- China

- /

- Transportation

- /

- SZSE:002627

Uncovering Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets experience broad-based gains with smaller-cap indexes outperforming large-caps, investor sentiment is buoyed by strong labor market reports and rising home sales in the U.S. This positive backdrop presents an opportunity to explore lesser-known stocks that may offer promising potential, as a good stock often combines solid fundamentals with favorable market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Hubei Three Gorges Tourism Group (SZSE:002627)

Simply Wall St Value Rating: ★★★★★★

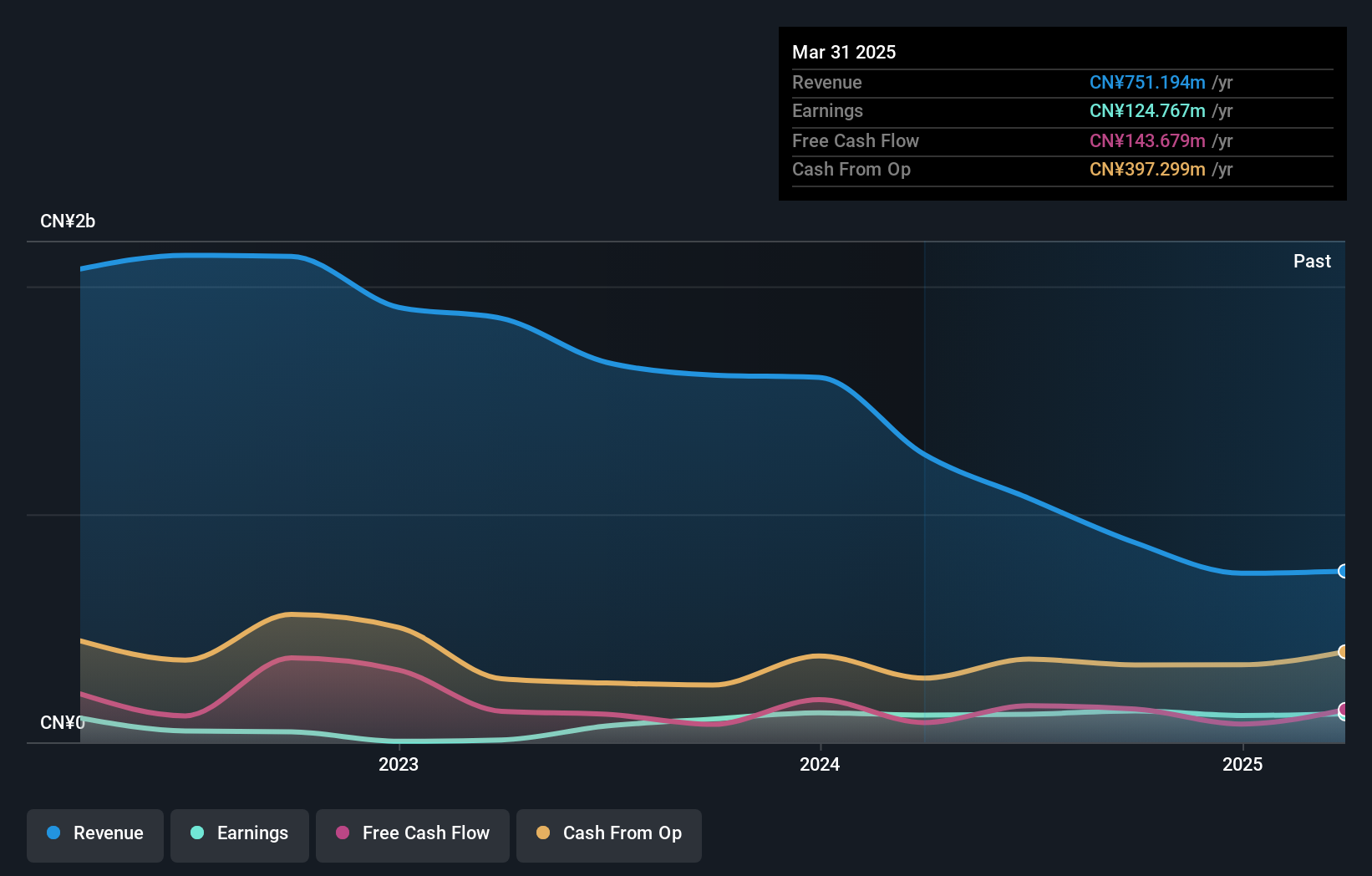

Overview: Hubei Three Gorges Tourism Group Co., Ltd. operates in the tourism industry, focusing on travel services and attractions related to the Three Gorges region, with a market cap of CN¥3.69 billion.

Operations: The company generates revenue primarily from travel services and attractions in the Three Gorges region. It focuses on optimizing its cost structure to enhance profitability, with a notable emphasis on managing operational expenses.

Hubei Three Gorges Tourism Group, a relatively small player in the tourism sector, shows promising financial health with its earnings growth of 34%, outpacing the transportation industry's 1.9%. The company reported net income of CNY 111.94 million for the first nine months of 2024, up from CNY 104.41 million last year, despite a drop in revenue to CNY 556.42 million from CNY 1.28 billion previously. With a debt-to-equity ratio reduced to 11% over five years and a P/E ratio of 26.9x below the market average, it seems well-positioned financially amidst industry challenges and recent shareholder meetings addressing capital changes.

Chiyoda (TSE:8185)

Simply Wall St Value Rating: ★★★★★★

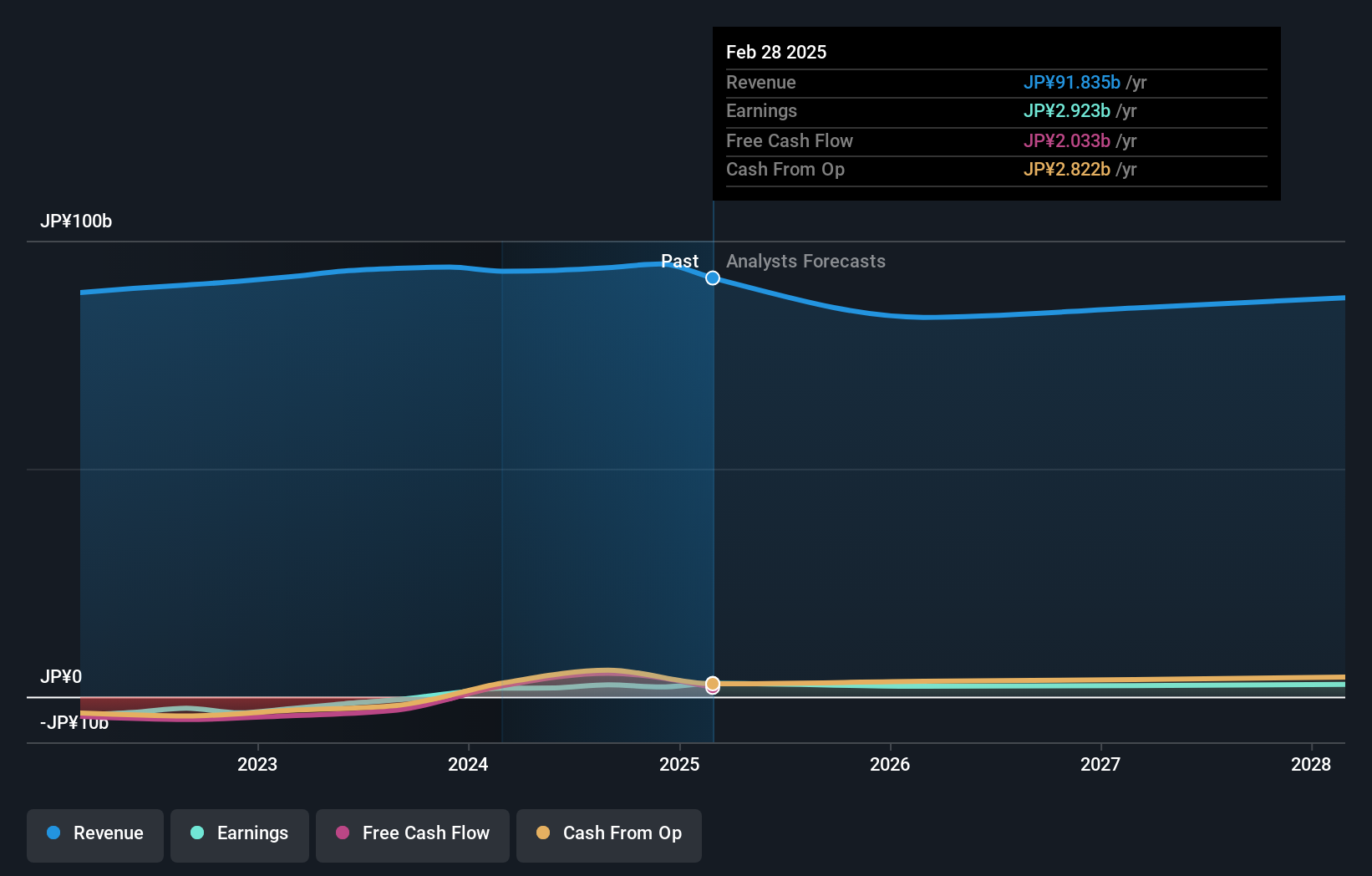

Overview: Chiyoda Co., Ltd., along with its subsidiaries, operates in the retail sector specializing in shoes and sneakers across Japan, with a market capitalization of ¥51.17 billion.

Operations: Chiyoda Co., Ltd. generates revenue primarily from the retail sale of shoes and sneakers in Japan. The company's financial performance is influenced by its cost structure, which includes expenses related to inventory, logistics, and retail operations. A key financial metric to note is the gross profit margin, which reflects the company's ability to manage production costs relative to sales revenue.

Chiyoda, a promising player in its field, has caught attention with its recent performance. The company is trading at 93.4% below what analysts consider fair value, presenting a potential opportunity for investors. It boasts high-quality earnings and has become profitable recently, outpacing the Specialty Retail industry growth of 2.6%. Chiyoda's debt-free status enhances its financial stability and eliminates concerns over interest payments. Additionally, it has shown positive free cash flow and reduced debt levels significantly over the past five years from a debt-to-equity ratio of 1.9%. Earnings are expected to grow by 4.1% annually moving forward.

- Delve into the full analysis health report here for a deeper understanding of Chiyoda.

Gain insights into Chiyoda's past trends and performance with our Past report.

Thinking Electronic Industrial (TWSE:2428)

Simply Wall St Value Rating: ★★★★★☆

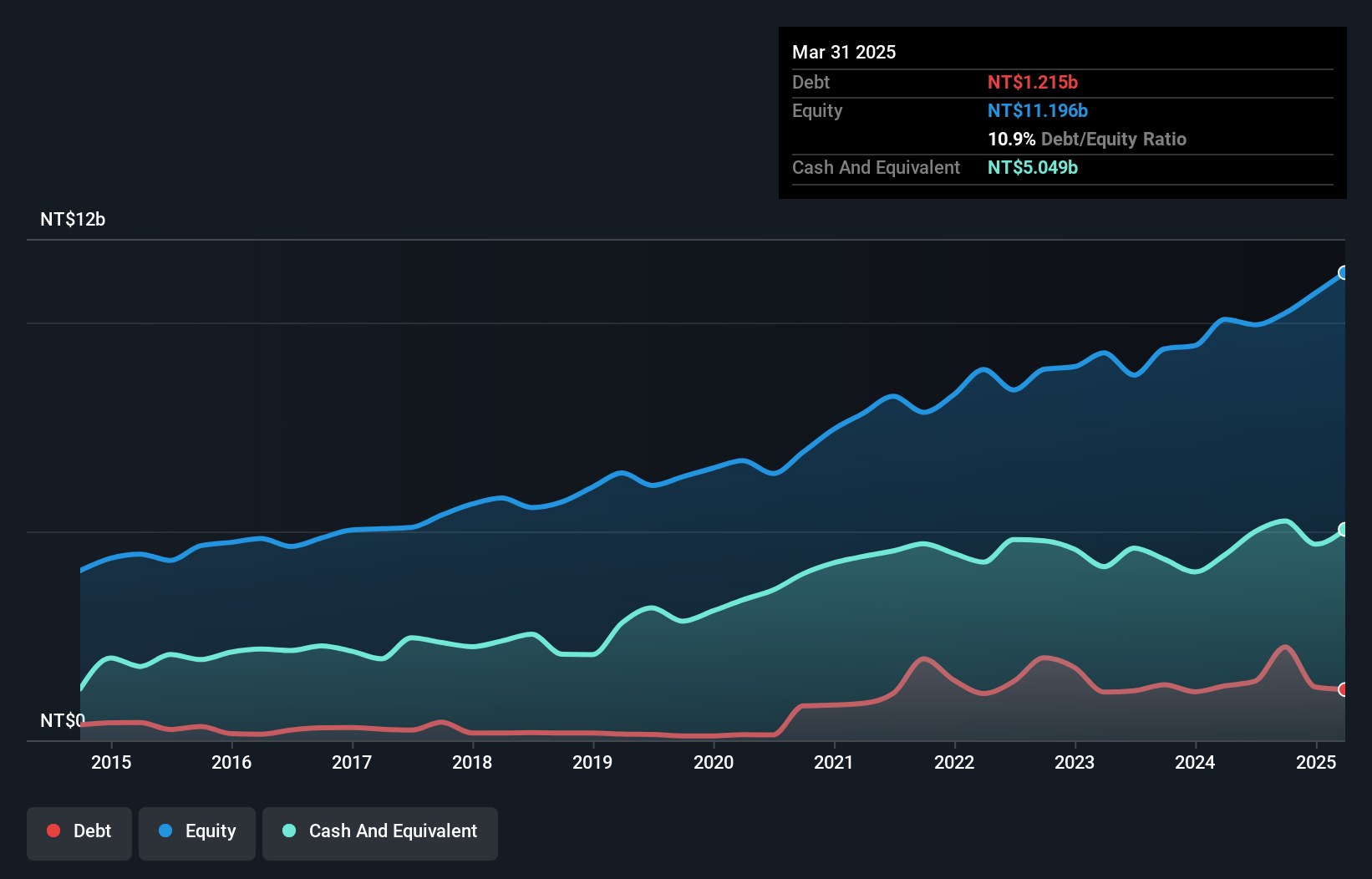

Overview: Thinking Electronic Industrial Co., Ltd. is engaged in the manufacturing, processing, and sale of electric devices, thermistors, varistors, and wires across Taiwan, China, and international markets with a market cap of NT$20.37 billion.

Operations: The company generates revenue primarily from the sale of electric devices, thermistors, varistors, and wires across various markets. Its cost structure includes manufacturing and processing expenses related to these products. The net profit margin is a key financial metric to consider when evaluating its profitability trends over time.

Thinking Electronic Industrial, a noteworthy player in the electronics sector, showcases strong financial health with earnings growth of 35.9% over the past year, outpacing the industry average of 9%. The company trades at a favorable price-to-earnings ratio of 13.5x compared to the TW market's 21.3x, indicating good relative value. Recent quarterly results highlight sales reaching TWD 1.98 billion and net income at TWD 378.59 million, both higher than last year's figures for the same period. Despite an increase in its debt-to-equity ratio from 1.7% to 21.9% over five years, it holds more cash than total debt and remains profitable with positive free cash flow.

Turning Ideas Into Actions

- Access the full spectrum of 4638 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hubei Three Gorges Tourism Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002627

Hubei Three Gorges Tourism Group

Hubei Three Gorges Tourism Group Co., Ltd.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives