Market Participants Recognise Takashimaya Company, Limited's (TSE:8233) Earnings

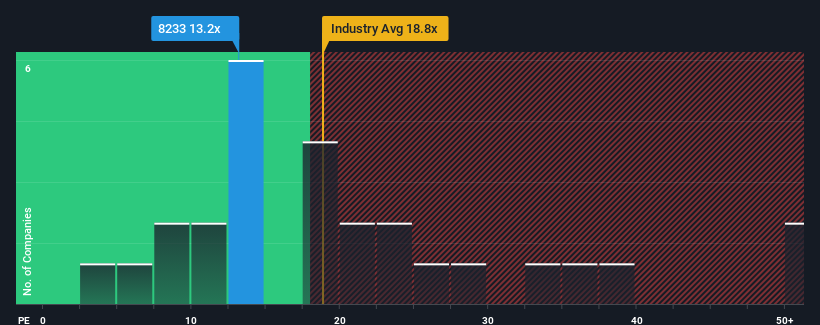

With a median price-to-earnings (or "P/E") ratio of close to 14x in Japan, you could be forgiven for feeling indifferent about Takashimaya Company, Limited's (TSE:8233) P/E ratio of 13.2x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been advantageous for Takashimaya Company as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Takashimaya Company

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Takashimaya Company's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 18% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 8.0% each year during the coming three years according to the four analysts following the company. With the market predicted to deliver 9.6% growth per annum, the company is positioned for a comparable earnings result.

With this information, we can see why Takashimaya Company is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Takashimaya Company maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Takashimaya Company with six simple checks on some of these key factors.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Takashimaya Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8233

Takashimaya Company

Engages in the department stores, corporate, and mail order business in Japan.

Established dividend payer with proven track record.

Market Insights

Community Narratives