simply Wall St

Despite a backdrop of economic contraction and a range-bound yen, Japanese equities have shown resilience with the Nikkei 225 Index gaining 1.5%. This environment underscores the potential value of investing in growth companies with high insider ownership, which can signal confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| SHIFT (TSE:3697) | 35.4% | 27.2% |

| Hottolink (TSE:3680) | 27% | 57.3% |

| Micronics Japan (TSE:6871) | 15.3% | 39.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 35.4% | 44.6% |

| ExaWizards (TSE:4259) | 24.8% | 80.2% |

| Money Forward (TSE:3994) | 21.4% | 63.5% |

| Medley (TSE:4480) | 34% | 24.4% |

| Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

| Soracom (TSE:147A) | 17.2% | 59.1% |

| freee K.K (TSE:4478) | 24% | 82.7% |

Underneath we present a selection of stocks filtered out by our screen.

Kusuri No Aoki Holdings (TSE:3549)

Simply Wall St Growth Rating: ★★★★☆☆

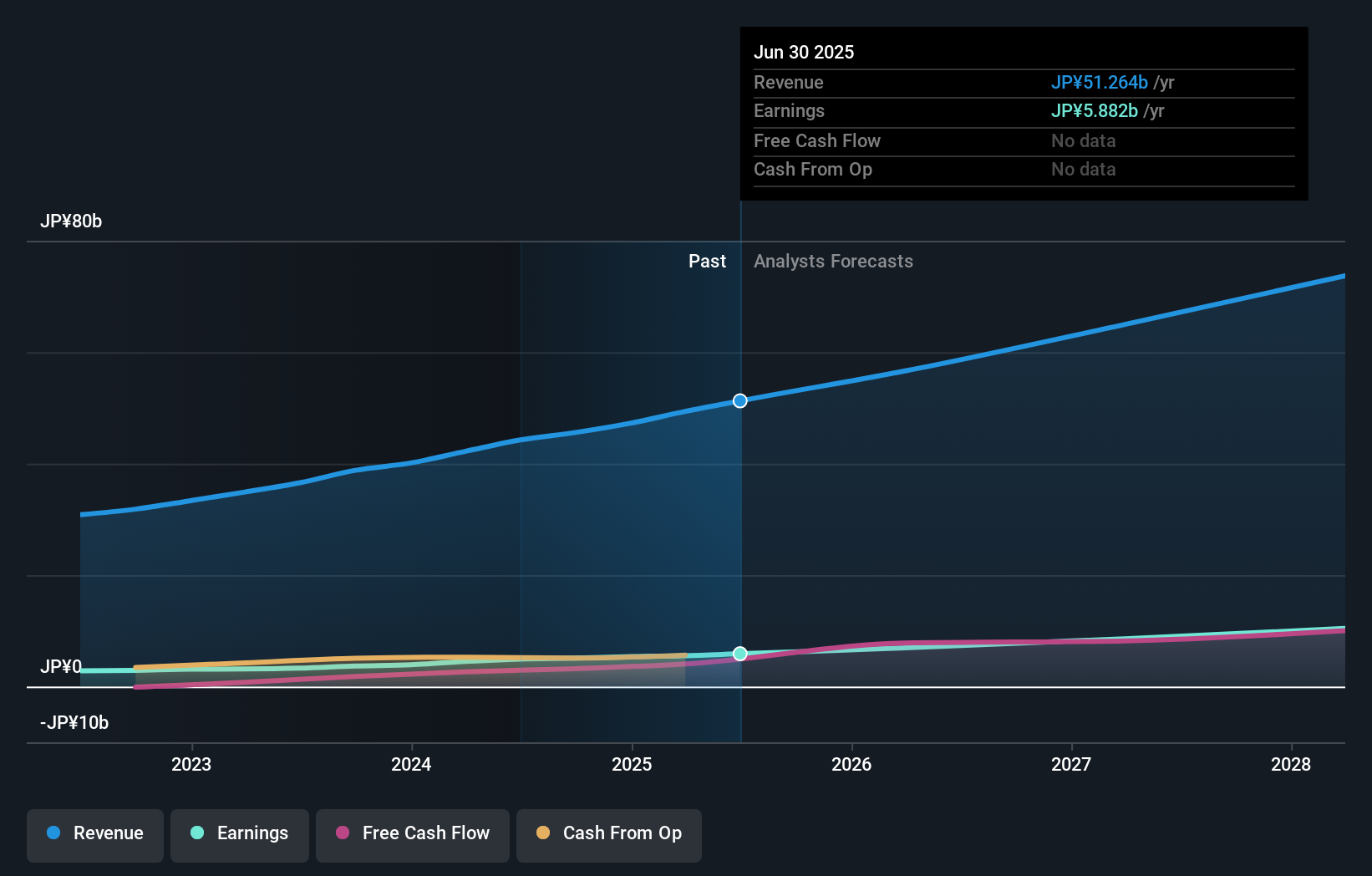

Overview: Kusuri No Aoki Holdings Co., Ltd. operates primarily in Japan, focusing on the retail of pharmaceuticals, cosmetics, and daily goods with a market capitalization of approximately ¥296.18 billion.

Operations: The company primarily generates its revenue from the sale of pharmaceuticals, cosmetics, and daily goods.

Insider Ownership: 28.9%

Earnings Growth Forecast: 21.8% p.a.

Kusuri No Aoki Holdings, a Japanese growth company with high insider ownership, is trading at 19.3% below its estimated fair value. The company's revenue is expected to grow by 7% per year, outpacing the Japanese market average of 3.9%. Moreover, earnings are projected to increase significantly at a rate of 21.83% annually over the next three years. However, it's important to note that profit margins have decreased from last year and the forecasted Return on Equity in three years is considered low at 14%.

- Take a closer look at Kusuri No Aoki Holdings' potential here in our earnings growth report.

- The valuation report we've compiled suggests that Kusuri No Aoki Holdings' current price could be inflated.

Japan Elevator Service HoldingsLtd (TSE:6544)

Simply Wall St Growth Rating: ★★★★☆☆

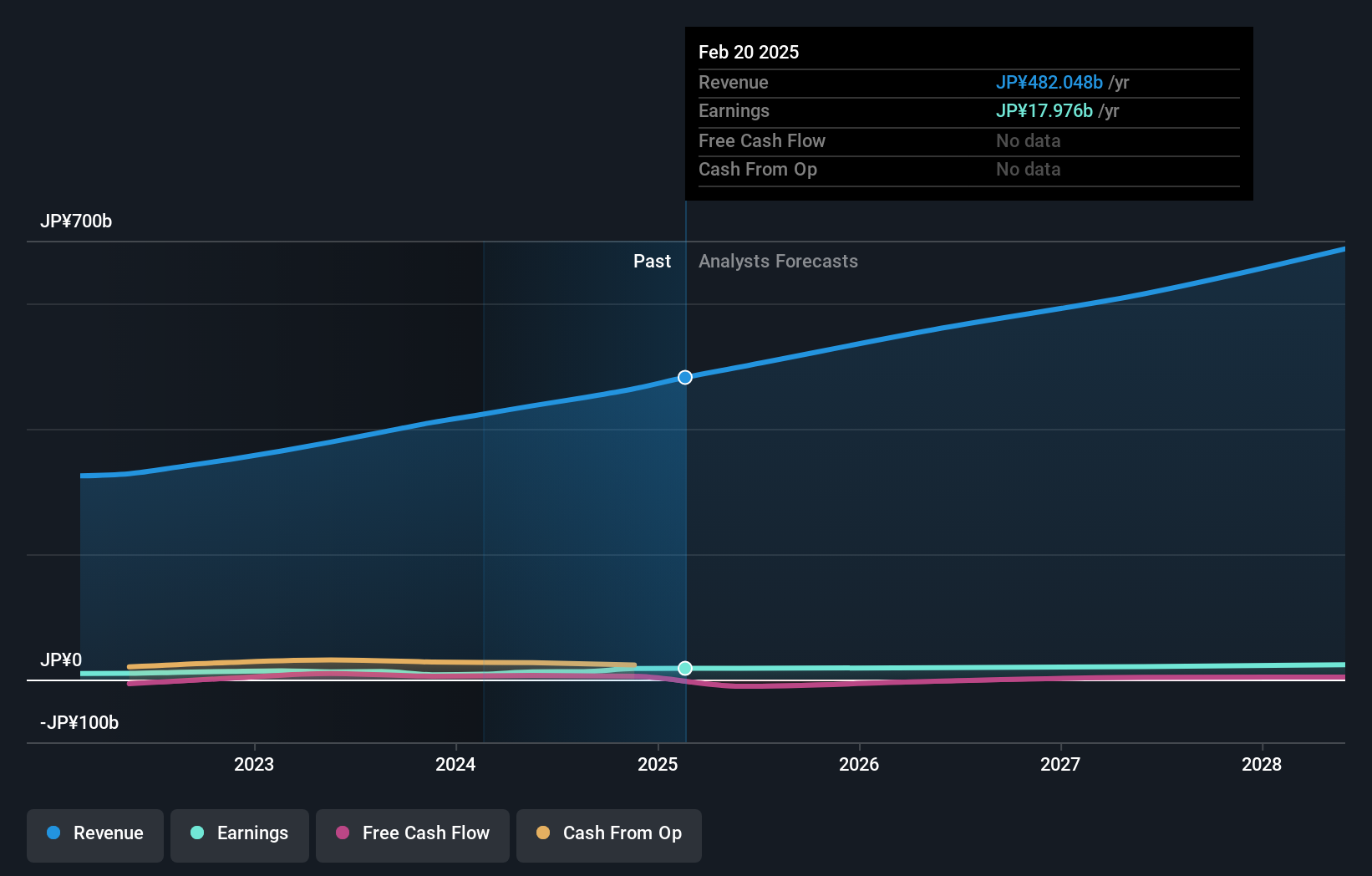

Overview: Japan Elevator Service Holdings Co., Ltd. specializes in the repair, maintenance, and modernization of elevators and escalators across Japan, with a market capitalization of approximately ¥252.03 billion.

Operations: The company generates approximately ¥42.22 billion in revenue from its maintenance services for elevators and escalators.

Insider Ownership: 23.4%

Earnings Growth Forecast: 18.2% p.a.

Japan Elevator Service Holdings Ltd., a growth-oriented firm with significant insider ownership, is poised for robust expansion. The company forecasts JPY 47 billion in net sales and an operating profit of JPY 8 billion for FY ending March 2025. Recent strategic moves include opening new service offices to enhance customer service, demonstrating a commitment to growth and shareholder returns, evidenced by an increased dividend forecast to JPY 25 per share from JPY 23. While its revenue growth rate (11.3% per year) trails the high-growth benchmark, it still outperforms the Japanese market average.

- Click here and access our complete growth analysis report to understand the dynamics of Japan Elevator Service HoldingsLtd.

- Upon reviewing our latest valuation report, Japan Elevator Service HoldingsLtd's share price might be too optimistic.

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lasertec Corporation specializes in designing, manufacturing, and selling inspection and measurement equipment both in Japan and globally, with a market capitalization of approximately ¥4.10 billion.

Operations: The company operates primarily in the design, manufacture, and sale of inspection and measurement equipment across domestic and international markets.

Insider Ownership: 12.1%

Earnings Growth Forecast: 20.7% p.a.

Lasertec Corporation, a Japanese growth company with high insider ownership, is experiencing substantial earnings growth, projected at 20.71% annually. Despite its highly volatile share price in recent months, the company's revenue is expected to increase by 17% per year, outpacing the Japanese market average of 3.9%. Additionally, significant executive changes were announced on April 30, 2024, including Tetsuya Sendoda's promotion to CEO, which could influence strategic direction and operational efficiency.

- Delve into the full analysis future growth report here for a deeper understanding of Lasertec.

- Our valuation report unveils the possibility Lasertec's shares may be trading at a premium.

Make It Happen

- Unlock more gems! Our Fast Growing Japanese Companies With High Insider Ownership screener has unearthed 104 more companies for you to explore.Click here to unveil our expertly curated list of 107 Fast Growing Japanese Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Japan Elevator Service HoldingsLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6544

Japan Elevator Service HoldingsLtd

Provides repair, maintenance, and modernization services for elevators and escalators in Japan.

Outstanding track record with flawless balance sheet.