Mercari (TSE:4385): Assessing Valuation After Recent Shifts in Investor Sentiment

Reviewed by Simply Wall St

For investors tracking Mercari (TSE:4385), recent trading activity may have felt like a bit of a curveball. The stock has seen some ups and downs in recent weeks that have caught the eye of both long-time shareholders and those considering a fresh position. Without a big headline event or major news to blame, you might be wondering if there is something bubbling under the surface or if we are simply witnessing the ebb and flow of a growth name adjusting to a new normal.

Mercari’s price action over the past year has been a story of swings and shifting investor sentiment. Shares have gained ground since the start of the year, though last month’s rally has only partially made up for weaker periods. Looking at the longer term, returns have bounced around, with growth spurts sometimes overshadowed by setbacks. The absence of a single market-moving event means momentum here is more about evolving expectations than headlines, and that is worth keeping in mind as we step into a valuation review.

So after a year of mixed moves, is Mercari setting up as an undervalued opportunity, or is the market already assuming future growth will play out?

Most Popular Narrative: 13.1% Undervalued

According to the most widely followed narrative, Mercari appears undervalued by double digits compared to its calculated fair value. The valuation hinges on expectations for both ongoing revenue growth and margin expansion, despite the company's recent volatility.

Mercari is leveraging advanced AI and automation across its organization and platform to enhance user experience, improve fraud detection, and drive operational efficiencies. These efforts are expected to reduce costs and support higher net margins over time.

Curious how Mercari’s future could be supercharged by bold bets on automation and international reach? The valuation is not just theory—there is a model with big assumptions behind it. Ever wonder what financial trajectory could justify that premium? If you want to see which levers must be pulled for this scenario to play out, you will want to uncover the numbers for yourself.

Result: Fair Value of ¥2,755 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower core market growth and rising operational costs could challenge Mercari’s ability to sustain the profit margins that drive this upbeat outlook.

Find out about the key risks to this Mercari narrative.Another View: What Does Our DCF Say?

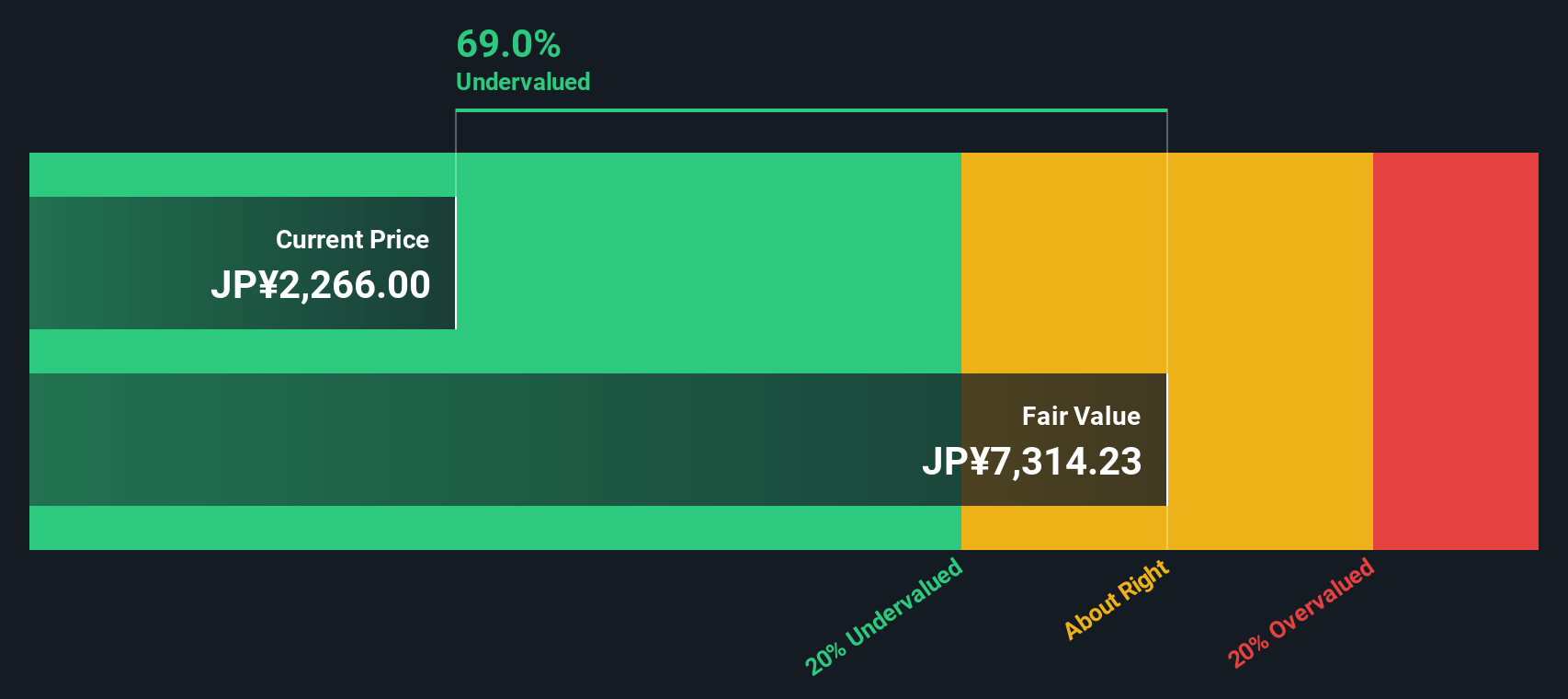

Taking a fresh angle, our DCF model also signals Mercari is undervalued and reinforces the earlier analysis. Different models reach a similar outcome. However, does this agreement make the case stronger or does it leave room for doubt?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mercari for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mercari Narrative

If you are the type who likes to dig into the numbers or challenge the consensus, you can build your own view with just a few clicks: Do it your way.

A great starting point for your Mercari research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Fuel Your Watchlist with Smart Opportunities

Smart investors never settle for just one idea. Unlock your next big winner today with Simply Wall Street’s hand-picked screeners that put hidden value, strong growth, and exciting sectors right at your fingertips. Make your move before everyone else catches on.

- Capture compelling bargains by using undervalued stocks based on cash flows to spot undervalued stocks based on real cash flow strength. Let the numbers reveal what others miss.

- Target innovation leaders and check out AI penny stocks to find companies powering the latest breakthroughs in artificial intelligence and next-generation automation.

- Secure income and peace of mind by exploring dividend stocks with yields > 3% that feature reliable yields above 3 percent. This can help with building confidence in uncertain markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:4385

Mercari

Plans, develops, and operates Mercari marketplace applications in Japan and the United States.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives