- Japan

- /

- Industrial REITs

- /

- TSE:3281

GLP J-REIT (TSE:3281): Valuation in Focus After Asset Sales and Upbeat Financial Forecast

Reviewed by Kshitija Bhandaru

GLP J-REIT (TSE:3281) has just completed the sale of its Tokyo-44 GLP Kashiwa II and GLP Koriyama III properties, directing proceeds toward boosting unitholder value, potential acquisitions, and share buybacks.

Following these asset sales, the company announced an upward revision to its financial forecast, anticipating increased operating income and higher cash distributions for the coming fiscal period. These moves reinforce GLP J-REIT’s focus on performance and value delivery, supporting its commitment to a targeted annual dividend per unit.

See our latest analysis for GLP J-REIT.

GLP J-REIT’s targeted asset sales and recent extension of its credit line agreements have added to an already steady narrative, with the market taking note of its operational focus and solid financial planning. The result is modest but positive momentum. GLP J-REIT has delivered a 1-year total shareholder return of 0.12%, and the stock’s stable performance suggests investors view the company’s disciplined funding and growth initiatives as a reassuring signal both for now and the future.

If you’re interested in discovering what else is catching investors’ attention, now is a great opportunity to broaden your horizons and explore fast growing stocks with high insider ownership

Yet with the stock trading at a discount to analyst price targets, but already reflecting steady returns, investors may wonder whether GLP J-REIT still offers genuine value or if expectations for future growth are already priced in.

Price-to-Earnings of 22.9x: Is it justified?

GLP J-REIT is currently trading at a price-to-earnings ratio of 22.9x, placing it near both the peer and sector averages, but slightly above the broader Asian Industrial REITs industry.

The price-to-earnings (P/E) ratio measures how much investors are paying for each yen of earnings and is a key metric for valuing real estate investment trusts, where steady cash flows are expected. For a company with stable profit margins, like GLP J-REIT, the P/E ratio can signal market expectations around future earnings and growth prospects.

GLP J-REIT’s P/E of 22.9x is almost identical to the Industrial REITs industry average (23x). This suggests the market sees fundamentals as closely aligned with sector peers. However, it is lower than the peer average of 26.9x, which could imply more cautious sentiment or a relative value opportunity. The fair price-to-earnings ratio, based on regression analysis, stands at 23.2x, putting GLP J-REIT’s current valuation nearly in line with what underlying fundamentals might justify. This positions the stock at a level the broader market could eventually move towards.

Explore the SWS fair ratio for GLP J-REIT

Result: Price-to-Earnings of 22.9x (ABOUT RIGHT)

However, risks such as slower revenue growth or unforeseen macroeconomic shifts could dampen the upbeat outlook and potentially impact valuation momentum.

Find out about the key risks to this GLP J-REIT narrative.

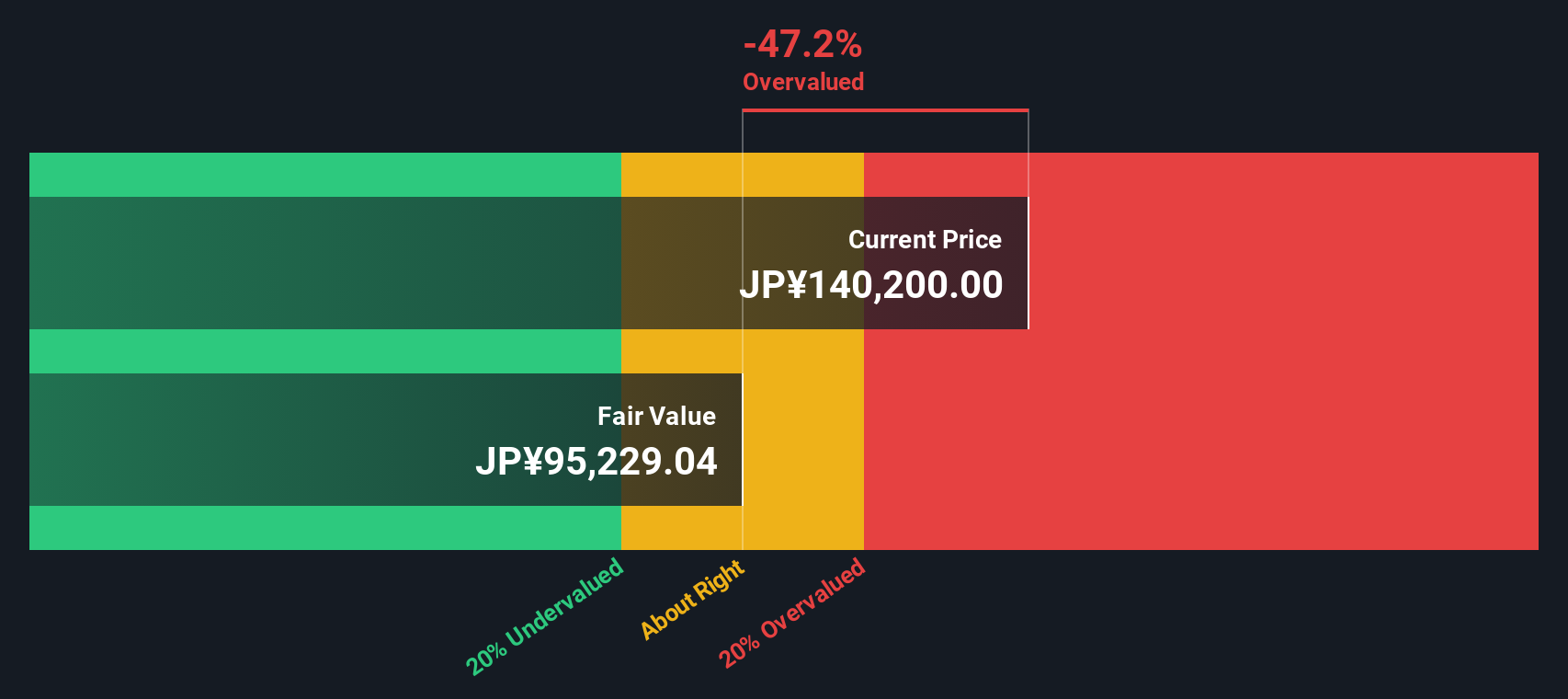

Another View: Discounted Cash Flow Tells a Different Story

While price-to-earnings multiples suggest GLP J-REIT is fairly valued relative to peers, our DCF model arrives at a much lower estimate of intrinsic value. This indicates the stock could be trading above what its projected cash flows support. Does this raise red flags, or is the gap justified?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GLP J-REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GLP J-REIT Narrative

If you would rather dive into the data yourself and shape your perspective, you can generate your own narrative in just minutes, or Do it your way.

A great starting point for your GLP J-REIT research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great stocks rarely wait around. Take charge now and check out fresh opportunities. Your next standout investment could be one smart move away.

- Unlock consistent income streams and tap into these 19 dividend stocks with yields > 3% offering yields above 3% for your portfolio.

- Take advantage of emerging healthcare breakthroughs by reviewing these 31 healthcare AI stocks powering the intersection of medicine and advanced artificial intelligence.

- Ride the wave of digital innovation when you assess these 78 cryptocurrency and blockchain stocks poised for growth at the frontier of blockchain and virtual assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3281

GLP J-REIT

A real estate investment corporation (“J-REIT”) specializing in logistics facilities, and it primarily invests in modern logistics facilities.

Average dividend payer with acceptable track record.

Market Insights

Community Narratives