- Japan

- /

- Specialty Stores

- /

- TSE:8214

Three Top Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

In a week marked by market turbulence and shifting economic policies, global indices experienced notable fluctuations as investors responded to emerging political dynamics and inflation data. Amidst this backdrop of uncertainty, dividend stocks remain an attractive option for investors seeking stability and income generation, offering potential resilience against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.14% | ★★★★★★ |

| Globeride (TSE:7990) | 4.17% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.38% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.33% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.88% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.73% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Loyalty Founder EnterpriseLtd (TPEX:5465)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Loyalty Founder Enterprise Co., Ltd. specializes in the manufacture, processing, and sale of precision steel molds and stamping die products for computers and server chassis across Taiwan, the United States, and Mainland China, with a market cap of approximately NT$4.97 billion.

Operations: Loyalty Founder Enterprise Co., Ltd. generates its revenue through the production and distribution of precision steel molds and stamping die products used in computer and server chassis across Taiwan, the United States, and Mainland China.

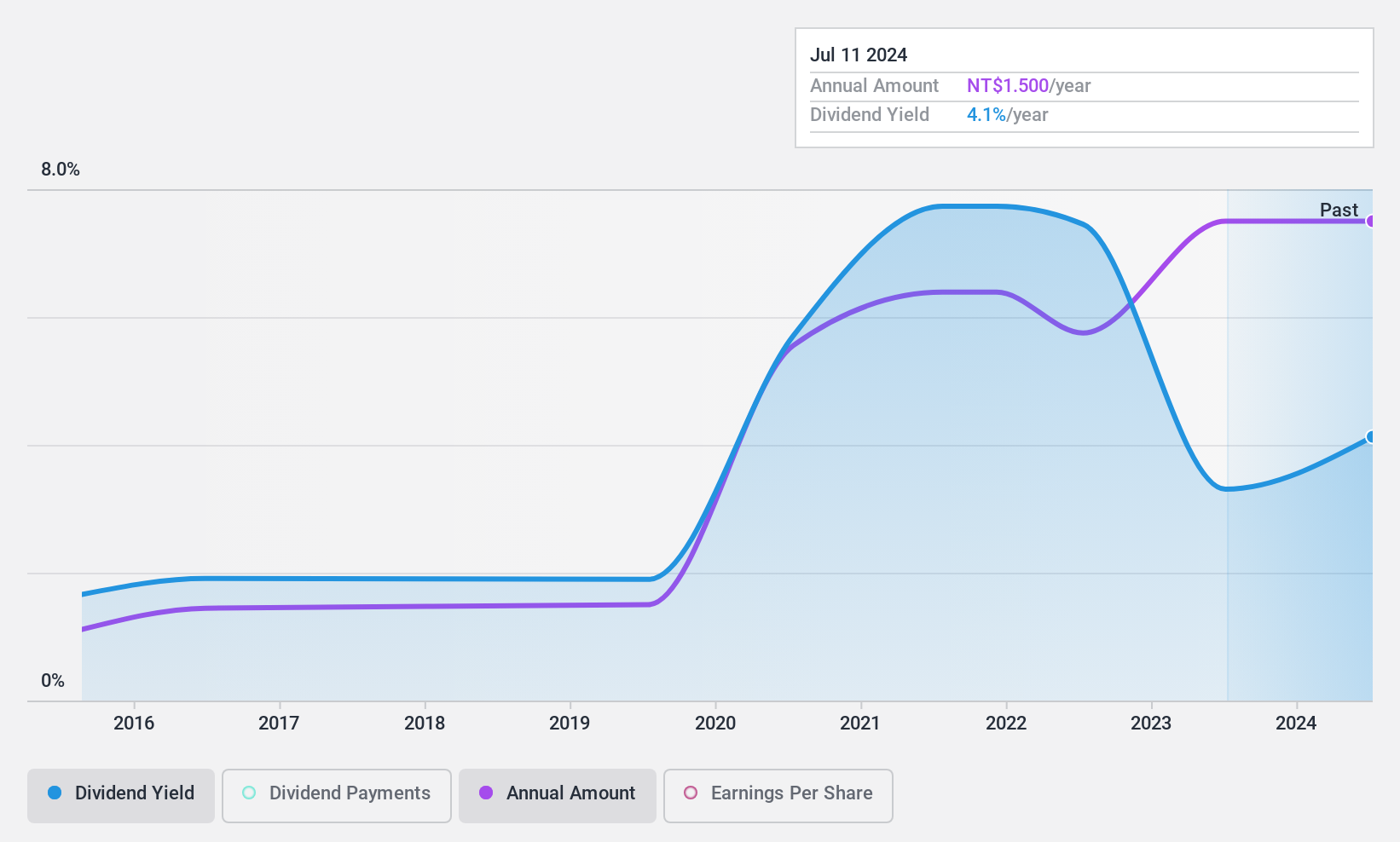

Dividend Yield: 4.1%

Loyalty Founder Enterprise Ltd.'s dividend payments have been volatile over the past decade, though they are well covered by earnings and cash flows with a payout ratio of 86.8% and a cash payout ratio of 36.8%. Despite recent declines in sales and net income, the company has managed to increase its dividends over the last ten years. However, its current yield is below top-tier levels in Taiwan's market, indicating room for improvement in dividend competitiveness.

- Delve into the full analysis dividend report here for a deeper understanding of Loyalty Founder EnterpriseLtd.

- Our valuation report here indicates Loyalty Founder EnterpriseLtd may be undervalued.

AOKI Holdings (TSE:8214)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: AOKI Holdings Inc. operates in the fashion, anniversary and bridal, entertainment, and real estate rental sectors in Japan with a market cap of ¥101.25 billion.

Operations: AOKI Holdings Inc. generates revenue from its diverse operations in the fashion, anniversary and bridal, entertainment, and real estate rental sectors in Japan.

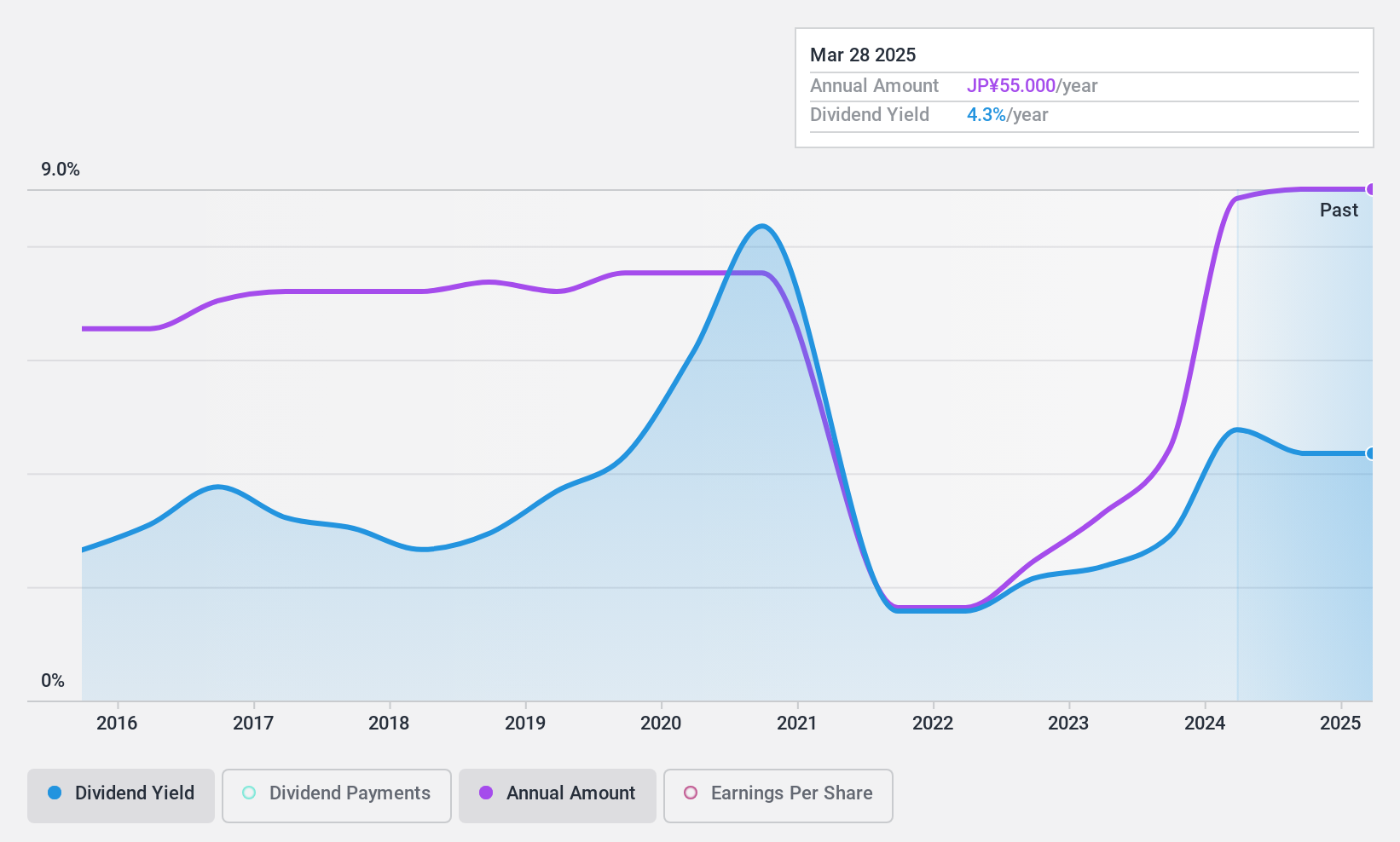

Dividend Yield: 4.4%

AOKI Holdings' dividend yield is among the top 25% in Japan, with a payout ratio of 37.5% and a cash payout ratio of 58.3%, indicating solid coverage by earnings and cash flows. Despite past volatility in dividends, recent increases from JPY 13.00 to JPY 15.00 per share reflect growth potential. Earnings have improved significantly, with net income rising to JPY 2,791 million for the half-year ending September 2024, supporting future dividend sustainability.

- Take a closer look at AOKI Holdings' potential here in our dividend report.

- According our valuation report, there's an indication that AOKI Holdings' share price might be on the cheaper side.

Nissan Tokyo Sales Holdings (TSE:8291)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nissan Tokyo Sales Holdings Co., Ltd. operates in the automobile dealership business in Japan with a market cap of ¥27.97 billion.

Operations: Nissan Tokyo Sales Holdings Co., Ltd. generates revenue primarily from its Automobile Related Business segment, amounting to ¥145.35 million.

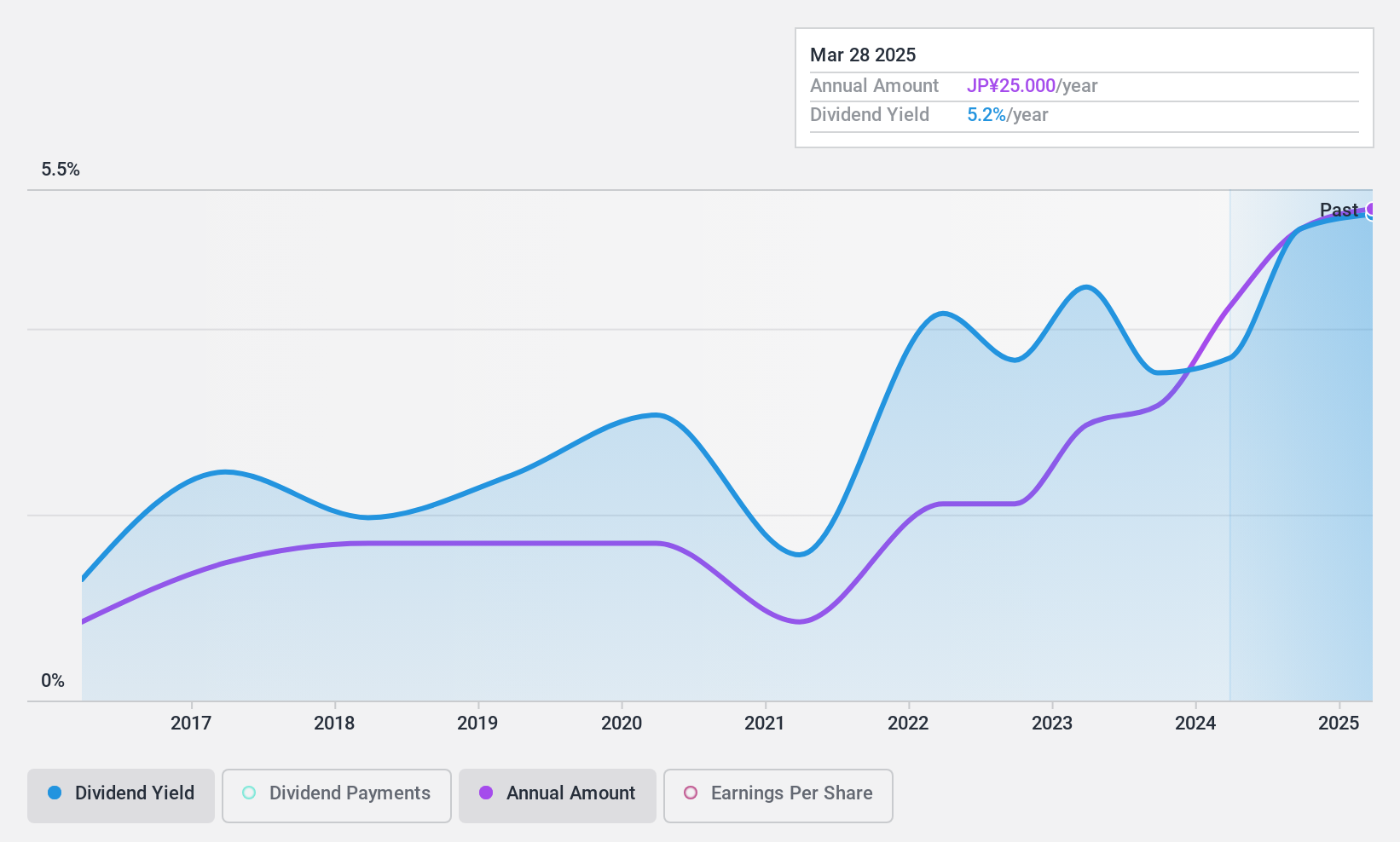

Dividend Yield: 5.6%

Nissan Tokyo Sales Holdings offers a dividend yield in the top 25% of the Japanese market, supported by a low payout ratio of 20.6% and a cash payout ratio of 41.4%, suggesting strong coverage by earnings and cash flows. Despite historical volatility, dividends increased from JPY 9.00 to JPY 12.00 per share recently, indicating potential growth. Earnings surged by 78.2% over the past year, enhancing prospects for future dividend stability and sustainability.

- Navigate through the intricacies of Nissan Tokyo Sales Holdings with our comprehensive dividend report here.

- Our expertly prepared valuation report Nissan Tokyo Sales Holdings implies its share price may be lower than expected.

Key Takeaways

- Explore the 1951 names from our Top Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8214

AOKI Holdings

Engages in the fashion, anniversary and bridal, entertainment, and real estate rental businesses in Japan.

Excellent balance sheet established dividend payer.