- Japan

- /

- Specialty Stores

- /

- TSE:3726

More Unpleasant Surprises Could Be In Store For 4Cs HD Co., Ltd.'s (TSE:3726) Shares After Tumbling 35%

4Cs HD Co., Ltd. (TSE:3726) shareholders that were waiting for something to happen have been dealt a blow with a 35% share price drop in the last month. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

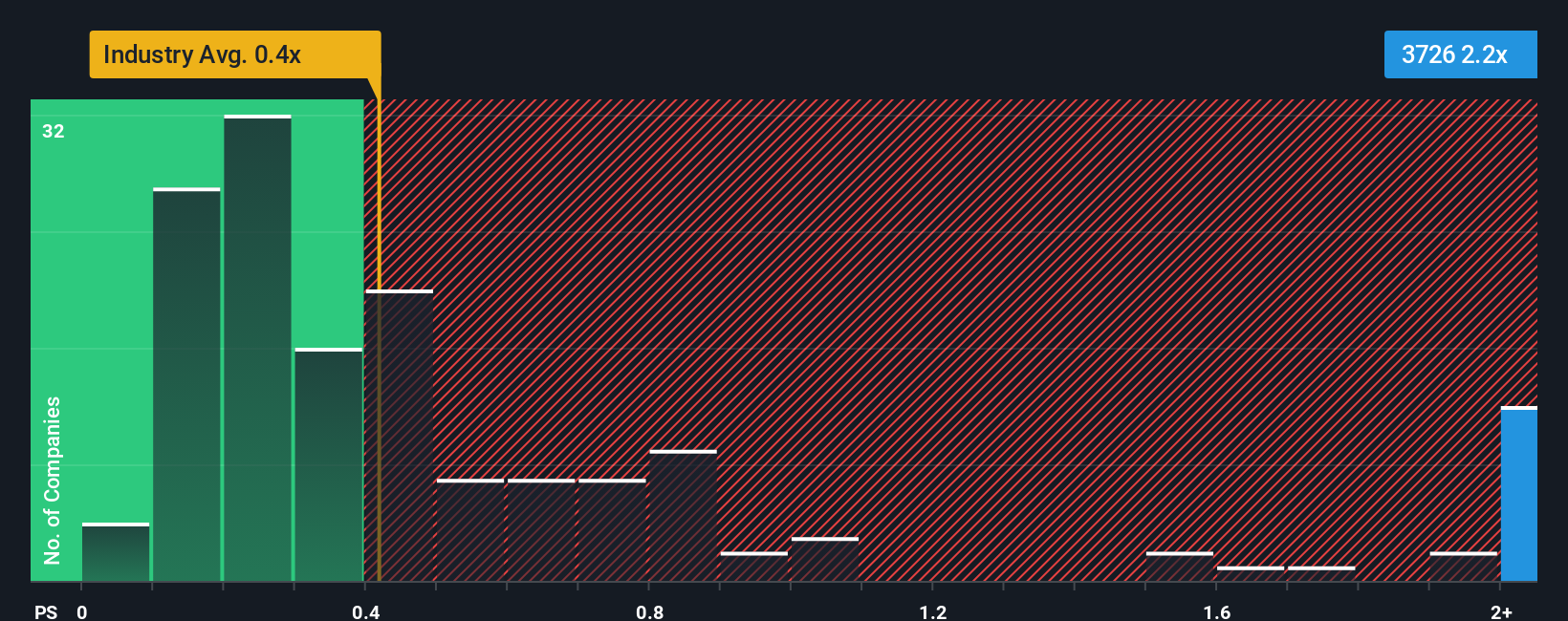

In spite of the heavy fall in price, given close to half the companies operating in Japan's Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.4x, you may still consider 4Cs HD as a stock to potentially avoid with its 2.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for 4Cs HD

What Does 4Cs HD's P/S Mean For Shareholders?

The recent revenue growth at 4Cs HD would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on 4Cs HD will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For 4Cs HD?

4Cs HD's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.4%. However, this wasn't enough as the latest three year period has seen an unpleasant 5.6% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 7.3% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's alarming that 4Cs HD's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does 4Cs HD's P/S Mean For Investors?

4Cs HD's P/S remain high even after its stock plunged. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of 4Cs HD revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for 4Cs HD (2 make us uncomfortable) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3726

4Cs HD

Engages in the mail order, retail, wholesale, and hygiene consulting businesses in Japan and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives