- Japan

- /

- Semiconductors

- /

- TSE:6235

OptorunLtd (TSE:6235) Will Pay A Larger Dividend Than Last Year At ¥27.00

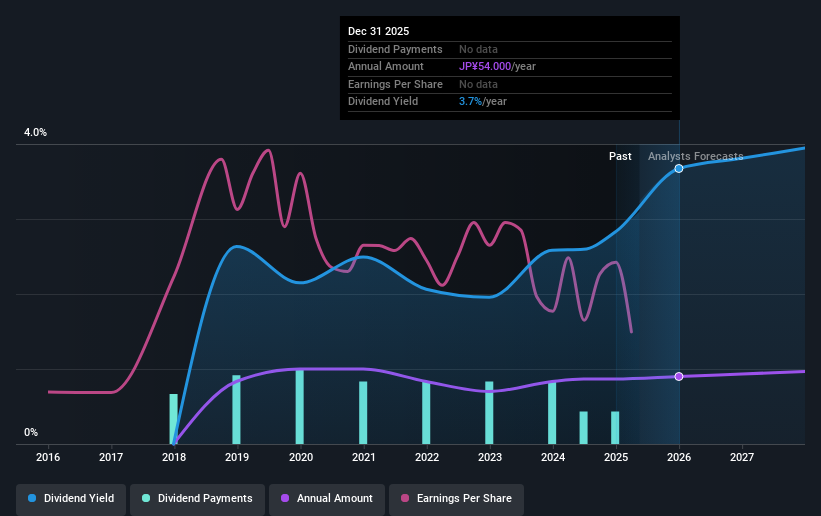

Optorun Co.,Ltd. (TSE:6235) has announced that it will be increasing its dividend from last year's comparable payment on the 9th of September to ¥27.00. This takes the dividend yield to 3.7%, which shareholders will be pleased with.

Our free stock report includes 1 warning sign investors should be aware of before investing in OptorunLtd. Read for free now.OptorunLtd's Future Dividend Projections Appear Well Covered By Earnings

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Prior to this announcement, OptorunLtd's dividend was only 58% of earnings, however it was paying out 117% of free cash flows. The company might be more focused on returning cash to shareholders, but paying out this much of its cash flow could expose the dividend to being cut in the future.

Looking forward, earnings per share is forecast to rise by 24.7% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 48%, which is in the range that makes us comfortable with the sustainability of the dividend.

Check out our latest analysis for OptorunLtd

OptorunLtd Doesn't Have A Long Payment History

The dividend's track record has been pretty solid, but with only 7 years of history we want to see a few more years of history before making any solid conclusions. The annual payment during the last 7 years was ¥42.00 in 2018, and the most recent fiscal year payment was ¥54.00. This means that it has been growing its distributions at 3.7% per annum over that time. OptorunLtd hasn't been paying a dividend for very long, so we wouldn't get to excited about its record of growth just yet.

The Dividend Has Limited Growth Potential

Investors could be attracted to the stock based on the quality of its payment history. However, things aren't all that rosy. OptorunLtd's EPS has fallen by approximately 11% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

The Dividend Could Prove To Be Unreliable

Overall, we always like to see the dividend being raised, but we don't think OptorunLtd will make a great income stock. While OptorunLtd is earning enough to cover the payments, the cash flows are lacking. We don't think OptorunLtd is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 1 warning sign for OptorunLtd that investors should know about before committing capital to this stock. Is OptorunLtd not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6235

OptorunLtd

Manufactures and sells optical thin film devices in Japan, China, Taiwan, Vietnam, South Korea, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026