Is MUJI (TSE:7453) Still a Good Value After Its Strong Multi-Year Stock Run?

Reviewed by Simply Wall St

Ryohin Keikaku (TSE:7453) has seen its shares catch the attention of investors recently, and questions are swirling about what could lie ahead for the company. While there have been no headline-grabbing events or dramatic business changes in recent days, the movement in the share price alone is causing many to pause and reassess their stance. Sometimes, a period of relative calm in the news cycle can be just as telling for investors as flashy announcements, especially for companies with solid multi-year track records.

Looking at the broader picture, Ryohin Keikaku’s stock performance over the past year has been strong. The share price has more than doubled in value and posted an impressive gain since the start of the year. However, recent months have brought a noticeable retracement, with shares declining over both the past month and the past quarter. The stock continues to follow a three-year uptrend, but the short-term pullback signals investor uncertainty after a solid multi-year run. There have been no other major developments reported recently, so most of the focus remains on the valuation picture and the underlying business momentum.

With the stock rallying so far this year but facing a recent cooling off, is Ryohin Keikaku a bargain at current levels or is the market already factoring in the company’s future growth prospects?

Price-to-Earnings of 31.6x: Is it justified?

Based on the current price-to-earnings (P/E) ratio, Ryohin Keikaku trades at 31.6 times its earnings, making it appear expensive compared to industry peers and averages. This ratio indicates that investors are paying a premium for each unit of current earnings, which is significantly higher than both the JP Multiline Retail industry average of 17.6x and the peer group average of 20.7x.

The P/E ratio is a widely followed measure that compares a company's share price to its per-share earnings. For retail businesses like Ryohin Keikaku, it is often used to gauge whether the market has high expectations for the company's future growth or is being overly optimistic.

Given the premium valuation, it seems the market is pricing in accelerated profit growth or sustained outperformance relative to peers. However, when the multiple is this much higher than sector benchmarks, investors should consider whether growth prospects or business quality fully justify the optimism.

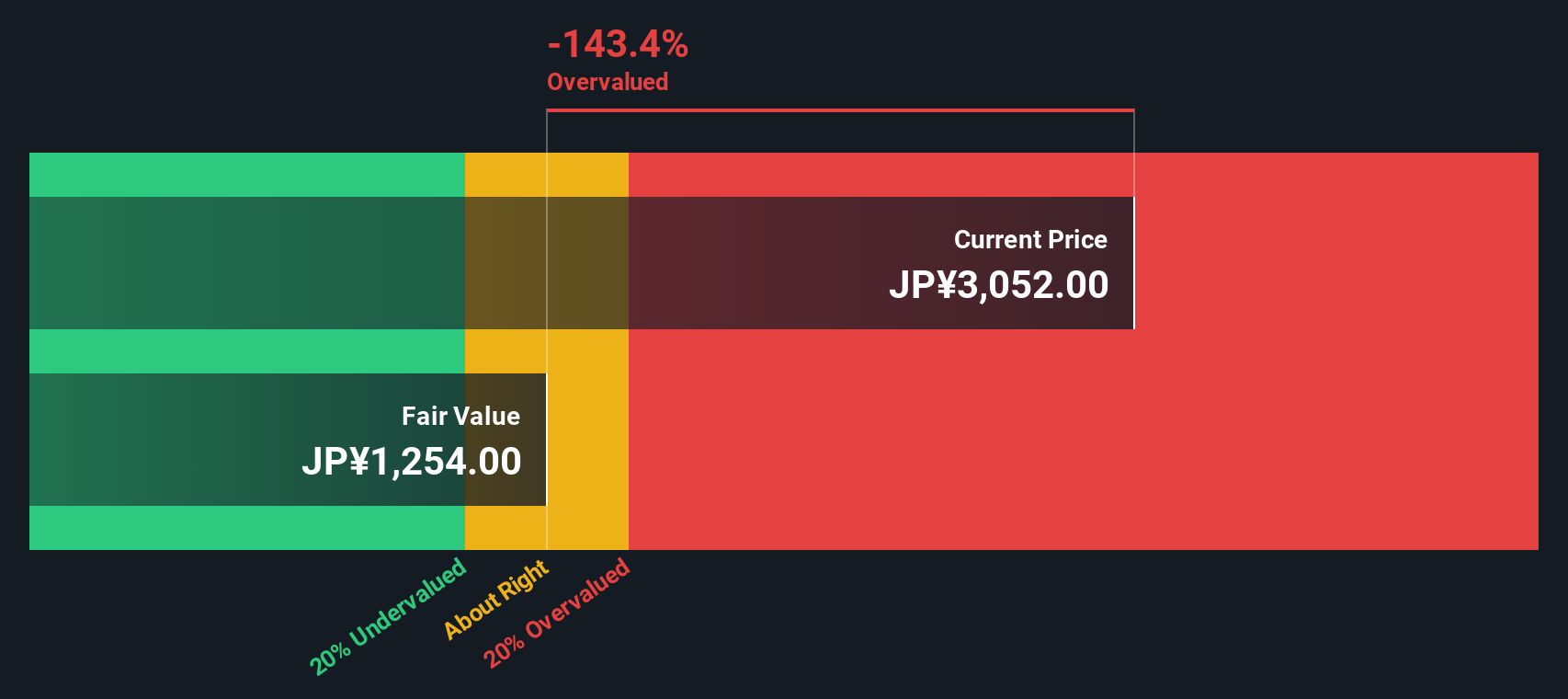

Result: Fair Value of ¥1,620.9 (OVERVALUED)

See our latest analysis for Ryohin Keikaku.However, if earnings momentum slows or there is a negative shift in consumer demand, the current optimism surrounding Ryohin Keikaku’s premium valuation could be quickly challenged.

Find out about the key risks to this Ryohin Keikaku narrative.Another View: What Does the SWS DCF Model Say?

Taking a different tack, the SWS DCF model looks at Ryohin Keikaku’s future cash flows and provides a valuation that also suggests the shares are priced higher than what the underlying business might warrant. However, is any one method ever the full story for investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ryohin Keikaku Narrative

If you would rather take a hands-on approach or dig into the numbers yourself, it's easy to build a personalized Ryohin Keikaku narrative in just a few minutes, and Do it your way.

A great starting point for your Ryohin Keikaku research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for just one opportunity when you can quickly compare stocks that meet your unique goals. Find standout companies and fresh angles worth your attention.

- Hunt for big value plays by using the insights in undervalued stocks based on cash flows. This can help you spot stocks the market could be underestimating right now.

- Tap into the next wave of health innovation and find medical companies transforming patient care with healthcare AI stocks.

- See which firms are reshaping the digital economy as you spot game-changing opportunities with cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:7453

Ryohin Keikaku

Develops, manufactures, distributes, and sells apparel, household goods, and food items in Japan and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives