Stock Analysis

- Japan

- /

- Semiconductors

- /

- TSE:6315

TORIDOLL Holdings And 2 More Japanese Exchange Stocks Considered Below Estimated Value

Reviewed by Simply Wall St

Amidst a week of negative returns for Japan's stock markets, with the Nikkei 225 and TOPIX indices both trending downwards, investors continue to navigate through uncertainties surrounding the Bank of Japan's monetary policy and its implications on the market. In such a climate, identifying stocks that are potentially undervalued becomes particularly crucial as they may offer opportunities for value in a challenging environment.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Link and Motivation (TSE:2170) | ¥463.00 | ¥894.01 | 48.2% |

| FP Partner (TSE:7388) | ¥2732.00 | ¥5067.34 | 46.1% |

| Hibino (TSE:2469) | ¥2519.00 | ¥4870.71 | 48.3% |

| OSAKA Titanium technologiesLtd (TSE:5726) | ¥2794.00 | ¥5530.81 | 49.5% |

| Cyber Security Cloud (TSE:4493) | ¥2198.00 | ¥4106.46 | 46.5% |

| S-Pool (TSE:2471) | ¥320.00 | ¥593.38 | 46.1% |

| Gift Holdings (TSE:9279) | ¥2724.00 | ¥5346.29 | 49% |

| Macromill (TSE:3978) | ¥861.00 | ¥1673.32 | 48.5% |

| NIHON CHOUZAILtd (TSE:3341) | ¥1482.00 | ¥2803.06 | 47.1% |

| freee K.K (TSE:4478) | ¥2422.00 | ¥4460.48 | 45.7% |

Below we spotlight a couple of our favorites from our exclusive screener

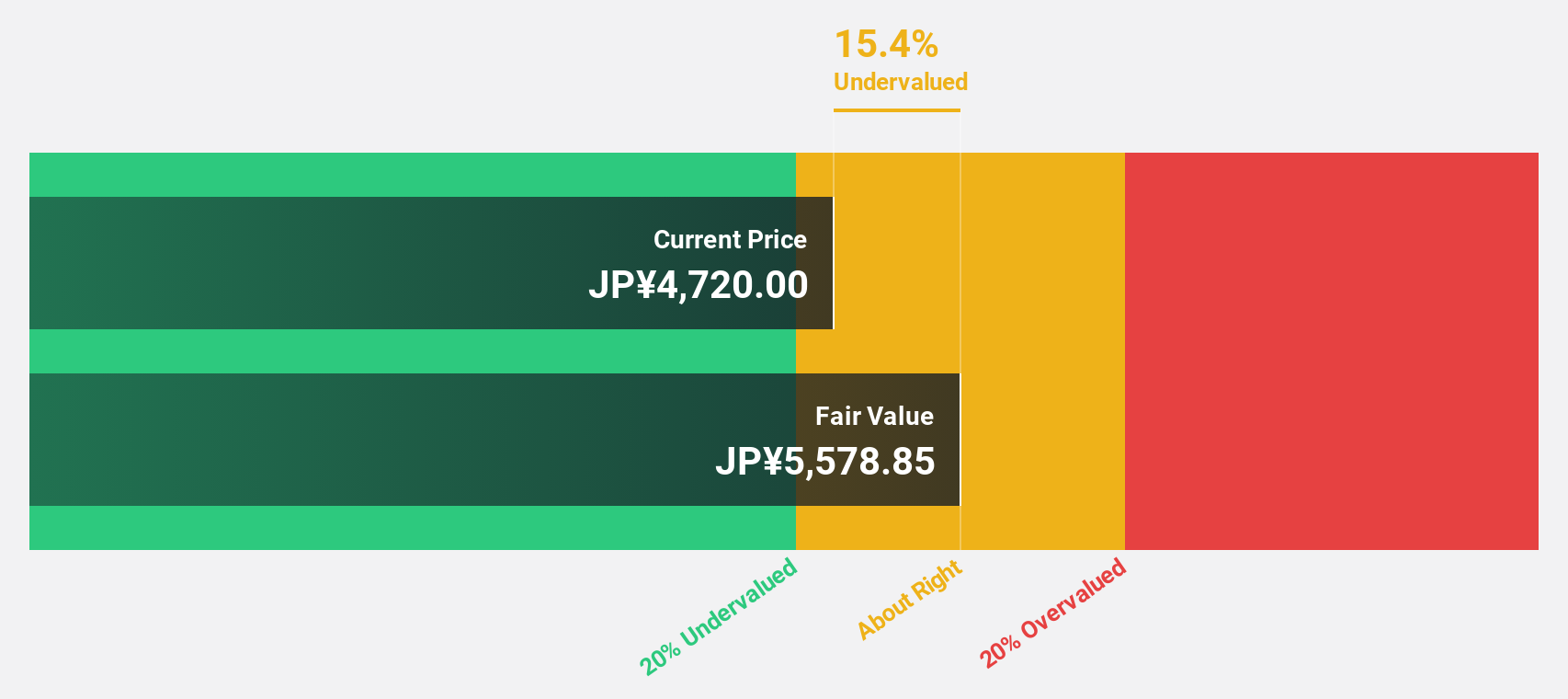

TORIDOLL Holdings (TSE:3397)

Overview: TORIDOLL Holdings Corporation operates and manages a chain of restaurants both in Japan and internationally, with a market capitalization of approximately ¥319.39 billion.

Operations: The company's revenue is divided into three main segments: Domestic Others generating ¥28.46 billion, Marugame Seimen contributing ¥114.86 billion, and Overseas Business producing ¥88.64 billion.

Estimated Discount To Fair Value: 37.5%

TORIDOLL Holdings, currently trading at ¥3658, is valued well below our fair value estimate of ¥5856.02, suggesting a significant undervaluation based on cash flows. The company's earnings are expected to grow by 27.7% annually over the next three years, outpacing the Japanese market average. However, its forecasted return on equity in three years is modest at 12.3%. Recent corporate guidance predicts robust revenue and profit growth for FY2025, alongside an increase in dividends reflecting improved profitability.

- Upon reviewing our latest growth report, TORIDOLL Holdings' projected financial performance appears quite optimistic.

- Navigate through the intricacies of TORIDOLL Holdings with our comprehensive financial health report here.

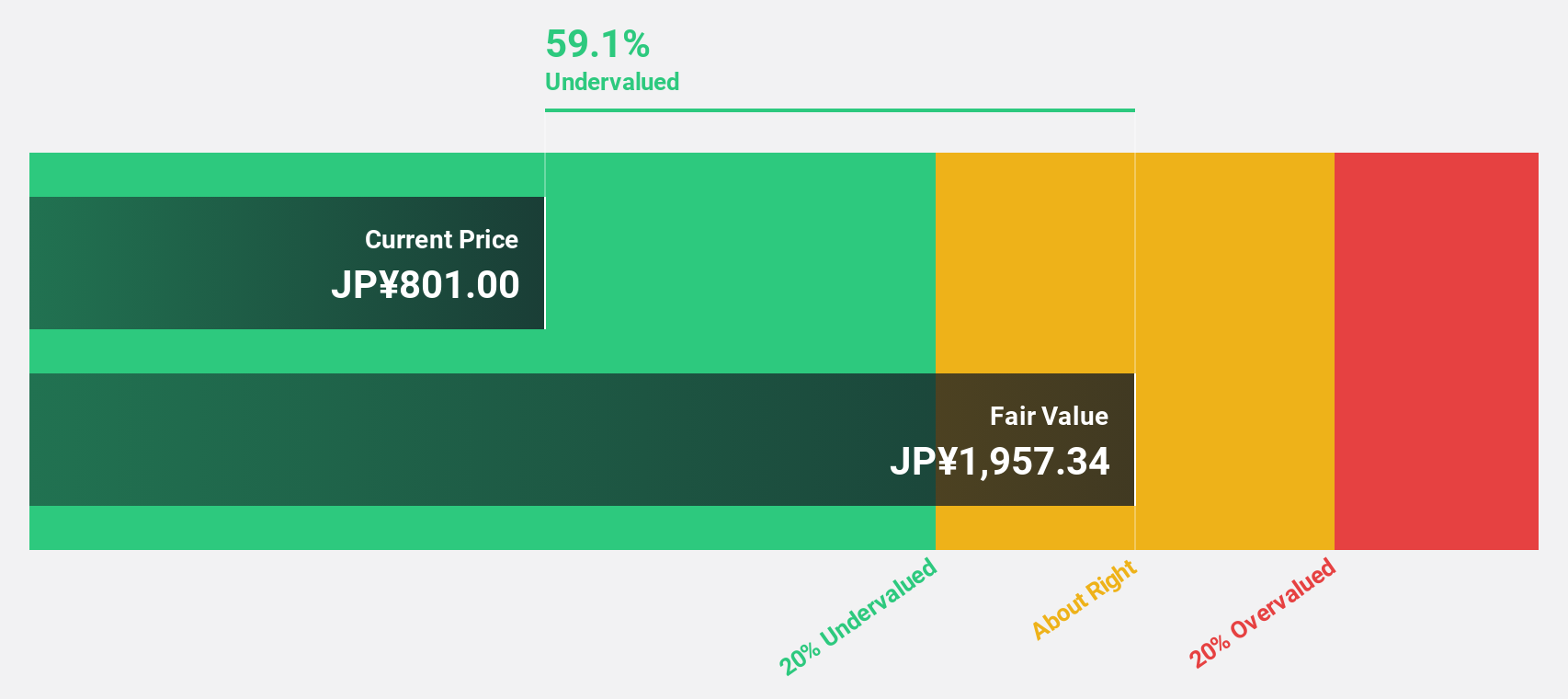

Takara Bio (TSE:4974)

Overview: Takara Bio Inc. operates in bioindustry, contract development and manufacturing (CDMO), and gene therapy sectors across Japan, China, other parts of Asia, the United States, and Europe with a market cap of approximately ¥128 billion.

Operations: The company generates revenue primarily from its Drug Discovery segment, amounting to ¥43.51 billion.

Estimated Discount To Fair Value: 24.8%

Takara Bio, priced at ¥1063, trades significantly below its calculated fair value of ¥1413.92, indicating a potential undervaluation based on cash flows. Expected to grow earnings by 22.14% annually over the next three years, it outperforms the Japanese market forecast of 8.9%. However, its return on equity is projected at a low 4.2%, and recent profit margins have declined to 3.4% from last year's 20.5%. Upcoming events include an AGM on June 21 and a reduced dividend payout effective June 24.

- Our earnings growth report unveils the potential for significant increases in Takara Bio's future results.

- Dive into the specifics of Takara Bio here with our thorough financial health report.

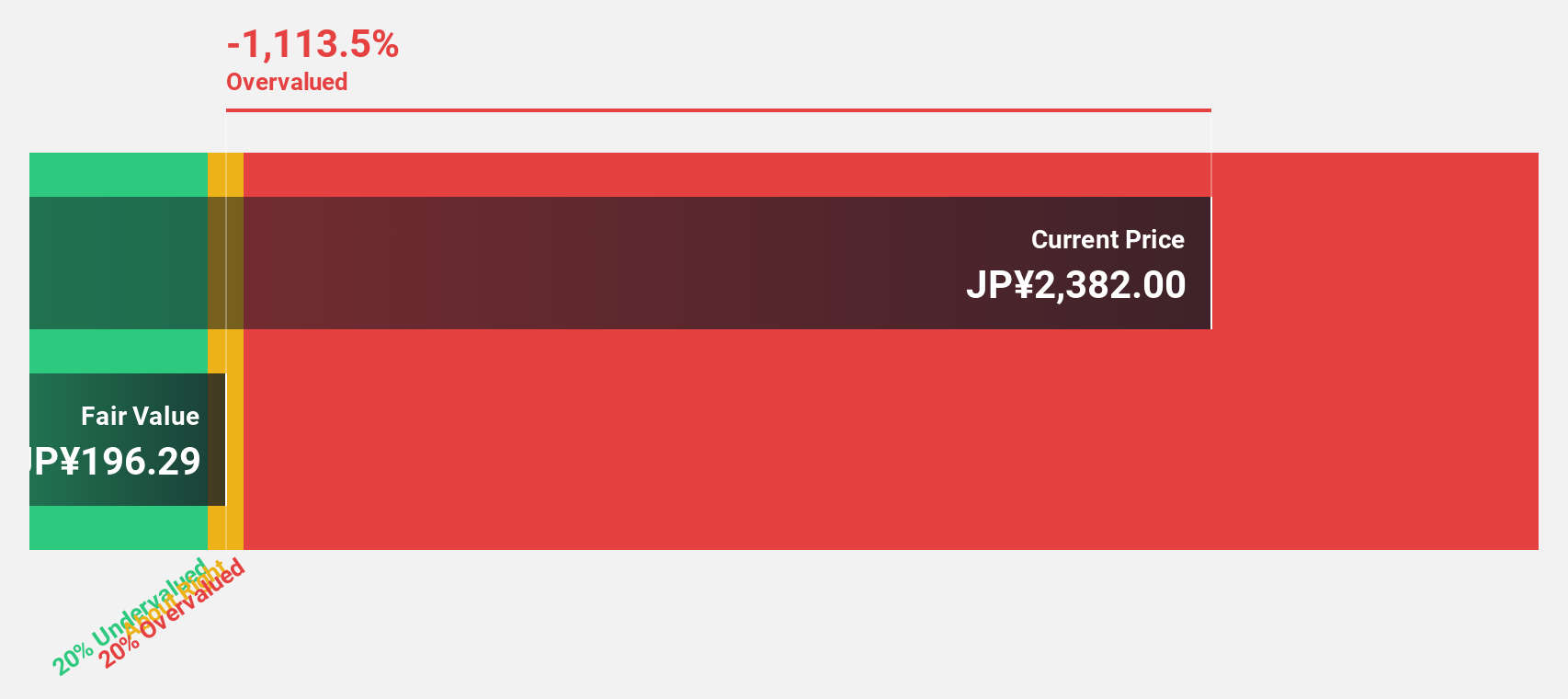

TOWA (TSE:6315)

Overview: TOWA Corporation specializes in designing, developing, manufacturing, and selling semiconductor manufacturing equipment and high-precision molds both domestically in Japan and internationally, with a market capitalization of approximately ¥289.49 billion.

Operations: The company generates revenue through three main segments: Fine Plastic Moldings (¥2.15 billion), Laser Processing Equipment (¥2.42 billion), and Semiconductor Manufacturing Equipment (¥45.90 billion).

Estimated Discount To Fair Value: 17.8%

TOWA, priced at ¥11,580, is valued below its estimated fair value of ¥14,084.97, suggesting a potential undervaluation. The company's revenue growth forecast of 15.6% annually surpasses the Japanese market average of 4.1%, and its earnings are expected to increase by 24.78% per year—significantly outpacing the market's 8.9%. Despite this robust growth outlook and a recent dividend increase to JPY 60 from JPY 40 per share, TOWA faces challenges with a highly volatile share price and a projected low return on equity of 17.9%.

- Insights from our recent growth report point to a promising forecast for TOWA's business outlook.

- Get an in-depth perspective on TOWA's balance sheet by reading our health report here.

Taking Advantage

- Gain an insight into the universe of 94 Undervalued Japanese Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether TOWA is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6315

TOWA

Designs, develops, manufactures, and sells semiconductor manufacturing equipment and high-precision molds in Japan and internationally.

Flawless balance sheet with reasonable growth potential.