- Japan

- /

- Semiconductors

- /

- TSE:6323

What Rorze Corporation's (TSE:6323) 27% Share Price Gain Is Not Telling You

Despite an already strong run, Rorze Corporation (TSE:6323) shares have been powering on, with a gain of 27% in the last thirty days. The last 30 days bring the annual gain to a very sharp 98%.

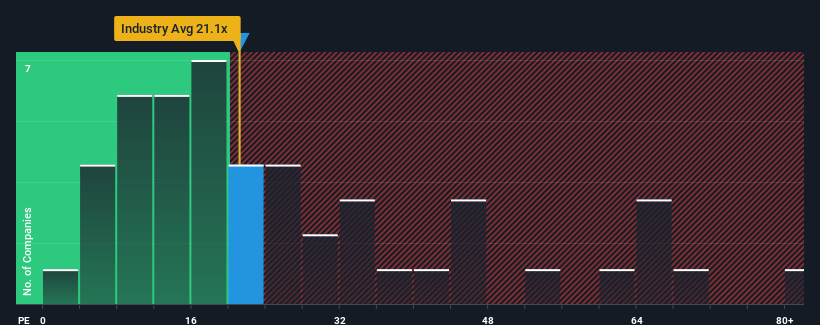

Since its price has surged higher, given around half the companies in Japan have price-to-earnings ratios (or "P/E's") below 14x, you may consider Rorze as a stock to potentially avoid with its 21.1x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Rorze hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Rorze

How Is Rorze's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Rorze's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 29%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 172% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 12% as estimated by the five analysts watching the company. That's shaping up to be similar to the 11% growth forecast for the broader market.

In light of this, it's curious that Rorze's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Rorze's P/E?

The large bounce in Rorze's shares has lifted the company's P/E to a fairly high level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Rorze's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Rorze is showing 1 warning sign in our investment analysis, you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6323

Rorze

Engages in the design, development, manufacture, and sale of automation systems for the semiconductor and flat panel display production worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives