I Ran A Stock Scan For Earnings Growth And Axas HoldingsLtd (TYO:3536) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Axas HoldingsLtd (TYO:3536). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Axas HoldingsLtd

Axas HoldingsLtd's Improving Profits

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that Axas HoldingsLtd's EPS went from JP¥0.033 to JP¥19.03 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company.

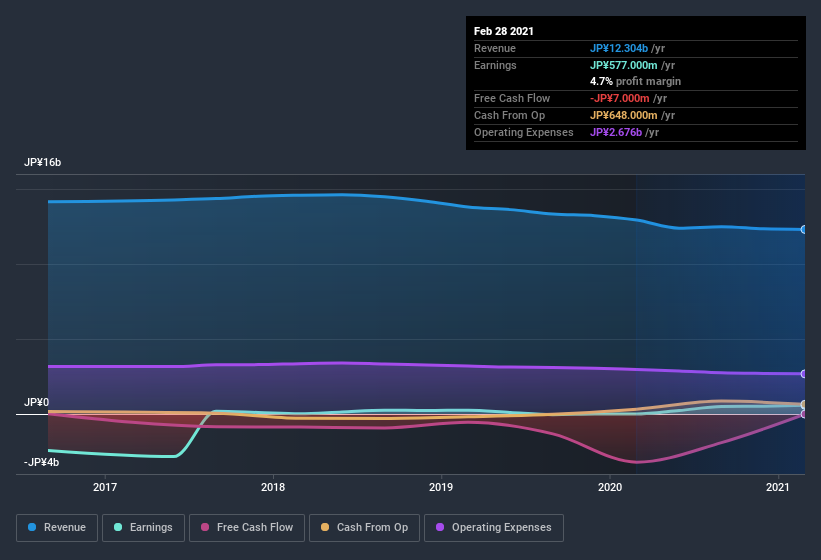

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Unfortunately, Axas HoldingsLtd's revenue dropped 4.8% last year, but the silver lining is that EBIT margins improved from 1.9% to 4.0%. That's not ideal.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Axas HoldingsLtd isn't a huge company, given its market capitalization of JP¥4.4b. That makes it extra important to check on its balance sheet strength.

Are Axas HoldingsLtd Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that Axas HoldingsLtd insiders own a meaningful share of the business. Indeed, with a collective holding of 73%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about JP¥3.3b riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add Axas HoldingsLtd To Your Watchlist?

Axas HoldingsLtd's earnings have taken off like any random crypto-currency did, back in 2017. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So to my mind Axas HoldingsLtd is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. We don't want to rain on the parade too much, but we did also find 2 warning signs for Axas HoldingsLtd (1 can't be ignored!) that you need to be mindful of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Axas HoldingsLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:3536

Axas HoldingsLtd

Engages in the distribution and retail of cosmetics, household goods, sports and outdoor gear products, alcoholic beverages, gardening and DIY products, and pharmaceuticals.

Questionable track record very low.

Market Insights

Community Narratives