- Japan

- /

- Semiconductors

- /

- TSE:6055

Did New Rapidus and TSMC Collaborations Just Shift JAPAN MATERIAL's (TSE:6055) Investment Narrative?

Reviewed by Sasha Jovanovic

- Recent analysis highlights JAPAN MATERIAL’s role as a critical supplier in the semiconductor industry, with the company set to gain from expected collaborations with Rapidus and TSMC’s Kumamoto plant.

- This positions JAPAN MATERIAL to potentially capture new opportunities as semiconductor supply chains expand to meet growing global demand.

- Let’s explore how JAPAN MATERIAL’s involvement with major semiconductor projects shapes its investment narrative and future growth prospects.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is JAPAN MATERIAL's Investment Narrative?

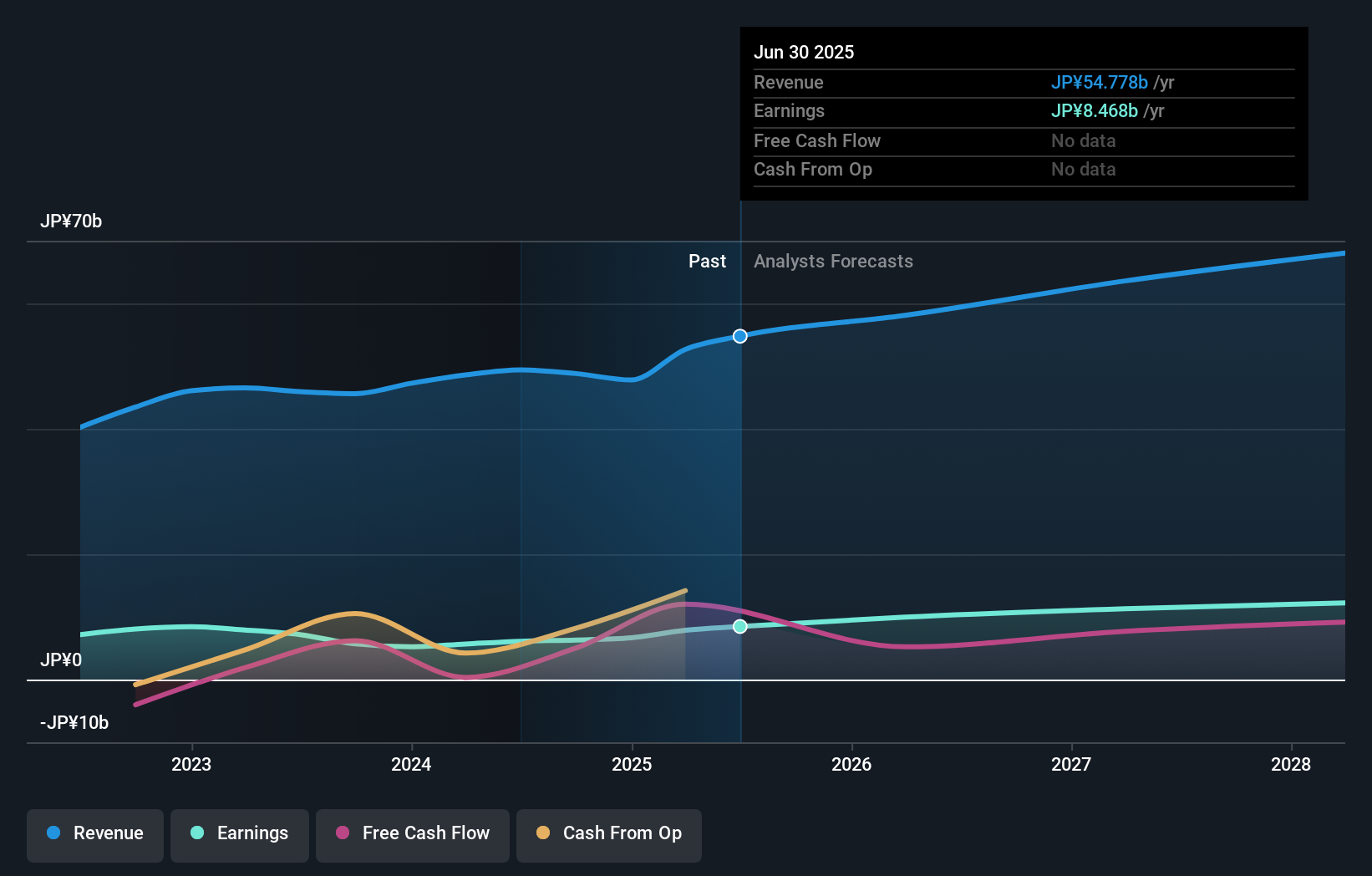

For anyone considering JAPAN MATERIAL today, the investment story hinges on the company's role as a crucial partner in the semiconductor supply chain. The recent news of collaborations with Rapidus and TSMC’s Kumamoto plant highlights a real, and possibly significant, catalyst that could accelerate growth prospects beyond what earlier analysis captured. Before this news, forecasts pointed to solid but not extraordinary annual growth, and valuation concerns lingered, with shares seen as expensive versus industry averages and a slight premium to consensus fair value. Short-term catalysts were largely tied to regular earnings cycles, margin improvements, and dividend increases, but this new supply chain involvement could shift attention to capacity, contract wins, or new customer announcements as the next big drivers. At the same time, risks around high valuation, recent share price volatility, and a profit outlook tied closely to the industry cycle are still important considerations. However, a sharp shift in chip industry orders could reshape this outlook quickly.

JAPAN MATERIAL's share price has been on the slide but might be up to 10% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore another fair value estimate on JAPAN MATERIAL - why the stock might be worth just ¥2200!

Build Your Own JAPAN MATERIAL Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JAPAN MATERIAL research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JAPAN MATERIAL research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JAPAN MATERIAL's overall financial health at a glance.

No Opportunity In JAPAN MATERIAL?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6055

JAPAN MATERIAL

Operates in the electronics and graphics businesses in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion