- Japan

- /

- Specialty Stores

- /

- TSE:9270

Valuence Holdings Inc. (TSE:9270) Stocks Shoot Up 28% But Its P/S Still Looks Reasonable

Valuence Holdings Inc. (TSE:9270) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 25% in the last year.

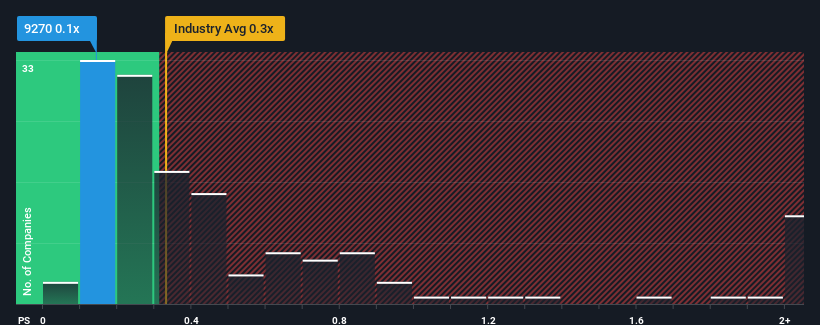

Although its price has surged higher, you could still be forgiven for feeling indifferent about Valuence Holdings' P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Specialty Retail industry in Japan is also close to 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Our free stock report includes 2 warning signs investors should be aware of before investing in Valuence Holdings. Read for free now.Check out our latest analysis for Valuence Holdings

How Has Valuence Holdings Performed Recently?

With revenue growth that's inferior to most other companies of late, Valuence Holdings has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Valuence Holdings will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Valuence Holdings?

In order to justify its P/S ratio, Valuence Holdings would need to produce growth that's similar to the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Although pleasingly revenue has lifted 51% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Turning to the outlook, the next three years should generate growth of 6.6% per annum as estimated by the two analysts watching the company. With the industry predicted to deliver 7.0% growth per year, the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Valuence Holdings' P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Its shares have lifted substantially and now Valuence Holdings' P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A Valuence Holdings' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Specialty Retail industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Valuence Holdings, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Valuence Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9270

Valuence Holdings

Engages in the purchase, auction, and sale of reused goods in Japan and internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives