- Japan

- /

- Semiconductors

- /

- TSE:6890

How Ferrotec’s (TSE:6890) Dividend Hike and Upbeat Outlook May Influence Investor Sentiment

Reviewed by Sasha Jovanovic

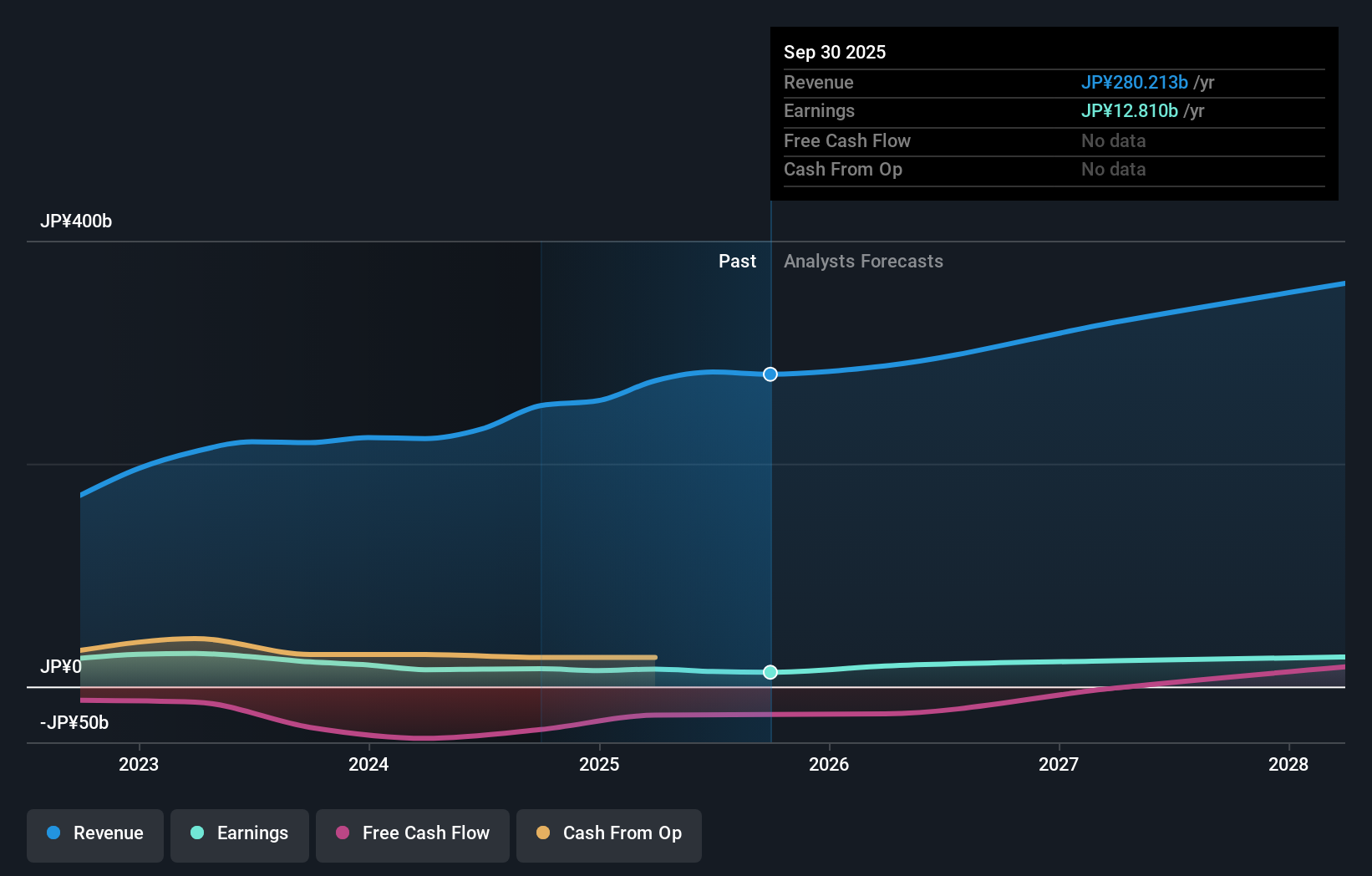

- Ferrotec Holdings recently reported a 4.3% increase in net sales year-over-year, although profit attributable to owners of the parent declined by 31.4% and the company announced a dividend increase to ¥148.00 per share.

- Despite the profit drop, Ferrotec issued guidance for higher full-year sales and operating profit, signaling management’s confidence in future business performance.

- We’ll explore how the increased dividend and optimistic full-year forecast shape Ferrotec’s current investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Ferrotec's Investment Narrative?

For anyone considering Ferrotec as an investment, the big picture centers on believing the company can navigate cyclical swings in semiconductor demand while executing international growth and shareholder return strategies. The recent news, a solid bump in sales, plus a dividend hike, even as profit slipped, could mark a shift in near-term catalysts. Management’s higher full-year guidance stands out, hinting at internal momentum or confidence about market recovery. That said, risks have become more nuanced: squeezing margins and a dip in net profit deserve attention, especially since previous analysis flagged slowing earnings and volatile recent share price moves. If the company can meet these new forecasts and sustain stronger cash flows to cover dividends, some of the flagged risks may ease. Otherwise, margin compression may remain a watchpoint for investors shortly.

On the flip side, margin pressure might linger if profit growth stalls, something investors should watch for.

Exploring Other Perspectives

Explore 2 other fair value estimates on Ferrotec - why the stock might be worth 16% less than the current price!

Build Your Own Ferrotec Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ferrotec research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ferrotec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ferrotec's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6890

Ferrotec

Engages in semiconductor equipment-related, electronic device, and other businesses in Japan and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives