- Japan

- /

- Hotel and Resort REITs

- /

- TSE:3287

Hoshino Resorts REIT (TSE:3287): Evaluating Valuation Following Expo-Fueled Surge in Occupancy and RevPAR

Reviewed by Kshitija Bhandaru

Hoshino Resorts REIT (TSE:3287) released figures for August 2025 showing that occupancy climbed 9% and revenue per available room rose 10%. These increases were driven by higher demand from the Osaka-Kansai World Expo.

See our latest analysis for Hoshino Resorts REIT.

Investor optimism has been building as Hoshino Resorts REIT’s success with Expo-driven demand helps offset earlier challenges from Kyushu’s natural disasters. After a strong year-to-date share price return of nearly 19%, the stock is regaining momentum, with the one-year total shareholder return standing at 16.6%. This indicates that both short- and long-term performance are turning a corner.

If travel and tourism trends have you considering what’s next, now’s an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

But with Hoshino Resorts REIT enjoying a strong rebound and trading near its recent highs, the key question now is whether shares remain undervalued or if the market has already accounted for upcoming growth potential.

Price-to-Earnings of 27.8: Is it justified?

With Hoshino Resorts REIT trading at a price-to-earnings ratio of 27.8x, the stock looks expensive relative to its peers and industry averages, especially considering its last close price of ¥262,000.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay today for a company’s earnings. For REITs and similar property entities, it provides insight into how the market values current and future profitability. This is crucial given sector dynamics and market cycles.

At 27.8x, Hoshino Resorts REIT’s P/E is substantially higher than both the peer average (17.5x) and the broader Asian Hotel and Resort REITs industry (12.8x). This suggests the market has high growth expectations or is ascribing a quality premium to its earnings. Any deviation in performance could prompt a re-rating. In addition, the P/E approaches the estimated fair ratio of 27.2x, a level that the market could shift toward if sentiment changes.

Explore the SWS fair ratio for Hoshino Resorts REIT

Result: Price-to-Earnings of 27.8 (OVERVALUED)

However, softer tourism trends or a reversal in Expo-driven demand could quickly dampen Hoshino Resorts REIT’s strong growth and share performance.

Find out about the key risks to this Hoshino Resorts REIT narrative.

Another View: Discounted Cash Flow Perspective

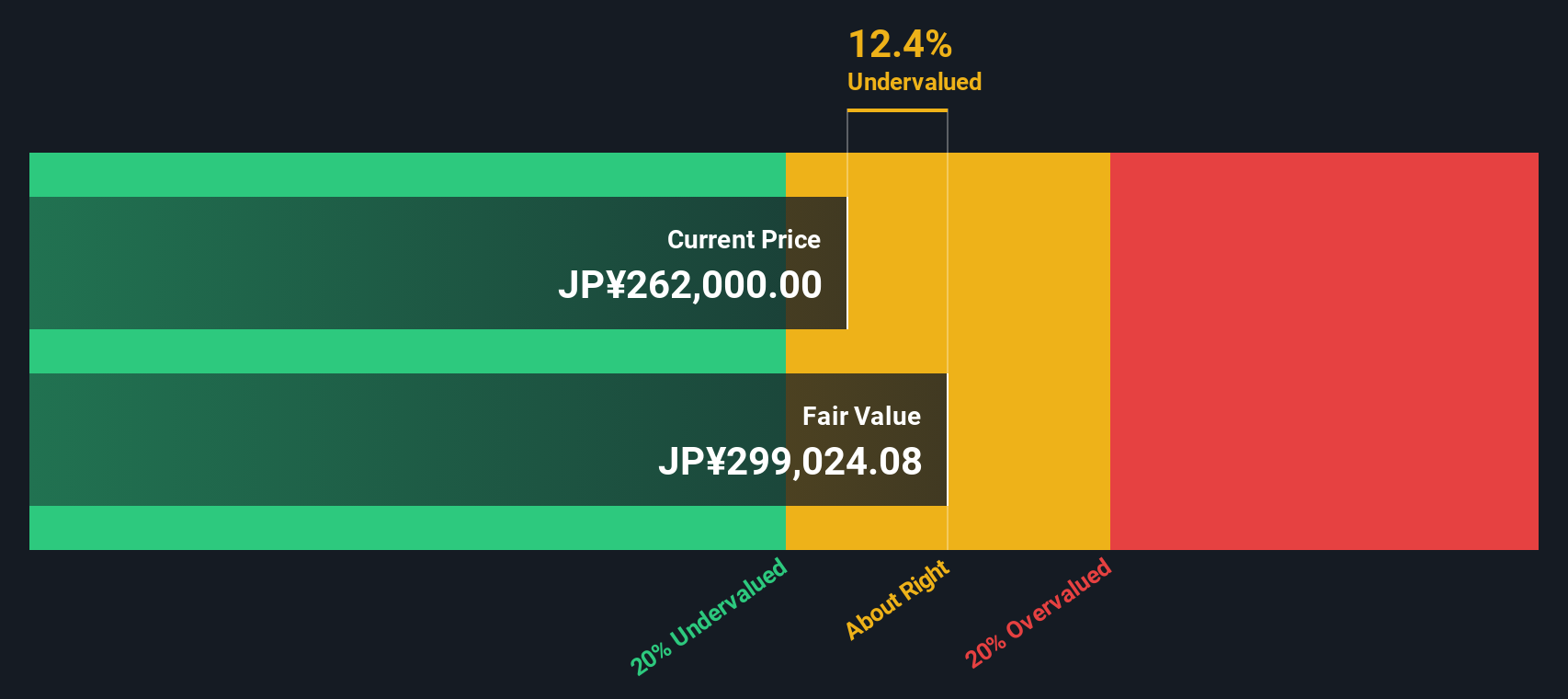

Switching gears, our DCF model suggests Hoshino Resorts REIT may actually be undervalued, with a trading price about 12.4% below our estimated fair value of ¥299,024.08. While market multiples flag the shares as expensive, does this DCF view hint at hidden upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hoshino Resorts REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hoshino Resorts REIT Narrative

Whether you have a different perspective or simply want to analyze the numbers firsthand, you can craft your own narrative and insights in just a few minutes. Do it your way.

A great starting point for your Hoshino Resorts REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their options open. Don’t let opportunity pass you by when there are standout stocks across emerging themes, innovation, and reliable income just waiting to be uncovered.

- Uncover strong potential for income by tapping into these 18 dividend stocks with yields > 3%, delivering yields above 3% and consistency even in uncertain markets.

- Jump into tomorrow’s hottest trends as you size up these 24 AI penny stocks, making headlines in artificial intelligence and redefining what’s possible.

- Capitalize on the next wave of disruptive technology by exploring these 26 quantum computing stocks, at the forefront of quantum computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hoshino Resorts REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3287

Hoshino Resorts REIT

Hoshino Resorts REIT, Inc. (hereinafter, “HRR”) invests in hotels, ryokans (Japanese-style inns) and ancillary facilities that serve at the core of the tourism industry and for which stable use is expected for the medium to long term.

Proven track record average dividend payer.

Market Insights

Community Narratives