- Japan

- /

- Semiconductors

- /

- TSE:6323

Rorze Corporation's (TSE:6323) 27% Share Price Plunge Could Signal Some Risk

Rorze Corporation (TSE:6323) shares have had a horrible month, losing 27% after a relatively good period beforehand. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 115% in the last twelve months.

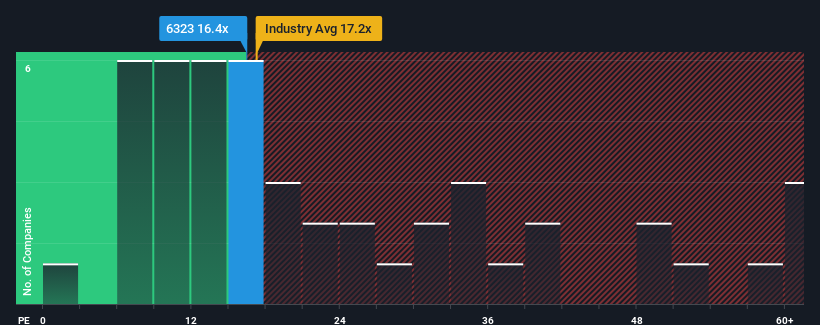

Although its price has dipped substantially, Rorze may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 16.4x, since almost half of all companies in Japan have P/E ratios under 14x and even P/E's lower than 9x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Rorze as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Rorze

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Rorze's is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 23% last year. The strong recent performance means it was also able to grow EPS by 220% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 6.2% per year as estimated by the four analysts watching the company. That's shaping up to be materially lower than the 9.5% per year growth forecast for the broader market.

With this information, we find it concerning that Rorze is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Rorze's P/E?

Despite the recent share price weakness, Rorze's P/E remains higher than most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Rorze currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Rorze, and understanding should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6323

Rorze

Engages in the design, development, manufacture, and sale of automation systems for the semiconductor and flat panel display production worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives