- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A036930

Top Insider-Owned Growth Companies To Watch In November 2024

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by geopolitical tensions and economic shifts, U.S. indexes are approaching record highs with broad-based gains, driven by strong labor market data and positive sentiment from recent home sales reports. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal confidence from those who know the business best, potentially aligning well with investors seeking stability amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 43.2% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 103.6% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

We're going to check out a few of the best picks from our screener tool.

JUSUNG ENGINEERINGLtd (KOSDAQ:A036930)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JUSUNG ENGINEERING Co., Ltd. is a company that manufactures and sells semiconductor, display, solar, and lighting equipment both in South Korea and internationally, with a market cap of ₩1.37 trillion.

Operations: The company generates revenue of ₩338.28 billion from its semiconductor equipment and services segment.

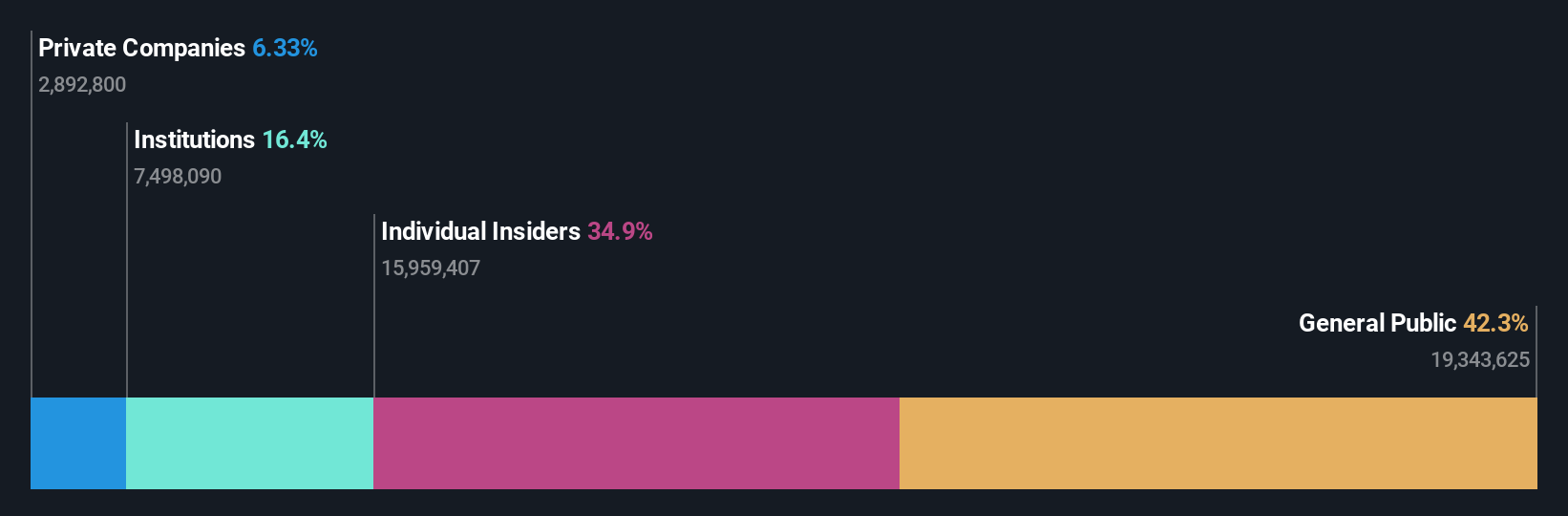

Insider Ownership: 37%

Earnings Growth Forecast: 20.6% p.a.

JUSUNG ENGINEERING Ltd. is poised for robust growth, with revenue expected to increase by 21.6% annually, surpassing the Korean market average of 9.2%. Although earnings growth at 20.61% per year trails the market's 29.3%, it remains significant. The company trades at a notable discount to its fair value and recently announced a KRW 50 billion share buyback program aimed at enhancing shareholder value and stabilizing stock price, reflecting confidence in its future prospects.

- Unlock comprehensive insights into our analysis of JUSUNG ENGINEERINGLtd stock in this growth report.

- The analysis detailed in our JUSUNG ENGINEERINGLtd valuation report hints at an deflated share price compared to its estimated value.

Chengdu M&S Electronics TechnologyLtd (SHSE:688311)

Simply Wall St Growth Rating: ★★★★★☆

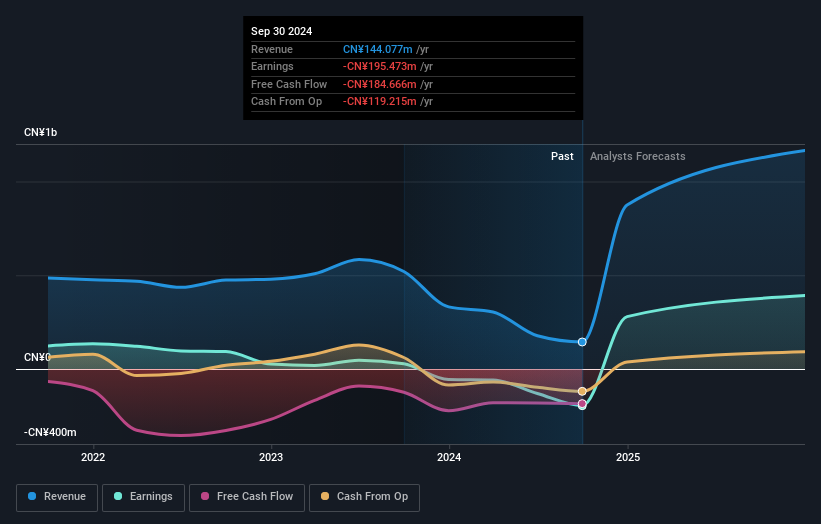

Overview: Chengdu M&S Electronics Technology Co., Ltd. (ticker: SHSE:688311) operates in the electronics sector and has a market capitalization of approximately CN¥5.45 billion.

Operations: Revenue segments for SHSE:688311 are not provided in the text.

Insider Ownership: 30%

Earnings Growth Forecast: 127.3% p.a.

Chengdu M&S Electronics Technology Ltd. is forecast to achieve significant revenue growth of 91.6% annually, outpacing the CN market's 13.8% growth rate, with profitability expected within three years. Despite this potential, recent financials show a challenging period with sales dropping to CNY 87.01 million from CNY 274.26 million year-on-year and a net loss of CNY 127.61 million compared to last year's profit of CNY 11.56 million, highlighting volatility concerns for investors.

- Get an in-depth perspective on Chengdu M&S Electronics TechnologyLtd's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Chengdu M&S Electronics TechnologyLtd's current price could be inflated.

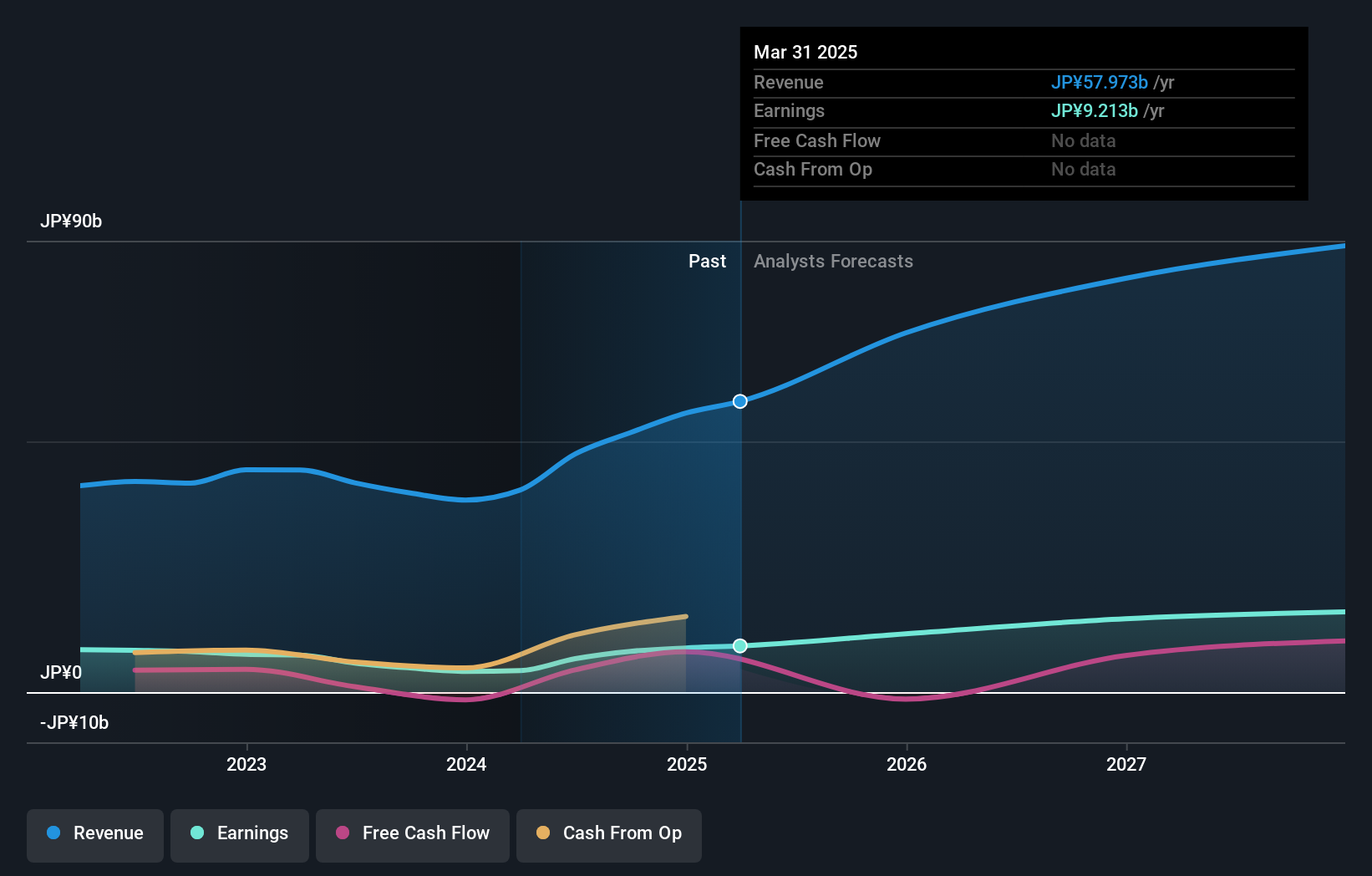

Micronics Japan (TSE:6871)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Micronics Japan Co., Ltd. develops, manufactures, and sells testing and measurement equipment for semiconductors and LCD testing systems worldwide, with a market cap of approximately ¥149.92 billion.

Operations: Micronics Japan generates revenue through the development, manufacturing, and sales of testing and measurement equipment for semiconductors and LCD testing systems globally.

Insider Ownership: 15.3%

Earnings Growth Forecast: 28.7% p.a.

Micronics Japan is positioned for robust growth, with revenue projected to rise by 19.9% annually, surpassing the JP market's average. Earnings are expected to grow significantly at 28.7% per year, indicating strong future profitability prospects. Despite high volatility in its share price recently, it trades at a substantial discount of 57.6% below estimated fair value and has no significant insider trading activity over the past three months, suggesting stability in insider confidence.

- Delve into the full analysis future growth report here for a deeper understanding of Micronics Japan.

- According our valuation report, there's an indication that Micronics Japan's share price might be on the cheaper side.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1514 Fast Growing Companies With High Insider Ownership by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A036930

JUSUNG ENGINEERINGLtd

Manufactures and sells semiconductor, display, solar, and lighting equipment in South Korea and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives