- Japan

- /

- Hotel and Resort REITs

- /

- TSE:8963

A Look at Invincible Investment’s (TSE:8963) Valuation After New Dividend Declaration

Reviewed by Kshitija Bhandaru

Invincible Investment (TSE:8963) just declared a semi-annual dividend of JPY 2,127 per share, which reinforces its financial strength and commitment to rewarding shareholders. The payout date is set for March 25, 2026.

See our latest analysis for Invincible Investment.

The announcement of a new semi-annual dividend has come at a time when Invincible Investment’s momentum has been steadily building. The share price has climbed 4.1% over the past month and 6.6% in the last quarter, adding to an impressive 17.6% total shareholder return for the past year. Short-term gains are being matched by robust long-term performance, which is helping to support renewed confidence in the stock’s outlook.

If this kind of steady progress has you eager to see what else stands out, take the next step and discover fast growing stocks with high insider ownership.

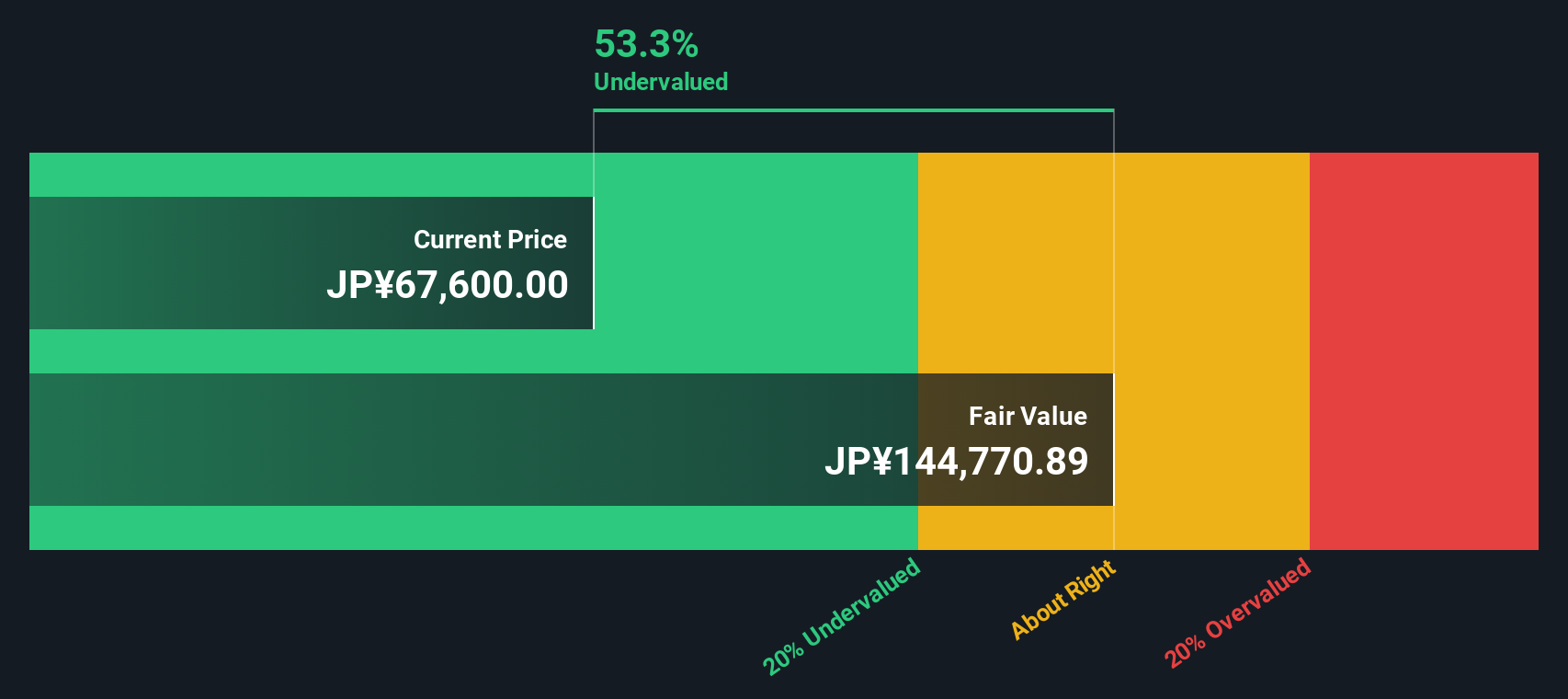

With such steady returns and robust dividend news, the key question for investors now is whether Invincible Investment’s shares remain undervalued or if the recent rally means future growth has already been reflected in the current price.Price-to-Earnings of 17.6x: Is it justified?

Invincible Investment’s current price-to-earnings ratio stands at 17.6x, which is notably higher than the broader Asian Hotel and Resort REITs industry average of 12x. This suggests the market is pricing in a premium for its shares, possibly in anticipation of future growth or a perception of higher quality relative to peers.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of earnings. For real estate investment trusts, it is a widely followed yardstick to gauge if shares are expensive versus sector norms and earning prospects.

While investors may see quality in Invincible Investment’s earnings profile, this higher valuation leaves little margin for error. The company is also trading below our estimated fair price-to-earnings ratio of 24.7x, which indicates there may still be some valuation gap for the market to recognize.

Compared to both industry peers and the estimated fair multiple, Invincible Investment’s shares are above the sector’s typical pricing but still have potential upside if the fair value thesis is realized.

Explore the SWS fair ratio for Invincible Investment

Result: Price-to-Earnings of 17.6x (ABOUT RIGHT)

However, slower revenue growth or unexpected economic shocks could challenge the outlook and quickly diminish the recent momentum in Invincible Investment’s share price.

Find out about the key risks to this Invincible Investment narrative.

Another View: Discounted Cash Flow Perspective

Looking at Invincible Investment through the lens of our DCF model offers a strikingly different perspective. The SWS DCF model puts the company’s fair value at ¥99,367.95, which is around 31.6% higher than the current price of ¥68,000. This signals that shares might be undervalued relative to future cash flow expectations. Could this point to significant upside the market is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Invincible Investment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Invincible Investment Narrative

If you want to explore Invincible Investment’s data on your own terms, you can analyze the numbers and assemble a personalized view in just a few minutes. Do it your way.

A great starting point for your Invincible Investment research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let untapped opportunities pass you by. Expand your horizons with unique stocks that match different investing goals and market trends using the screener below.

- Benefit from solid income streams and strong financials when you check out these 19 dividend stocks with yields > 3%, which are poised to sustain yields above the market average.

- Tap into tomorrow's innovation and growth by browsing these 24 AI penny stocks, which are riding the surge in artificial intelligence breakthroughs and new technologies.

- Seize value-driven opportunities by reviewing these 899 undervalued stocks based on cash flows, which our research indicates may have significant upside potential based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8963

Invincible Investment

INV was established in January 2002 in accordance with the Investment Trust and Investment Corporation Act (Act No.

Good value with mediocre balance sheet.

Market Insights

Community Narratives