- Japan

- /

- Real Estate

- /

- TSE:8929

3 Global Stocks Estimated To Be Trading 41.5% To 49.1% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets grapple with the steepest stock declines in years due to unexpected tariff announcements and mounting trade tensions, investors are increasingly focused on finding opportunities amidst uncertainty. In such turbulent times, identifying stocks that are trading significantly below their intrinsic value can offer potential for long-term growth as they may provide a margin of safety against market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Suzhou TFC Optical Communication (SZSE:300394) | CN¥62.73 | CN¥125.35 | 50% |

| Micro Systemation (OM:MSAB B) | SEK48.885 | SEK97.65 | 49.9% |

| JAPAN MATERIAL (TSE:6055) | ¥976.00 | ¥1951.48 | 50% |

| Mandom (TSE:4917) | ¥1247.00 | ¥2472.91 | 49.6% |

| Zinzino (OM:ZZ B) | SEK141.20 | SEK279.83 | 49.5% |

| Cosel (TSE:6905) | ¥973.00 | ¥1934.15 | 49.7% |

| LPP (WSE:LPP) | PLN15495.00 | PLN30700.35 | 49.5% |

| ArcticZymes Technologies (OB:AZT) | NOK15.85 | NOK31.21 | 49.2% |

| Fodelia Oyj (HLSE:FODELIA) | €7.00 | €13.91 | 49.7% |

| Figeac Aero Société Anonyme (ENXTPA:FGA) | €7.32 | €14.57 | 49.7% |

Let's uncover some gems from our specialized screener.

AVIC Heavy Machinery (SHSE:600765)

Overview: AVIC Heavy Machinery Co., Ltd. operates in forging, casting, and hydraulic environmental sectors in China with a market cap of CN¥23.88 billion.

Operations: The company's revenue segments include forging, casting, and hydraulic environmental operations in China.

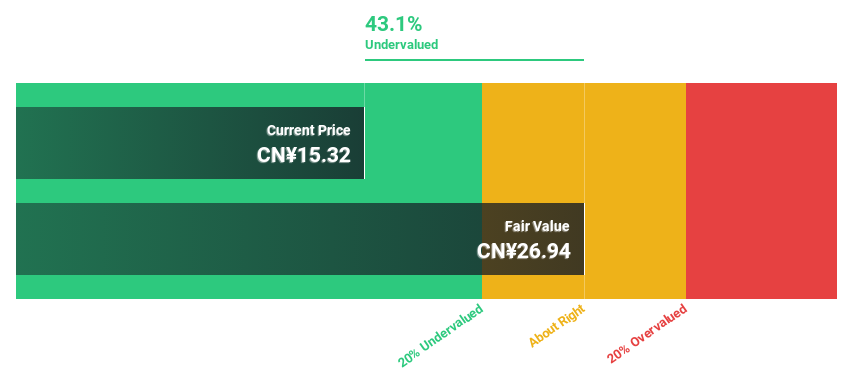

Estimated Discount To Fair Value: 41.5%

AVIC Heavy Machinery is trading at CN¥15.89, significantly below its estimated fair value of CN¥27.15, suggesting it may be undervalued based on cash flows. Despite a forecasted revenue growth of 16.7% per year and significant earnings growth expectations, the company's profit margins have decreased from 12.6% to 6.2%. Recent M&A activity saw Aviation Industry Corporation of China acquiring a 4.8% stake for CN¥1.5 billion, potentially impacting capital structure and shareholder dynamics.

- Our earnings growth report unveils the potential for significant increases in AVIC Heavy Machinery's future results.

- Click here to discover the nuances of AVIC Heavy Machinery with our detailed financial health report.

Tongqinglou Catering (SHSE:605108)

Overview: Tongqinglou Catering Co., Ltd. offers catering services in China and has a market cap of CN¥5.29 billion.

Operations: Tongqinglou Catering Co., Ltd. generates its revenue from providing catering services in China.

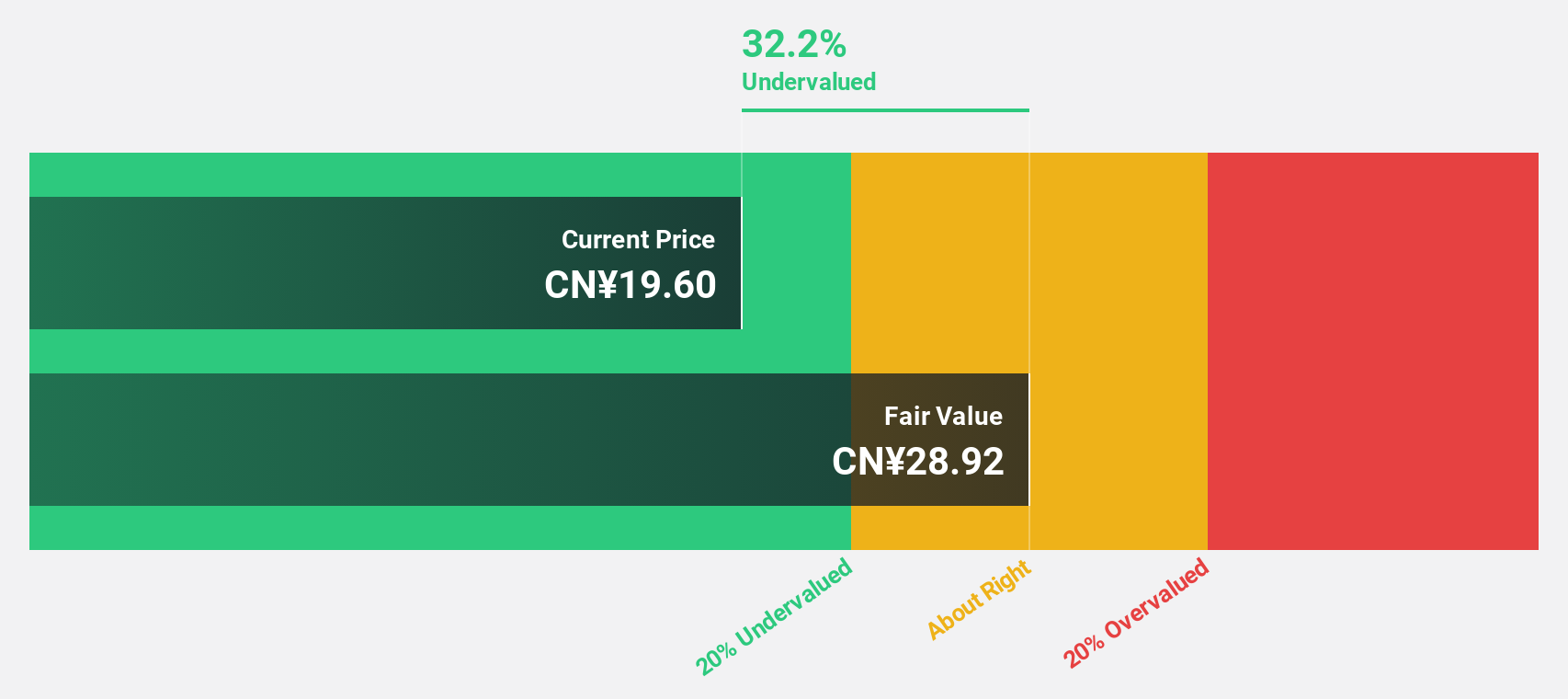

Estimated Discount To Fair Value: 49.1%

Tongqinglou Catering is trading at CN¥21.27, well below its estimated fair value of CN¥41.77, indicating potential undervaluation based on cash flows. Despite high debt levels and a dividend yield of 1.93% not fully covered by free cash flows, the company is expected to see significant earnings growth of 44.9% annually over the next three years, outpacing the Chinese market's average growth rate and offering good relative value compared to peers.

- Our expertly prepared growth report on Tongqinglou Catering implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Tongqinglou Catering.

Aoyama Zaisan Networks CompanyLimited (TSE:8929)

Overview: Aoyama Zaisan Networks Company, Limited offers property consulting solutions to individual and institutional asset owners in Japan, with a market capitalization of ¥41.81 billion.

Operations: The company generates revenue through its property consulting services aimed at both individual and institutional asset owners in Japan.

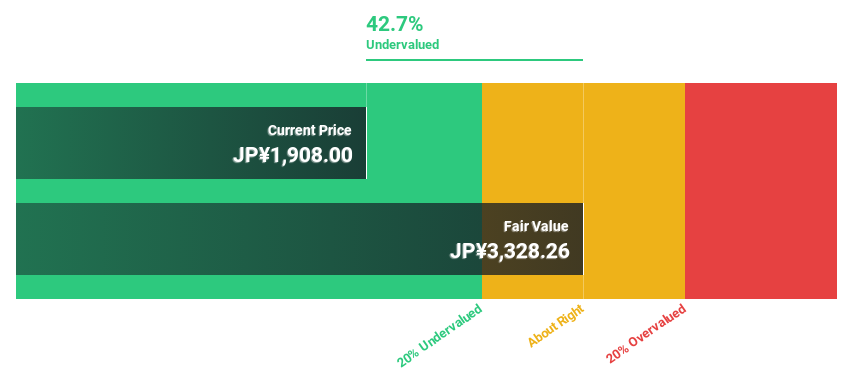

Estimated Discount To Fair Value: 44.8%

Aoyama Zaisan Networks Company is trading at ¥1812, significantly below its estimated fair value of ¥3281.42, highlighting potential undervaluation based on cash flows. The company offers a reliable dividend yield of 2.81% and is expected to see earnings growth of 13.1% annually, surpassing the Japanese market average. While revenue growth is modest at 5.6%, it's still above the market rate, and return on equity is projected to be high in three years.

- The analysis detailed in our Aoyama Zaisan Networks CompanyLimited growth report hints at robust future financial performance.

- Navigate through the intricacies of Aoyama Zaisan Networks CompanyLimited with our comprehensive financial health report here.

Taking Advantage

- Click through to start exploring the rest of the 484 Undervalued Global Stocks Based On Cash Flows now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8929

Aoyama Zaisan Networks CompanyLimited

Provides property consulting solutions to individual and institutional asset owners in Japan.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)