XYMAX REIT (TSE:3488) Margin Expansion Reinforces Defensive Narrative, Despite Dividend and Balance Sheet Risks

Reviewed by Simply Wall St

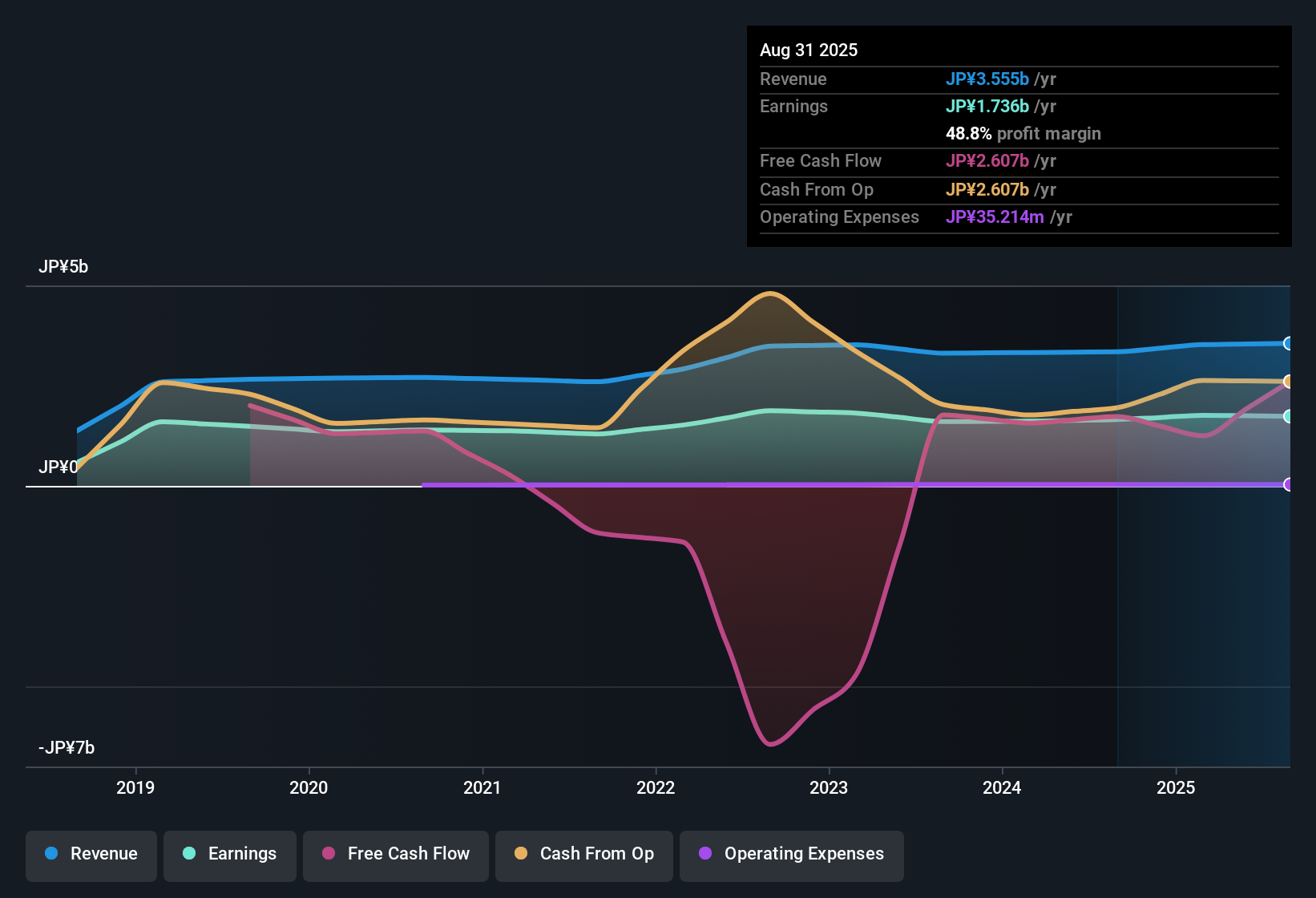

XYMAX REIT Investment (TSE:3488) reported a net profit margin of 50%, up from 48.5% a year earlier, with annual earnings growth clocking in at 9.1%. This figure is well above its five-year annual growth rate of 5.5%. The trust’s Price-to-Earnings ratio stands at 17x, which is slightly better than both the JP REITs industry average of 20.2x and the peer group’s 17.7x. Investors will likely note these steady profit gains and solid margins, recognizing the earnings power while keeping an eye on the company’s higher-than-estimated fair value.

See our full analysis for XYMAX REIT Investment.Now let's see how these headline results measure up against the market narratives. Some assumptions may get reinforced, while others could be challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Consistently Above Industry Norms

- Net profit margin held firm at 50%, outpacing both the previous year’s 48.5% and typical levels seen elsewhere in the sector. This highlights robust cost control and operational discipline.

- Despite margin strength and reliable profit expansion, the prevailing market view highlights lingering caution due to the absence of major growth catalysts.

- Investor focus remains on steady distributions, but the narrative emphasizes that limited upside drivers and stable payouts keep expectations in check.

- This resilience in core profitability supports a “wait-and-see” approach, as investors prioritize present stability over chasing breakout growth.

Growth Pace Beats Long-Term Average

- Annual earnings recently grew 9.1%, a notable acceleration versus the five-year annual average of 5.5%. This underlines that growth has picked up steam even as the sector faced headwinds.

- Bulls argue that this faster earnings trajectory justifies the REIT’s reputation for resilient income.

- Stable growth, reinforced by a strong tenant base and disciplined management, offers a compelling case for those seeking income plus moderate upside.

- At the same time, the yield is bolstered by consistent distributions, directly supporting the income-focused bullish thesis.

Share Price Sits Above DCF Fair Value

- With the current share price at ¥119,700 and DCF fair value estimated at ¥213,256.47, the trust trades at a discount by standard valuation models. However, it trades at a modest premium to sector peers by P/E.

- Prevailing market narratives suggest that while recent trading levels are above calculated fair value, strong profitability and perceived safety justify the elevated price.

- Many investors prefer the defensive qualities and consistent margins, even if the stock trades higher than models suggest it should.

- This valuation gap may persist as long as management maintains reliability and sector risks remain top of mind.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on XYMAX REIT Investment's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite its steady earnings and strong margins, XYMAX REIT’s valuation trades at a premium to peers, raising concerns about paying too much for stability.

If you want better value for your investment, use our these 878 undervalued stocks based on cash flows to search for stocks offering more attractive pricing based on their fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3488

XYMAX REIT Investment

XYMAX REIT Investment Corporation (hereinafter, “XYMAX REIT”) was listed on the Tokyo Stock Exchange Real Estate Investment Trust Securities Market on February 15, 2018.

Good value average dividend payer.

Market Insights

Community Narratives