- Japan

- /

- Specialty Stores

- /

- TSE:4732

Did USS' (TSE:4732) Dividend Hike and Payout Commitment Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- On November 11, USS Co., Ltd. announced an increased second quarter dividend of ¥25.20 per share, raised full-year dividend guidance to ¥26.20, and released upgraded consolidated earnings forecasts for the fiscal year ending March 2026.

- The company's updated shareholder return policy includes a consolidated dividend payout ratio of at least 60% and a total payout ratio of at least 100% over the next three years.

- We’ll examine how USS’s commitment to higher dividends and reinforced payout policies shapes its investment thesis moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

What Is USS' Investment Narrative?

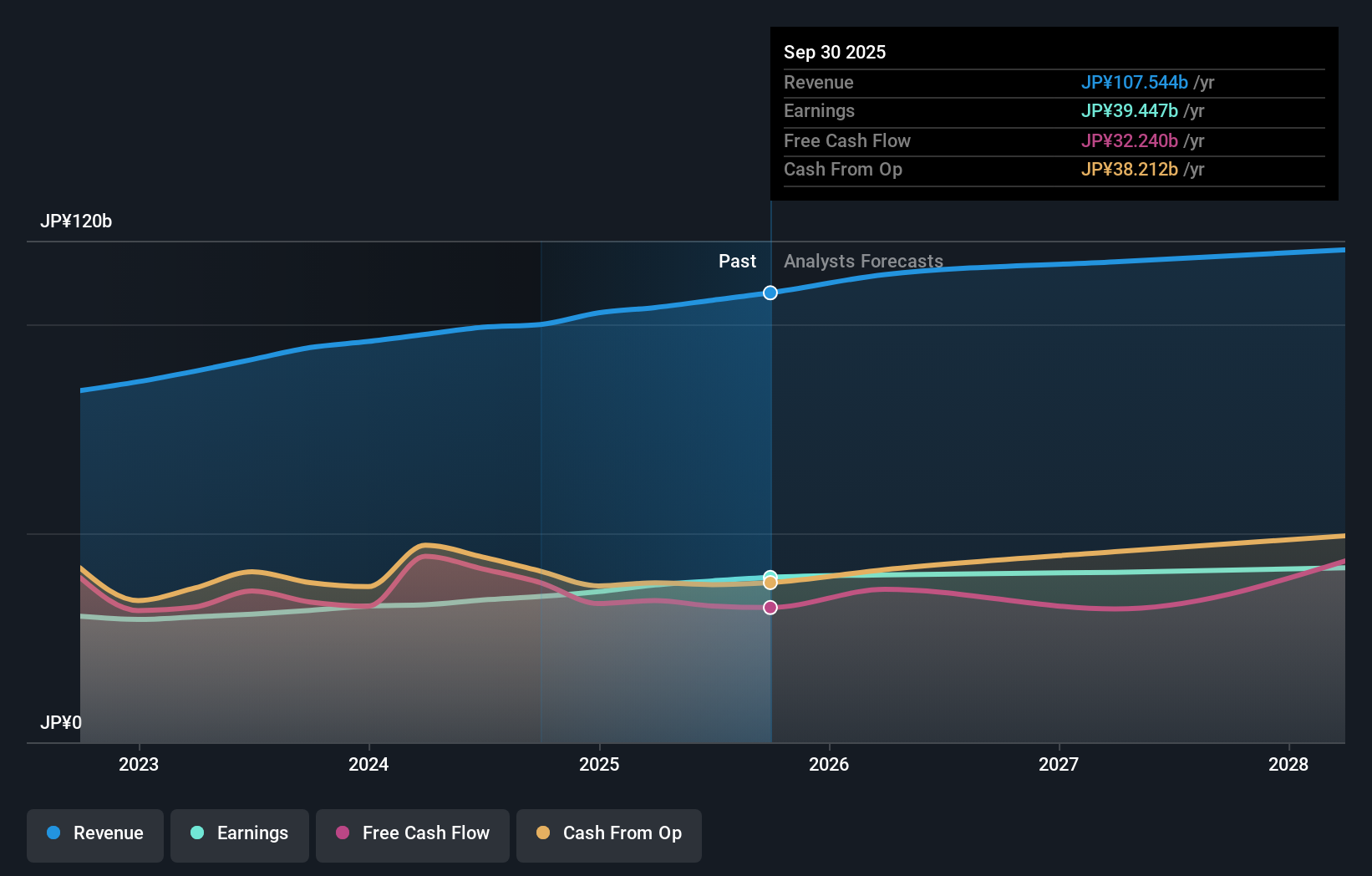

For investors sizing up USS Co., Ltd., the big picture centers on confidence in the company’s ability to keep generating dependable earnings and sharing returns with shareholders, even as growth moderates. The recent boost to dividends and the new payout policy could make USS more attractive to those prioritizing income and capital returns, strengthening the near-term investment case. However, the move arrives amid only modest top and bottom-line growth forecasts and a valuation that remains higher than industry or peer averages, which may temper enthusiasm for some. Questions also linger about whether such high-dispersion payout commitments will be sustainable if growth slows further, or if earnings surprises appear. So, while the dividend news is welcomed by many, it puts a fresh spotlight on sustainably strong cash flows and the need for USS to manage risk in a changing retail environment. Despite the earnings upgrade, future dividend sustainability deserves closer consideration.

Despite retreating, USS' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on USS - why the stock might be worth just ¥1715!

Build Your Own USS Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your USS research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free USS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate USS' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4732

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives