Takashimaya (TSE:8233) Valuation in Focus After Latest Share Buyback Update

Reviewed by Kshitija Bhandaru

Takashimaya Company (TSE:8233) has provided an update on its ongoing treasury share purchase program, reporting the acquisition of nearly 2.5 million shares in September. The buyback plan, approved by its Board, highlights the company's focus on shareholder value and ESG priorities.

See our latest analysis for Takashimaya Company.

Takashimaya’s recent treasury share buyback signals the company’s commitment to investor returns and ESG priorities. While the latest share price has barely budged this year, the 1-year total shareholder return tells a similar story of muted momentum, suggesting that the market is waiting for more decisive catalysts.

If this steady approach has you thinking about what else is happening in the market, now is the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares trading close to recent highs, yet sitting below analyst targets, investors may wonder if Takashimaya is trading at a discount or if the market already reflects all its future growth prospects, leaving limited upside.

Price-to-Earnings of 15.5x: Is it justified?

Takashimaya shares are trading at a price-to-earnings ratio of 15.5x. This places the company at what appears to be good value compared to its peers and industry benchmarks.

The price-to-earnings (P/E) ratio shows how much investors are willing to pay for each yen of earnings. In the multiline retail sector, this multiple often reflects the stability and competitive pressures of Japan's established retail environment.

For Takashimaya, a P/E of 15.5x is below both the peer average (16.9x) and the JP Multiline Retail industry average (17.8x), suggesting the market values its earnings more conservatively than its competitors. This P/E is also below the estimated fair price-to-earnings ratio of 16.8x, indicating there may be further scope for the market to close the gap if outlook improves.

Explore the SWS fair ratio for Takashimaya Company

Result: Price-to-Earnings of 15.5x (UNDERVALUED)

However, weaker annual net income growth and Takashimaya's significant discount to analyst price targets may signal caution for investors who are watching future market moves.

Find out about the key risks to this Takashimaya Company narrative.

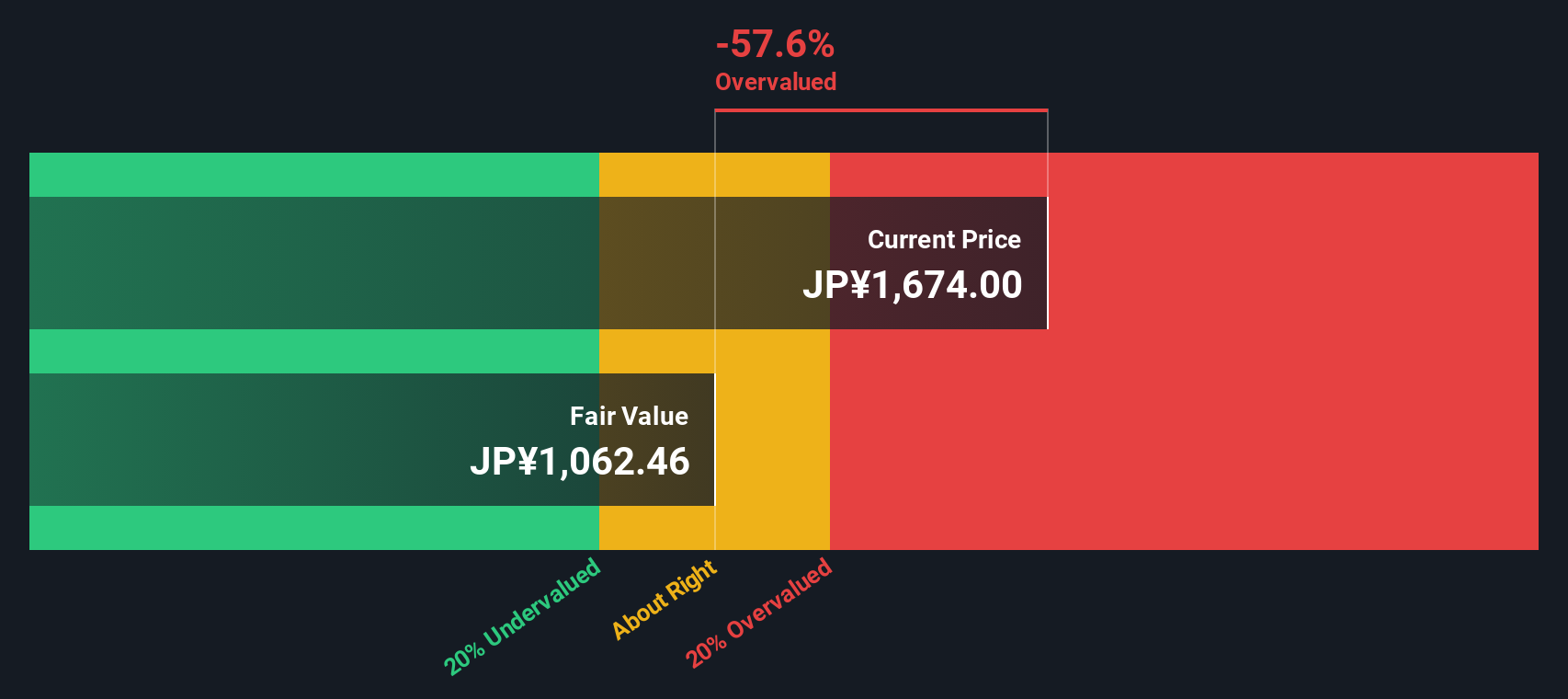

Another View: Is Takashimaya Overvalued?

While the current price-to-earnings ratio points to possible value, our DCF model tells a very different story. Based on discounted future cash flows, Takashimaya shares are actually trading well above what our fundamentals-based estimate considers fair. Are investors overlooking the risks ahead, or does something else justify this premium?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Takashimaya Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Takashimaya Company Narrative

If you see the numbers differently or want to dig even deeper, you can shape your own view using our tools, all in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Takashimaya Company.

Ready for More Investment Opportunities?

Don’t stop with Takashimaya. The market is full of smart investment angles you could be acting on right now. Put your cash to work and see real potential.

- Catch high yields and stable returns by checking out these 19 dividend stocks with yields > 3% offering more than 3% payouts to strengthen your income stream.

- Get ahead of the tech curve and find future leaders among these 24 AI penny stocks already making an impact in artificial intelligence innovation.

- Seize unbeatable value by targeting these 902 undervalued stocks based on cash flows that are priced below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takashimaya Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8233

Takashimaya Company

Engages in the department stores, corporate, and mail order business in Japan.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives