- Japan

- /

- Specialty Stores

- /

- TSE:2726

Is PAL GROUP Holdings’ (TSE:2726) Profit Surge a Sign of Lasting Competitive Strength?

Reviewed by Sasha Jovanovic

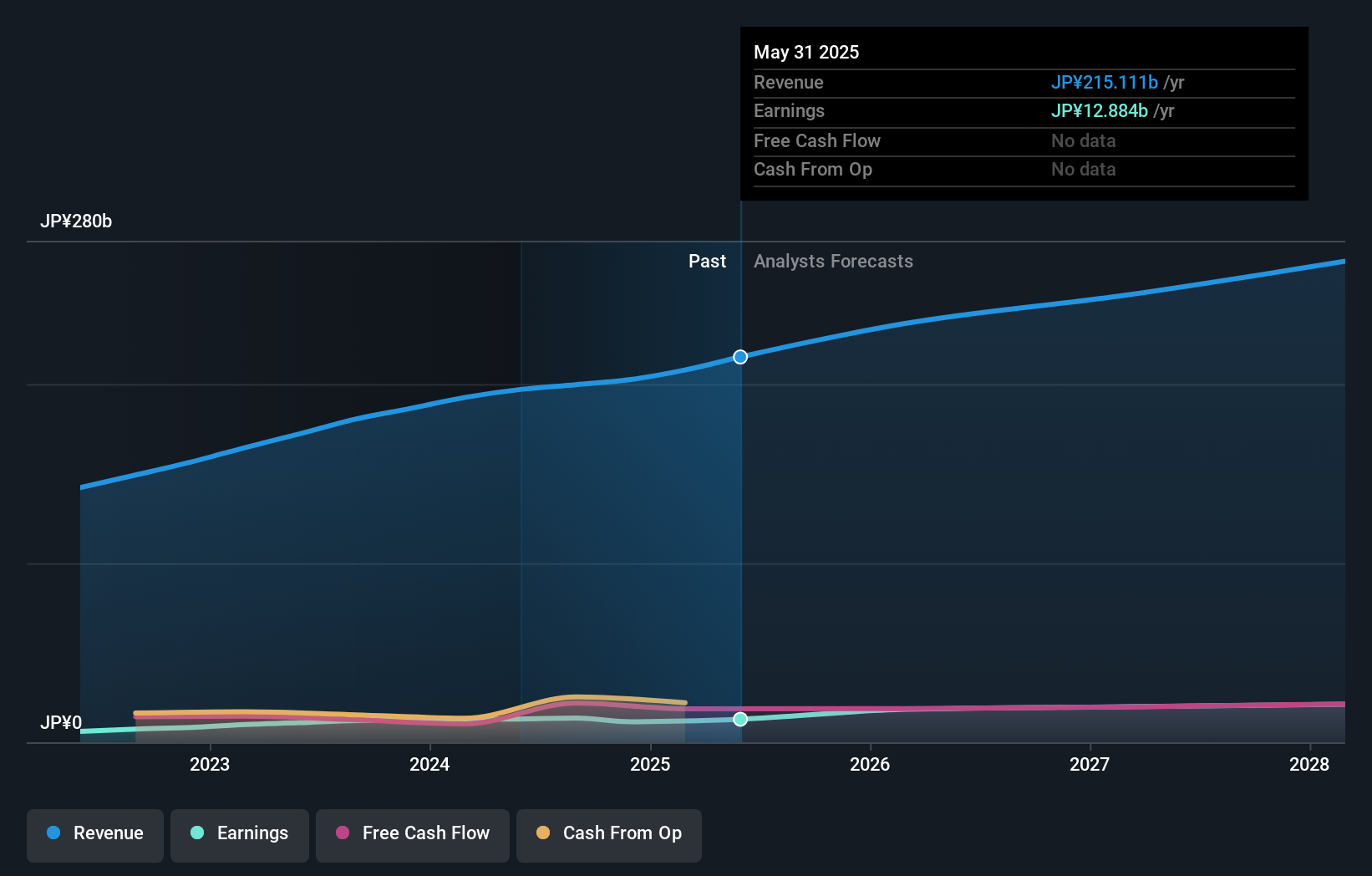

- PAL GROUP Holdings recently reported strong financial results for the six months ending August 31, 2025, highlighting significant increases in net sales, operating profit, and profit attributable to owners of the parent compared to the previous year.

- The company's 2-for-1 stock split, which enhances share liquidity, was also reflected in the updated earnings per share figures.

- With this in mind, we'll explore how sustained profitability growth strengthens PAL GROUP Holdings' investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is PAL GROUP Holdings' Investment Narrative?

For investors to back PAL GROUP Holdings, they’d need to believe the company can build on its impressive short-term momentum while managing elevated costs and competitive pressures. The latest earnings and the 2-for-1 stock split highlight sustained sales and profit growth, likely boosting confidence around near-term profit catalysts and share liquidity. However, the recent cut in dividend per share, now reflected post–stock split, raises questions about capital allocation and future shareholder returns. The company’s premium price-to-earnings ratio suggests expectations are already high, so even strong performance might not drive the share price much higher without a positive surprise. While past analysis saw the main risks as aggressive board turnover and stretched valuation, this robust earnings report could reduce some immediate business concerns but does not erase concerns about valuation and board stability.

By contrast, concerns over board turnover remain relevant for forward-looking investors.

Exploring Other Perspectives

Explore 2 other fair value estimates on PAL GROUP Holdings - why the stock might be worth as much as ¥2400!

Build Your Own PAL GROUP Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PAL GROUP Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free PAL GROUP Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PAL GROUP Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2726

PAL GROUP Holdings

Engages in the planning, manufacture, wholesale, and retail of clothing products, including men’s and women’s clothing and accessories in Japan.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives