As global markets grapple with renewed U.S.-China trade tensions and economic uncertainties, investors are increasingly turning their attention to Asia's dividend stocks as a potential source of stability and income. In such a volatile environment, selecting stocks with strong dividend yields can offer an attractive balance of risk and reward, providing investors with consistent returns even amid market fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.16% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.08% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.98% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Daicel (TSE:4202) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.46% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.81% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.44% | ★★★★★★ |

Click here to see the full list of 1065 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

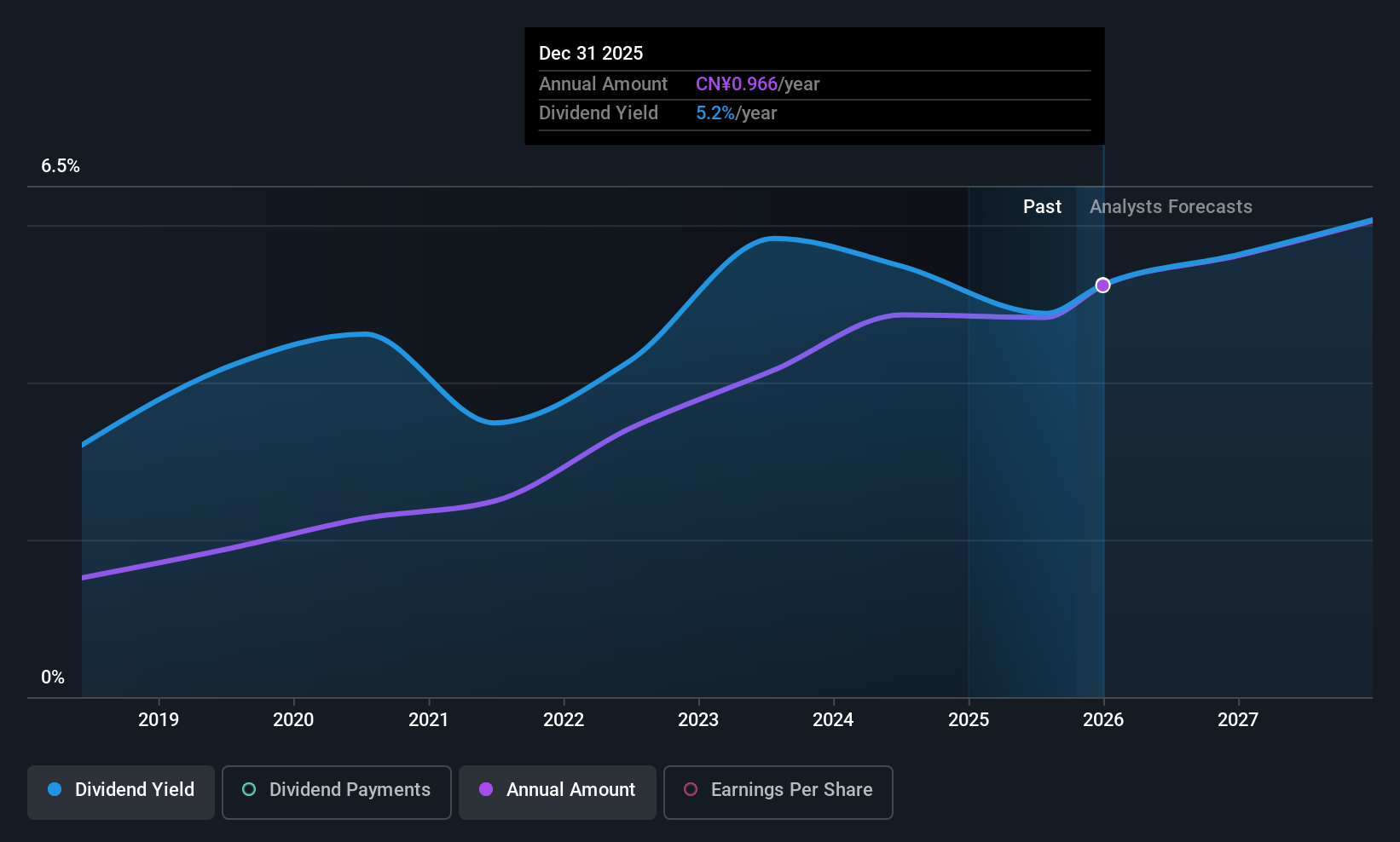

Bank of Chengdu (SHSE:601838)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Chengdu Co., Ltd. offers a range of commercial banking products and services in China and has a market cap of CN¥79.05 billion.

Operations: Bank of Chengdu Co., Ltd. generates revenue through its main segments: Personal Banking (CN¥4.47 billion), Corporate Banking (CN¥12.17 billion), and Financial Operations (CN¥4.87 billion).

Dividend Yield: 4.8%

Bank of Chengdu offers a compelling dividend profile with its payouts well-covered by earnings, demonstrated by a low payout ratio of 27.6%. The bank's dividends are in the top 25% of CN market payers, yielding 4.78%. Despite having only a seven-year history of dividends, payments have been stable and reliable. Recent earnings growth supports sustainability, as net income rose to CNY 6.62 billion for H1 2025 from CNY 6.17 billion last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Bank of Chengdu.

- Insights from our recent valuation report point to the potential undervaluation of Bank of Chengdu shares in the market.

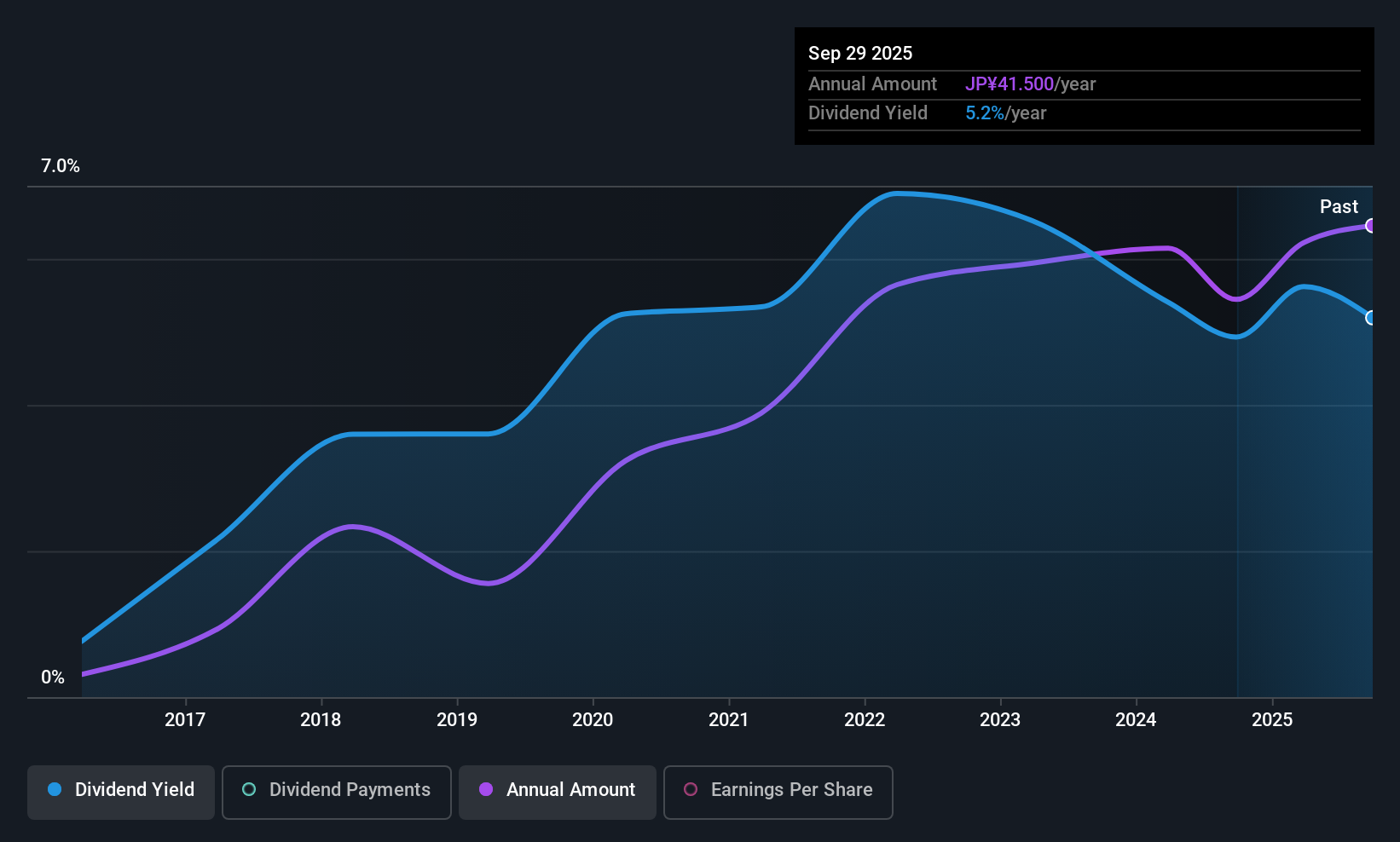

Asanuma (TSE:1852)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asanuma Corporation operates as a general contractor both in Japan and internationally, with a market cap of ¥72.17 billion.

Operations: Asanuma Corporation's revenue is primarily derived from its Building Construction segment, which accounts for ¥149.92 billion, followed by the Civil Engineering segment at ¥24.22 billion.

Dividend Yield: 4.6%

Asanuma Corporation's dividend payments are reasonably covered by both earnings and cash flows, with payout ratios of 65.5% and 73%, respectively. Recent earnings growth, highlighted by a net income increase to ¥712 million for Q1 2025 from ¥360 million the previous year, supports this coverage. However, its dividend history has been volatile over the past decade, lacking reliability despite being in the top 25% of payers in Japan with a yield of 4.63%.

- Take a closer look at Asanuma's potential here in our dividend report.

- The valuation report we've compiled suggests that Asanuma's current price could be inflated.

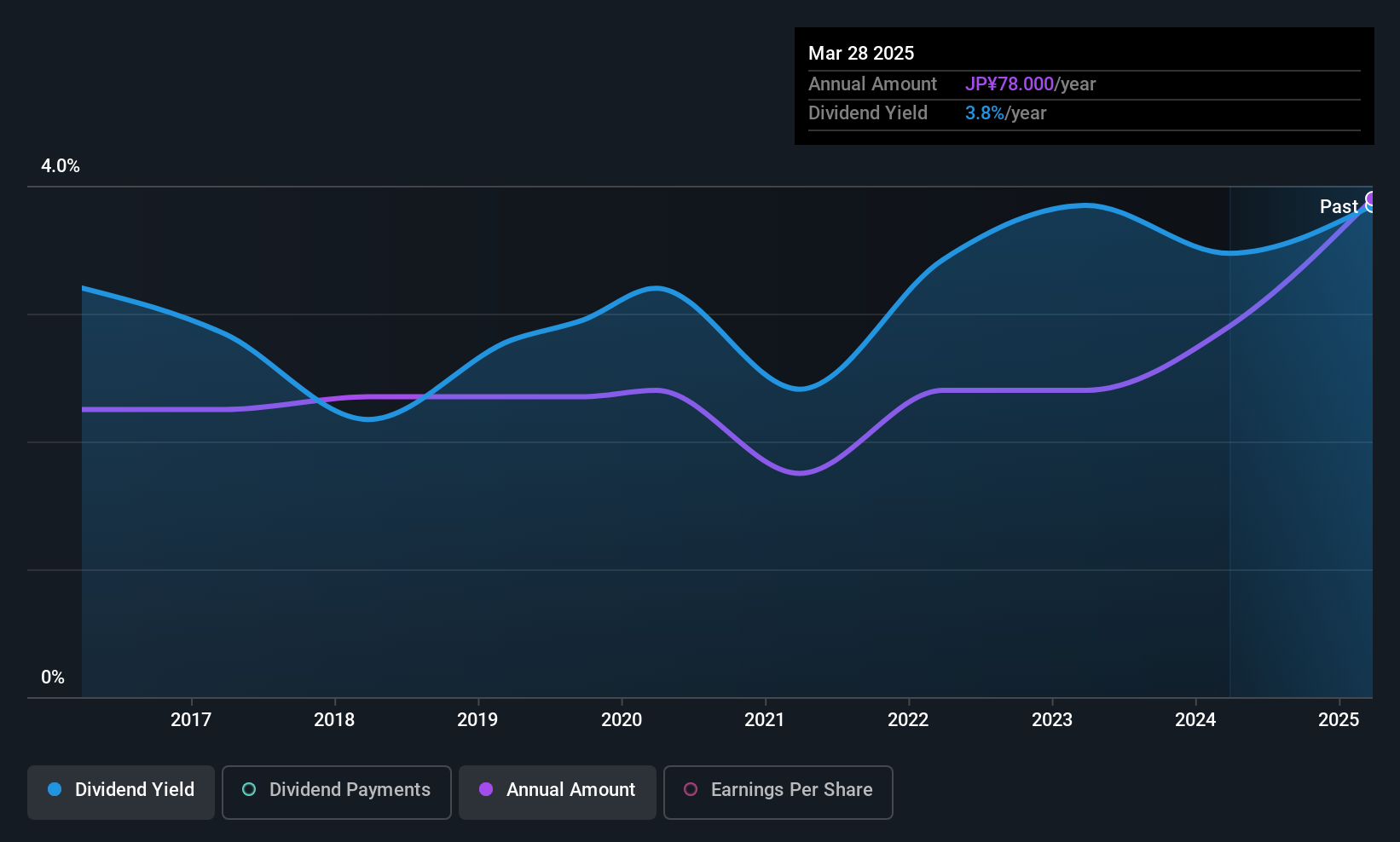

YagiLtd (TSE:7460)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yagi & Co., Ltd. is a fiber trading company based in Japan with a market capitalization of ¥25.95 billion.

Operations: Yagi & Co., Ltd. generates its revenue from several segments, including the Apparel Business at ¥44.32 billion, Material Business at ¥22.43 billion, Lifestyle Business at ¥6.68 billion, Real Estate Business at ¥887 million, and Brand/Retail Business (excluding Lifestyle) at ¥10.95 billion.

Dividend Yield: 3.6%

Yagi Ltd.'s dividend payments are well covered by earnings and cash flows, with payout ratios of 27.1% and 25.7%, respectively, indicating sustainability despite a history of volatility over the past decade. The company's recent share buyback program, totaling ¥1 billion for 320,000 shares, reflects a flexible capital policy but does not directly enhance its dividend appeal. Its yield of 3.59% is slightly below Japan's top-tier payers' average.

- Unlock comprehensive insights into our analysis of YagiLtd stock in this dividend report.

- The analysis detailed in our YagiLtd valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Reveal the 1065 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Chengdu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601838

Bank of Chengdu

Provides various commercial banking products and services in China.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives