- Japan

- /

- Specialty Stores

- /

- TSE:9843

There's Reason For Concern Over Nitori Holdings Co., Ltd.'s (TSE:9843) Price

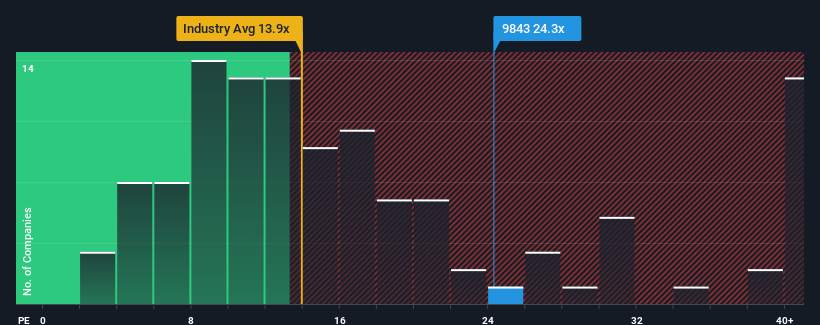

With a price-to-earnings (or "P/E") ratio of 24.3x Nitori Holdings Co., Ltd. (TSE:9843) may be sending very bearish signals at the moment, given that almost half of all companies in Japan have P/E ratios under 13x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's inferior to most other companies of late, Nitori Holdings has been relatively sluggish. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Nitori Holdings

How Is Nitori Holdings' Growth Trending?

Nitori Holdings' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 5.8% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 7.7% overall drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings should grow by 8.5% each year over the next three years. That's shaping up to be similar to the 10% per year growth forecast for the broader market.

With this information, we find it interesting that Nitori Holdings is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Nitori Holdings currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Nitori Holdings with six simple checks on some of these key factors.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Nitori Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9843

Nitori Holdings

Engages in the retail of furniture and interior products in Japan.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives