- Japan

- /

- Retail REITs

- /

- TSE:8953

Did Securing Over 94% of Kyoto’s Kawaramachi OPA Just Shift Japan Metropolitan Fund’s (TSE:8953) Investment Narrative?

Reviewed by Sasha Jovanovic

- Japan Metropolitan Fund Investment Corporation announced it will acquire an additional stake in Kawaramachi OPA, a prime retail property in Kyoto's major commercial district, for ¥790 million, bringing its ownership interest to over 94%.

- This increased ownership is part of the company’s effort to improve liquidity, operational flexibility, and enhance property returns within its retail portfolio.

- We will explore how this move to consolidate a landmark Kyoto asset strengthens Japan Metropolitan Fund Investment’s overall investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Japan Metropolitan Fund Investment's Investment Narrative?

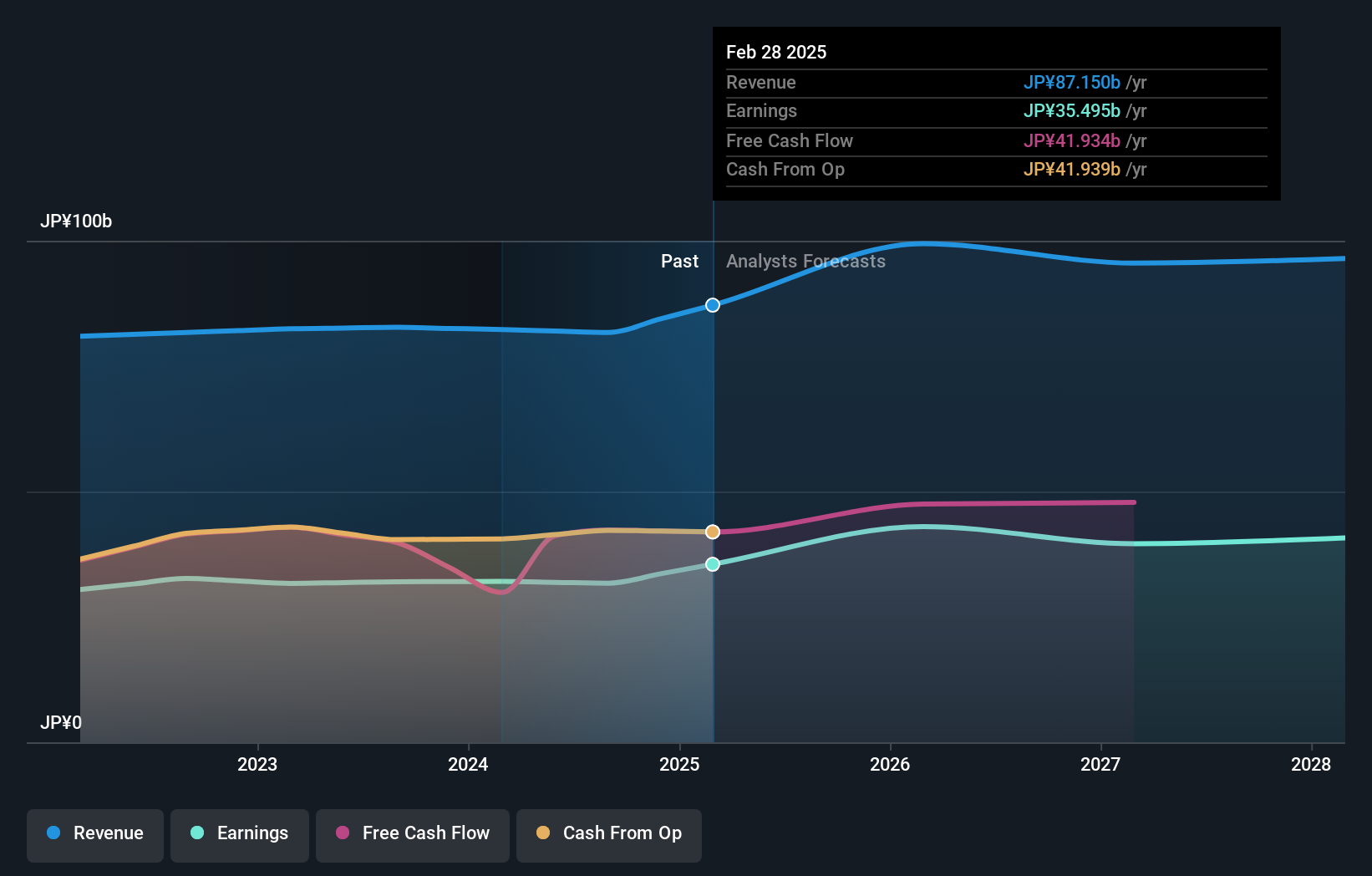

To be confident as a shareholder in Japan Metropolitan Fund Investment Corporation, you’d want to believe in the resilience and growth prospects of Japan’s prime retail real estate market, particularly in high-traffic urban centers like Kyoto. The recent move to lift ownership in Kawaramachi OPA fits this theme, reinforcing the company’s long-term strategy around asset consolidation and operational efficiency. While previous analyses pointed to steady revenue, modest earnings growth, and reliable dividends, this acquisition stands out as a tactical adjustment that might nudge short-term catalysts by improving liquidity and flexibility at one of its flagship properties. Still, the impact on overall business momentum and risk is likely to be measured rather than dramatic; management’s steady hand and financing approach have thus far kept performance aligned with market expectations, but borrowing levels and board independence remain key areas for ongoing scrutiny.

On the other hand, board independence is still an issue investors should be mindful of.

Exploring Other Perspectives

Explore another fair value estimate on Japan Metropolitan Fund Investment - why the stock might be worth 29% less than the current price!

Build Your Own Japan Metropolitan Fund Investment Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Japan Metropolitan Fund Investment research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Japan Metropolitan Fund Investment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Japan Metropolitan Fund Investment's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8953

Japan Metropolitan Fund Investment

Japan Urban Fund Investment Corporation (hereinafter referred to as the "Investment Corporation") was established on September 14, 2001 under the Act on Investment Trusts and Investment Corporations (Act The Investment Corporation was established on September 14, 2001 under the Investment Trust Law (hereinafter referred to as the "Investment Trust Law") and became the first investment corporation in Japan to specialize in the management of commercial facilities.

6 star dividend payer with solid track record.

Market Insights

Community Narratives