- Japan

- /

- Semiconductors

- /

- TSE:6627

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by record highs in U.S. indexes and geopolitical uncertainties, investors are increasingly focused on strategies that offer stability amid volatility. With strong labor market data and positive sentiment around economic growth, dividend stocks present an appealing option for those seeking consistent income streams and potential capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.57% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.30% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.78% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.77% | ★★★★★☆ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

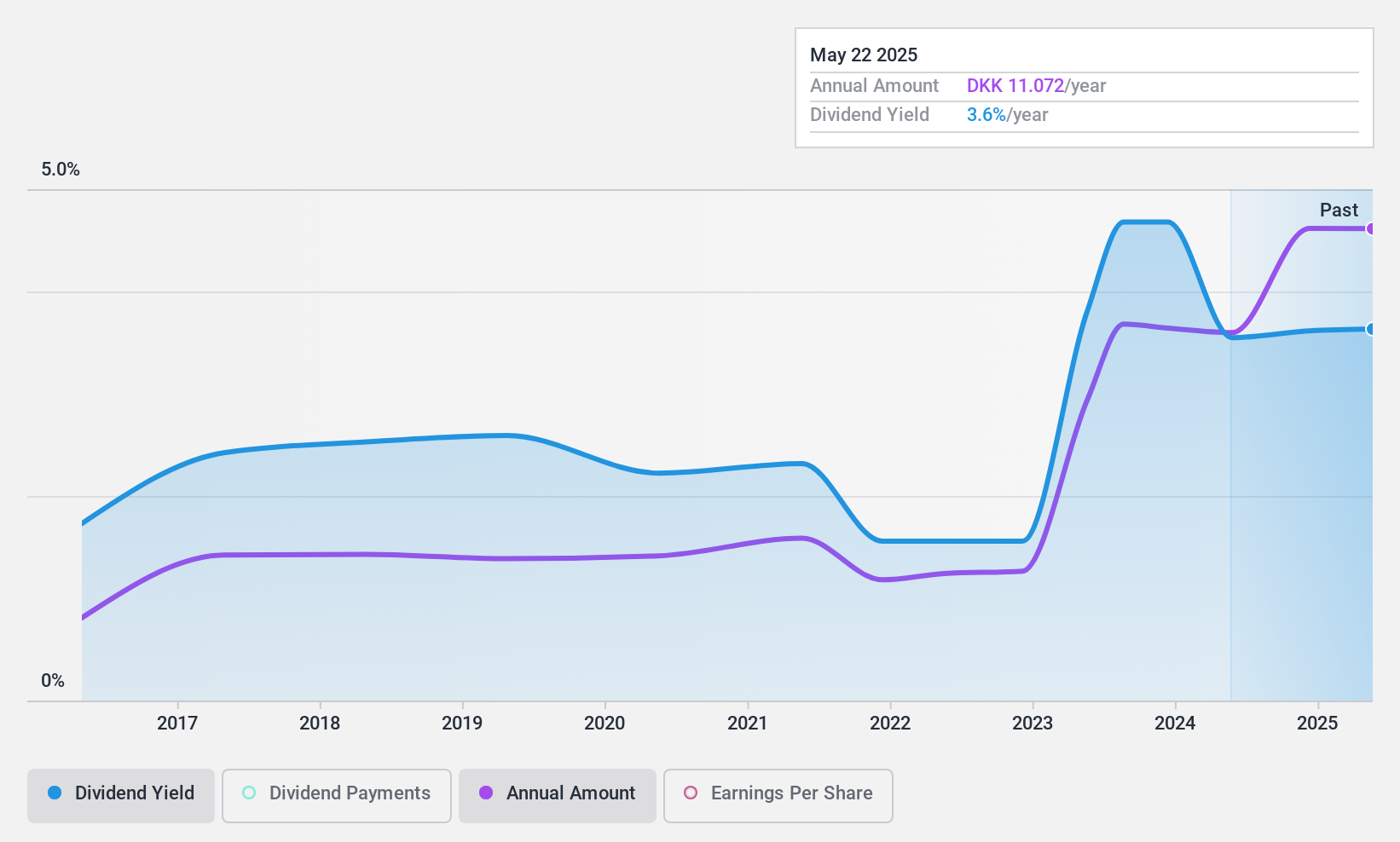

UIE (CPSE:UIE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UIE Plc is an investment company that operates in the agro-industrial, industrial, and technology sectors across Malaysia, Indonesia, the United States, Europe, and internationally with a market capitalization of DKK9.88 billion.

Operations: The company's revenue is primarily derived from United Plantations Berhad (UP), amounting to $462.25 million.

Dividend Yield: 3.5%

UIE's dividend payments are well covered by both earnings and cash flows, with payout ratios of 22.6% and 37.9%, respectively, indicating sustainability. However, the dividend yield of 3.54% is below the top tier in Denmark, and dividends have been volatile over the past decade with significant annual drops. Despite this volatility, UIE has increased its dividends over ten years and trades at a discount to its estimated fair value. Recent earnings growth suggests improved financial health but includes large one-off items affecting results.

- Unlock comprehensive insights into our analysis of UIE stock in this dividend report.

- Our comprehensive valuation report raises the possibility that UIE is priced lower than what may be justified by its financials.

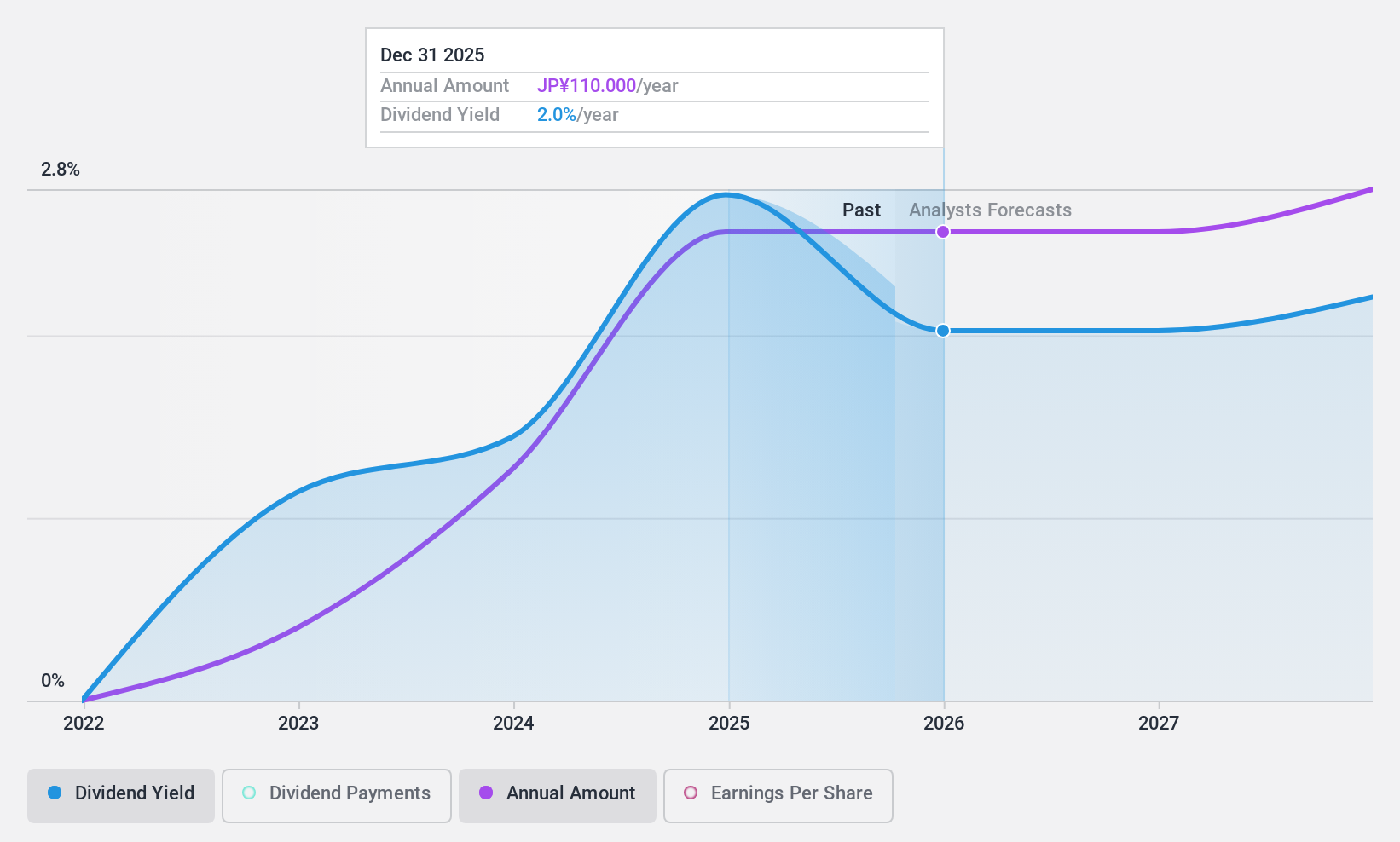

Tera Probe (TSE:6627)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tera Probe, Inc. operates in wafer testing, final testing, testing technology development, and worker dispatching businesses both in Japan and internationally with a market cap of ¥24.65 billion.

Operations: Tera Probe, Inc.'s revenue segments include wafer testing, final testing, and testing technology development.

Dividend Yield: 3.8%

Tera Probe's dividend payments are well-supported by earnings and cash flows, with payout ratios of 26.6% and 11%, respectively, indicating sustainability. Despite being relatively new to dividends, with only three years of payments, they have been stable and reliable. The company's dividend yield is in the top quartile of the Japanese market at 3.81%. Additionally, Tera Probe trades at a significant discount to its estimated fair value but has experienced high share price volatility recently.

- Dive into the specifics of Tera Probe here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Tera Probe is trading behind its estimated value.

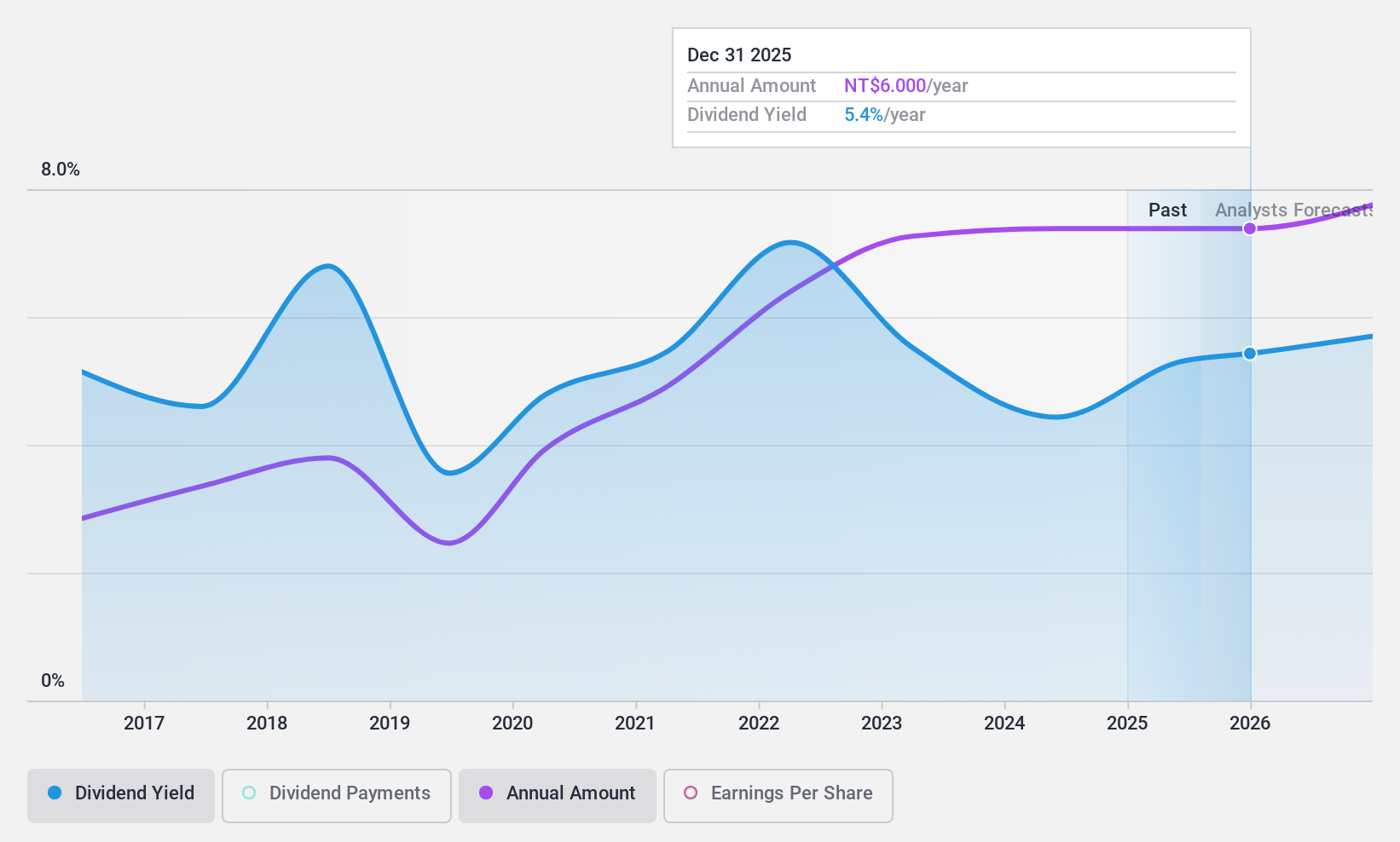

Chicony Power Technology (TWSE:6412)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chicony Power Technology Co., Ltd. is a Taiwanese company engaged in the development, manufacturing, and sale of switching power supplies, electronic components, LED lighting modules, and smart building solutions with a market cap of NT$48.29 billion.

Operations: Chicony Power Technology Co., Ltd. generates revenue from Asia (NT$31.32 billion), America (NT$1.05 billion), and Domestic markets (NT$35.12 billion).

Dividend Yield: 4.8%

Chicony Power Technology's dividend yield of 4.76% ranks in the top quartile of the Taiwanese market, but its sustainability is questionable due to a high cash payout ratio of 199.7%. While dividends have grown over the past decade, they have been volatile with significant annual drops. The company trades at a favorable price-to-earnings ratio of 14.6x compared to the local market average, and recent earnings growth shows potential for future financial stability.

- Navigate through the intricacies of Chicony Power Technology with our comprehensive dividend report here.

- Our expertly prepared valuation report Chicony Power Technology implies its share price may be lower than expected.

Seize The Opportunity

- Take a closer look at our Top Dividend Stocks list of 1960 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tera Probe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6627

Tera Probe

Engages in the wafer testing, final testing, testing technology development, and worker dispatching businesses in Japan, Taiwan, rest of Asia, North America, and Europe.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.