- Japan

- /

- Gas Utilities

- /

- TSE:9535

Top Dividend Stocks Including Marusan Securities And Two Others

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are increasingly focused on the implications of interest rate adjustments and economic resilience. With U.S. stocks experiencing fluctuations amid these developments, dividend stocks have garnered attention for their potential to provide steady income streams in volatile times. In this context, identifying strong dividend stocks involves assessing companies with stable earnings, robust cash flows, and a commitment to returning value to shareholders—qualities that can offer some stability amidst market turbulence.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.45% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.71% | ★★★★★★ |

Click here to see the full list of 1928 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Marusan Securities (TSE:8613)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Marusan Securities Co., Ltd. operates in the financial products trading sector in Japan and has a market capitalization of ¥66.26 billion.

Operations: Marusan Securities Co., Ltd. generates revenue through its financial products trading business in Japan.

Dividend Yield: 6.5%

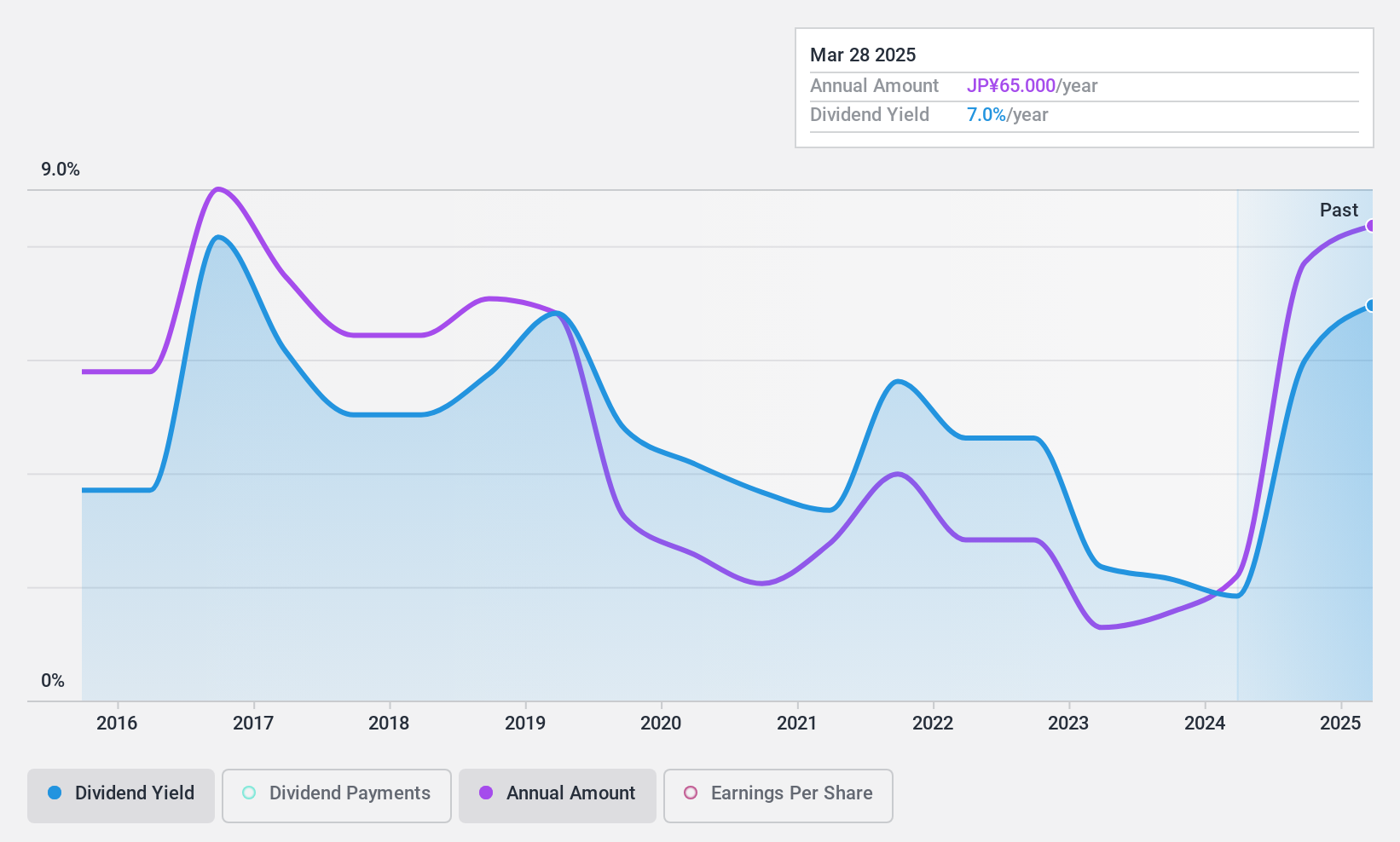

Marusan Securities offers an attractive dividend yield of 6.49%, placing it in the top 25% of dividend payers in Japan. Its dividends are well-covered by earnings and cash flows, with payout ratios of 42.2% and 33.5%, respectively, suggesting sustainability. However, despite a recent earnings growth of ¥74.3 billion, its dividend history has been volatile over the past decade, indicating potential reliability concerns for long-term investors seeking stable income streams.

- Click here and access our complete dividend analysis report to understand the dynamics of Marusan Securities.

- The analysis detailed in our Marusan Securities valuation report hints at an inflated share price compared to its estimated value.

HIROSHIMA GASLtd (TSE:9535)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HIROSHIMA GAS Co., Ltd. operates in the gas industry in Japan and has a market capitalization of ¥26.41 billion.

Operations: HIROSHIMA GAS Co., Ltd.'s revenue is primarily derived from its Gas Business, which generates ¥70.55 billion, and its LPG Business, contributing ¥17.83 billion.

Dividend Yield: 3.1%

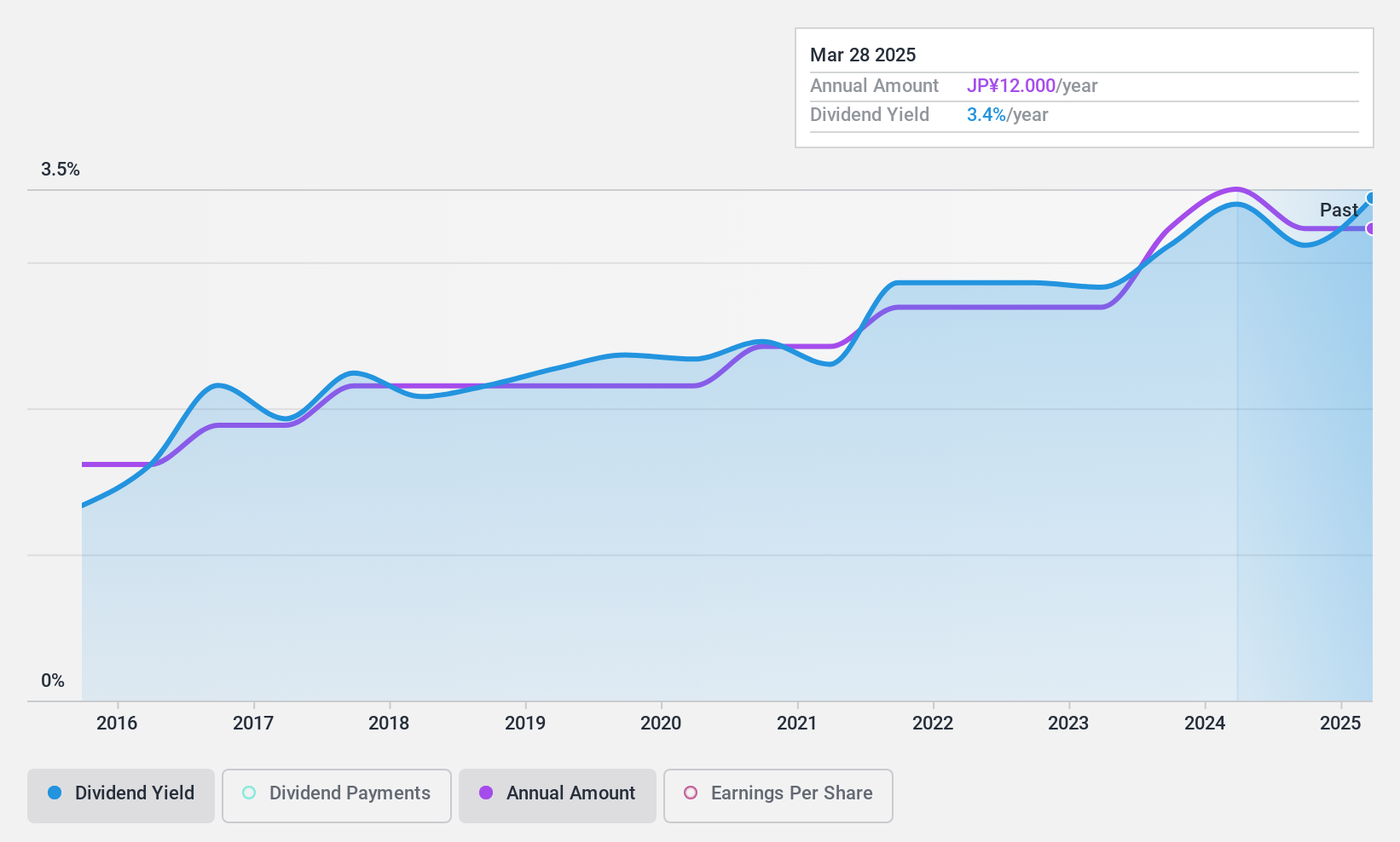

Hiroshima Gas Ltd. offers a dividend yield of 3.12%, below the top 25% in Japan, with stable and growing dividends over the past decade. However, its payout ratio of 89.3% suggests earnings coverage, but high cash payout ratio (212.7%) indicates insufficient free cash flow support, raising sustainability concerns despite reliability in payments historically. Recent profit margins have declined to 1%, further challenging dividend sustainability amidst financial pressures.

- Navigate through the intricacies of HIROSHIMA GASLtd with our comprehensive dividend report here.

- According our valuation report, there's an indication that HIROSHIMA GASLtd's share price might be on the expensive side.

Autobacs Seven (TSE:9832)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Autobacs Seven Co., Ltd. operates a chain of retail stores offering automotive goods and services both in Japan and internationally, with a market cap of ¥115.46 billion.

Operations: Autobacs Seven Co., Ltd.'s revenue segments include retail sales of automotive goods and services both domestically and internationally.

Dividend Yield: 4.1%

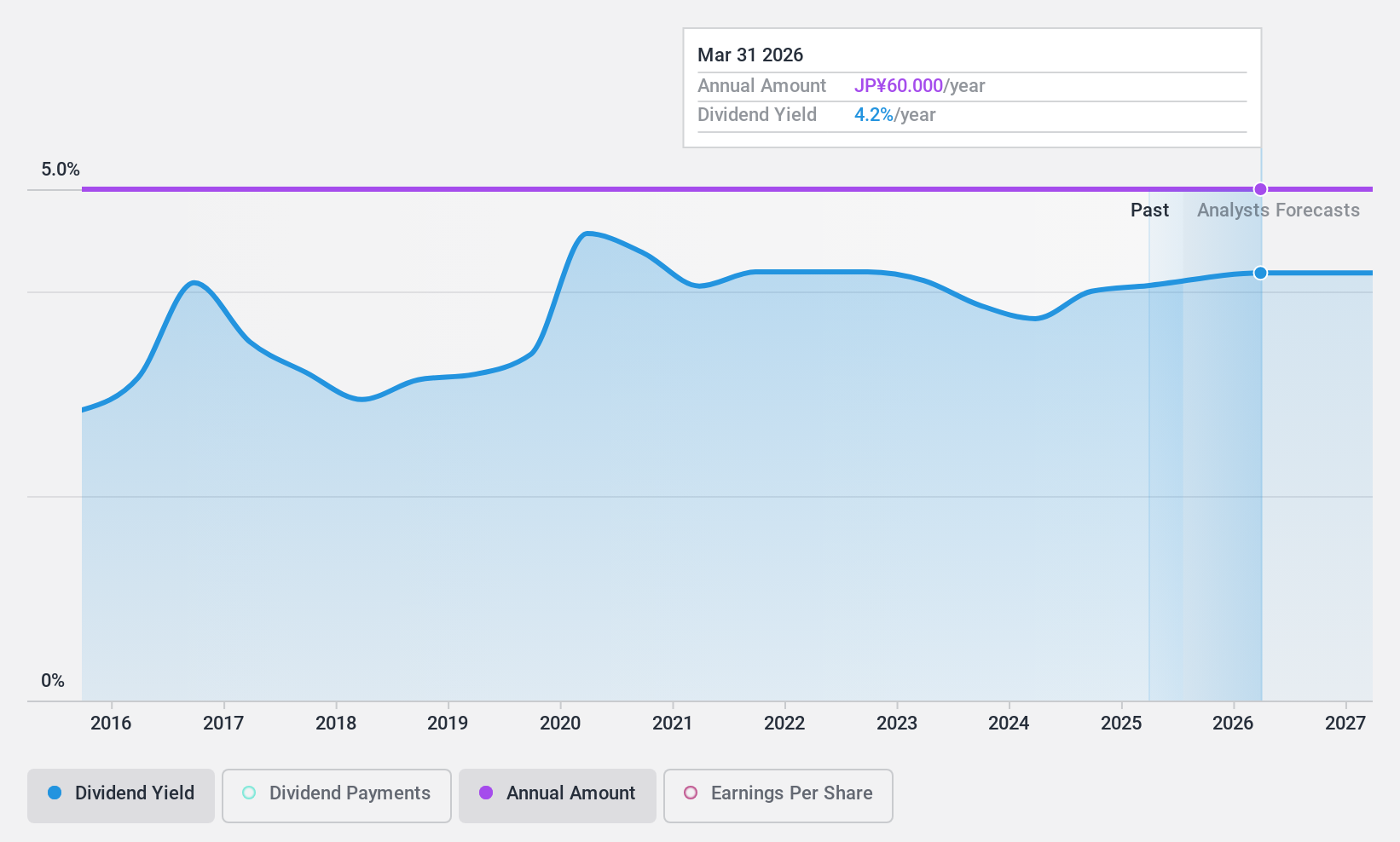

Autobacs Seven's dividend yield of 4.07% ranks in the top 25% in Japan, with stable and reliable dividends over the past decade. However, a high payout ratio of 164% indicates insufficient earnings coverage, compounded by a lack of free cash flow support. Recent profit margin declines from 3.8% to 1.3%, alongside delisting due to inactivity, highlight sustainability concerns despite historical growth in dividend payments.

- Unlock comprehensive insights into our analysis of Autobacs Seven stock in this dividend report.

- The valuation report we've compiled suggests that Autobacs Seven's current price could be inflated.

Key Takeaways

- Click this link to deep-dive into the 1928 companies within our Top Dividend Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HIROSHIMA GASLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9535

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives