Star Asia Investment (TSE:3468): Evaluating Valuation After Strategic Long-Term Hotel Lease Expansion

Reviewed by Kshitija Bhandaru

Star Asia Investment (TSE:3468) unveiled two new long-term hotel lease agreements that extend existing lease terms and add more rooms to their portfolio. This move is expected to enhance the company's platform scale and profitability.

See our latest analysis for Star Asia Investment.

Star Asia Investment’s recent expansion follows a strong performance, with its total shareholder return up 23.5% over the past year and longer-term investors seeing robust gains of over 74% in five years. The latest moves to secure long-term hotel leases are fueling a sense that growth momentum is building, as the market has started to price in rising confidence around profitability and scale.

If this platform growth story has your attention, it could be the perfect time to broaden your investing universe and discover fast growing stocks with high insider ownership

With Star Asia Investment’s impressive run and fresh expansion, the big question is whether the market has already priced in all this growth, or if there is still an attractive buying opportunity for investors.

Price-to-Earnings of 33.5x: Is it justified?

Star Asia Investment trades at a price-to-earnings ratio of 33.5x, which is significantly higher than both its peer average of 21.4x and the broader JP REITs industry average of 19.7x. The last close price of ¥60,300 reflects this premium, raising questions about whether the current valuation is justified given recent company growth and performance.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each yen of the company's earnings. For real estate investment trusts (REITs), this ratio is a key gauge of how the market values their portfolio income and future growth potential, especially in a sector where income stability is prized.

Compared to its sector, Star Asia Investment appears distinctly more expensive. This high P/E suggests that investors expect either stronger growth or superior asset quality compared to industry peers. However, unless future earnings move sharply higher, the premium could represent market over-optimism rather than true outperformance.

The company's P/E ratio of 33.5x is well above both the peer average of 21.4x and the industry average of 19.7x, spotlighting a valuation far richer than the sector norm. Without a clear catalyst for earnings outperformance, this could be a tough level for the share price to sustain on fundamentals alone.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 33.5x (OVERVALUED)

However, shifts in market sentiment or any slowdown in earnings growth could quickly challenge Star Asia Investment’s currently elevated valuation and growth expectations.

Find out about the key risks to this Star Asia Investment narrative.

Another View: Discounted Cash Flow Model Tells a Different Story

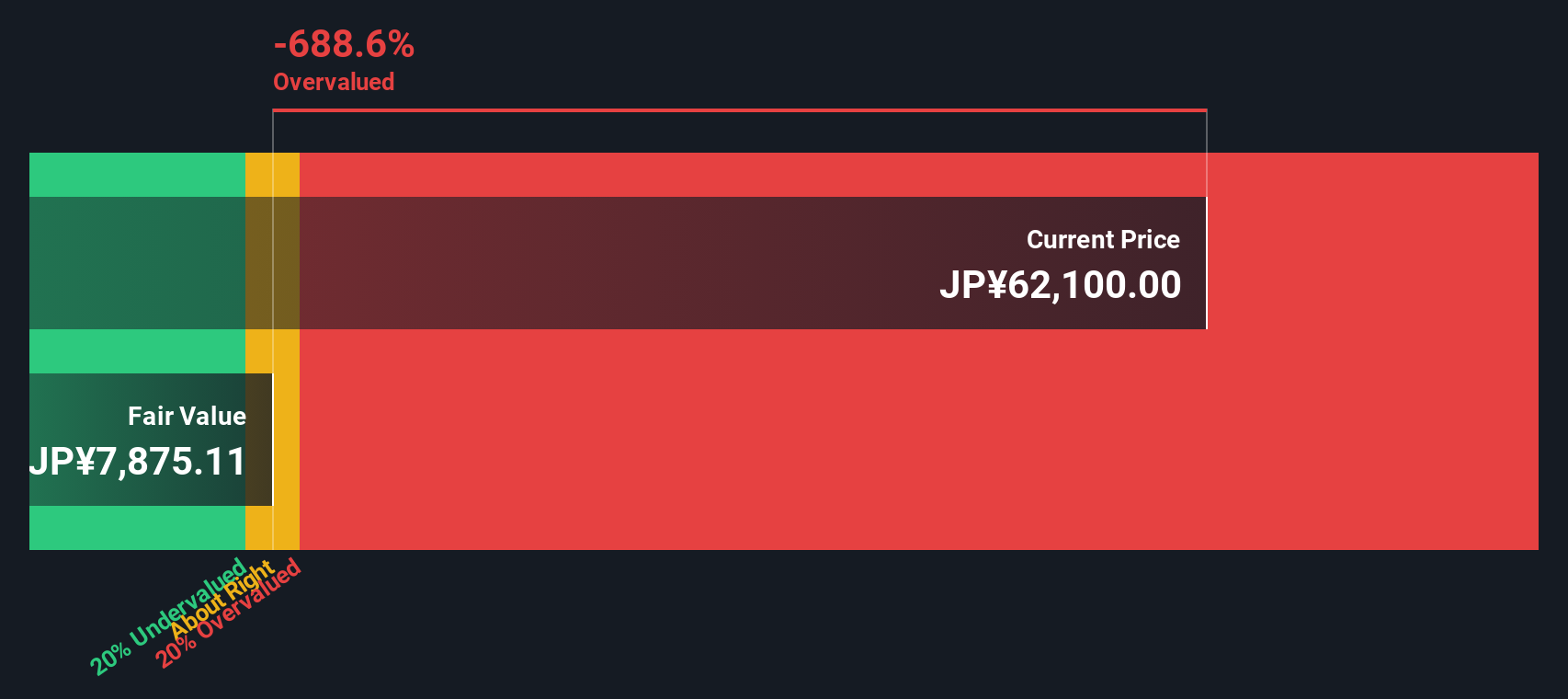

Looking from a different angle, our DCF model suggests Star Asia Investment may actually be overvalued, with shares trading well above an estimated fair value of ¥7,423. This presents a strong contrast to the market’s high price-to-earnings ratio. Could this mean the current premium is unsustainable if growth disappoints?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Star Asia Investment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Star Asia Investment Narrative

If you want to take a fresh approach or think differently about Star Asia Investment, you can easily craft your own analysis in under three minutes with Do it your way.

A great starting point for your Star Asia Investment research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take the next step toward smarter investing and broaden your horizons. Don’t let unique market opportunities pass you by simply sticking to the familiar.

- Uncover growth potential by tracking these 892 undervalued stocks based on cash flows that the market might be missing. This could give you an edge over the crowd.

- Tap into passive income streams with these 18 dividend stocks with yields > 3%, where strong yields over 3% could boost your portfolio’s stability and returns.

- Seize the momentum in disruptive trends by pinpointing these 25 AI penny stocks poised to transform tomorrow’s economy with artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3468

Star Asia Investment

Star Asia Investment Corporation (SAR) was established as a diversified real estate investment trust on December 1, 2015, under the Act on Investment Trusts and Investment Corporations (Act No.

Low risk with questionable track record.

Market Insights

Community Narratives