Discovering THK And 2 More Japanese Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

Japan's stock markets recently experienced notable declines as investors reacted to political changes and the new prime minister's monetary policy stance, although some losses were recouped following a shift towards a more dovish tone. Despite these fluctuations, opportunities may exist for discerning investors seeking stocks that are potentially undervalued relative to their intrinsic value. In this context, identifying companies with strong fundamentals and resilience amid economic shifts can be crucial for navigating current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Densan System Holdings (TSE:4072) | ¥2727.00 | ¥5300.09 | 48.5% |

| Hagiwara Electric Holdings (TSE:7467) | ¥3495.00 | ¥6755.09 | 48.3% |

| Kotobuki Spirits (TSE:2222) | ¥1842.50 | ¥3434.73 | 46.4% |

| Stella Chemifa (TSE:4109) | ¥4365.00 | ¥8092.75 | 46.1% |

| Pilot (TSE:7846) | ¥4562.00 | ¥8876.70 | 48.6% |

| Hibino (TSE:2469) | ¥3625.00 | ¥6996.09 | 48.2% |

| Medley (TSE:4480) | ¥4010.00 | ¥7884.05 | 49.1% |

| Infomart (TSE:2492) | ¥339.00 | ¥617.62 | 45.1% |

| NATTY SWANKY holdingsLtd (TSE:7674) | ¥3295.00 | ¥6030.21 | 45.4% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2793.00 | ¥5423.23 | 48.5% |

Underneath we present a selection of stocks filtered out by our screen.

THK (TSE:6481)

Overview: THK Co., Ltd. manufactures and sells mechanical components globally, with a market cap of ¥322.78 billion.

Operations: THK Co., Ltd.'s revenue is primarily derived from Japan (¥162.26 billion), followed by The Americas (¥94.66 billion), Europe (¥71.28 billion), China (¥60.45 billion), and other regions (¥20.52 billion).

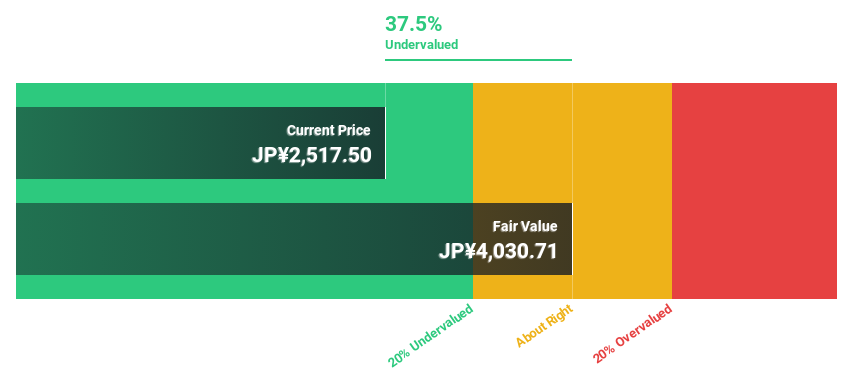

Estimated Discount To Fair Value: 35%

THK is trading at ¥2,632.5, significantly below its estimated fair value of ¥4,052.81, making it undervalued based on cash flows. Earnings are expected to grow significantly at 21% annually over the next three years, outpacing the Japanese market's growth rate of 8.7%. However, a recent dividend decrease from ¥30 to ¥18 per share may concern income-focused investors. Recent executive changes aim to enhance production and sales efficiency in industrial machinery operations.

- In light of our recent growth report, it seems possible that THK's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of THK.

Aozora Bank (TSE:8304)

Overview: Aozora Bank, Ltd., along with its subsidiaries, offers a range of banking products and services both in Japan and internationally, with a market capitalization of ¥369.94 billion.

Operations: The company's revenue segments include the Corporate Sales Group with ¥16.11 billion, Customer Relations Group at ¥8.35 billion, Structured Finance Group generating ¥40.97 billion, and International Business Group contributing ¥18.48 billion.

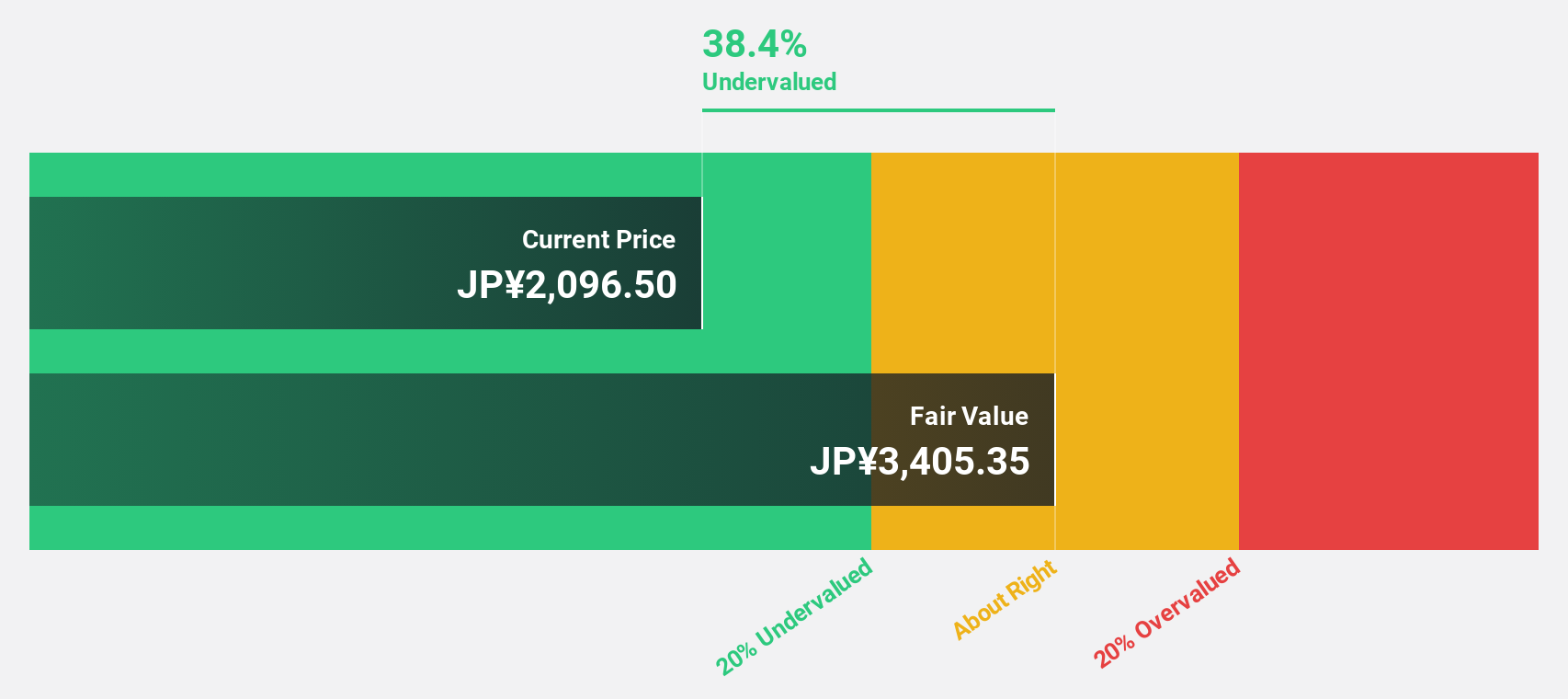

Estimated Discount To Fair Value: 20.8%

Aozora Bank is trading at ¥2,705.5, well below its estimated fair value of ¥3,416.19, indicating undervaluation based on cash flows. Despite a high level of bad loans at 3.1% and a low allowance for these loans (67%), revenue growth is forecast to exceed the Japanese market average significantly at 10.6% annually. However, the dividend yield of 2.81% may not be sustainable with current earnings coverage levels remaining inadequate.

- Our comprehensive growth report raises the possibility that Aozora Bank is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Aozora Bank stock in this financial health report.

Relo Group (TSE:8876)

Overview: Relo Group, Inc. provides property management services in Japan and has a market cap of ¥298.17 billion.

Operations: The company's revenue segments include ¥25.94 billion from the Welfare Program, ¥14.64 billion from the Tourism Business, and ¥95.54 billion from the Relocation Business.

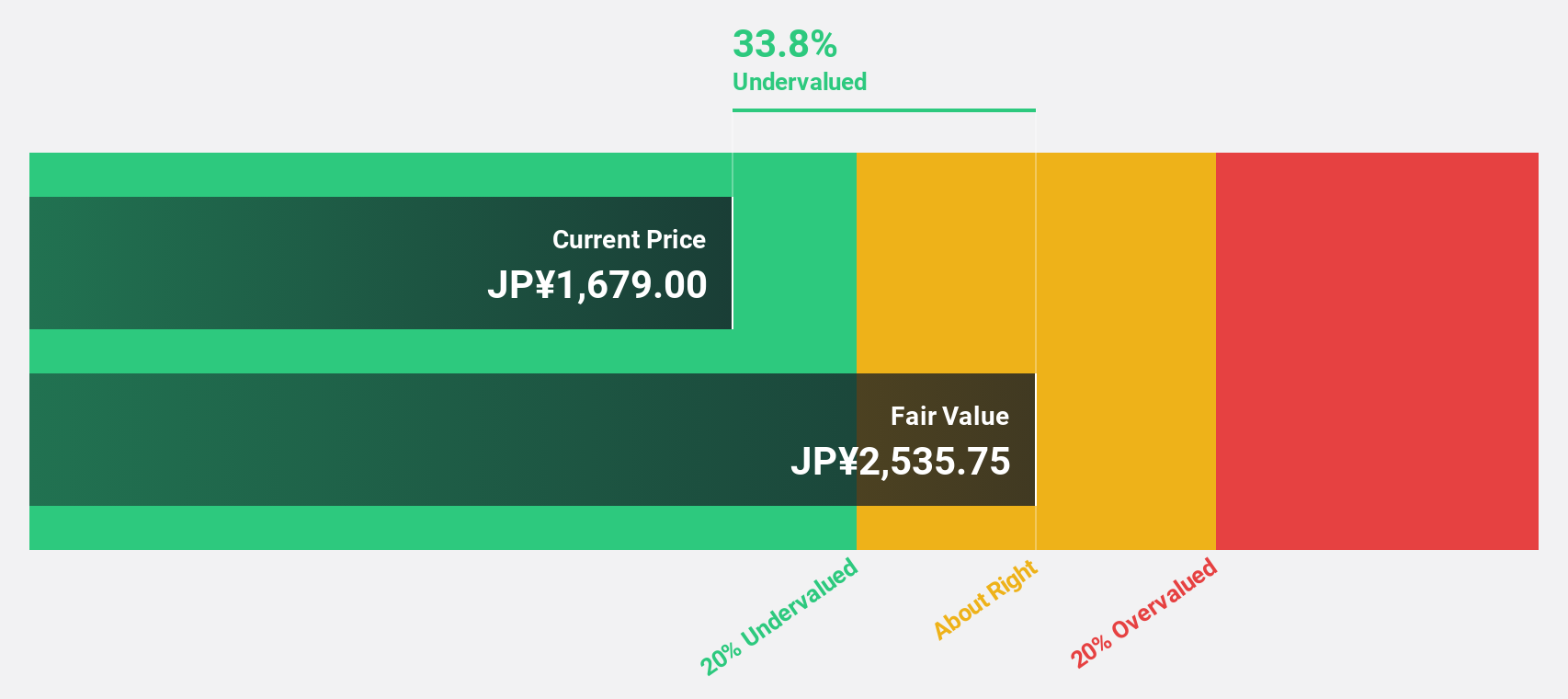

Estimated Discount To Fair Value: 21.2%

Relo Group is trading at ¥1,973, significantly below the estimated fair value of ¥2,502.77, highlighting its undervaluation based on cash flows. The company forecasts robust annual earnings growth of 23.29% and revenue growth surpassing the Japanese market average at 6.2%. Despite a high forecasted return on equity of 26.7%, its dividend yield of 1.93% lacks strong earnings coverage. Recent share buybacks totaling ¥4,354.05 million further enhance capital efficiency.

- Our growth report here indicates Relo Group may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Relo Group's balance sheet health report.

Where To Now?

- Navigate through the entire inventory of 76 Undervalued Japanese Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8304

Aozora Bank

Provides various banking products and services in Japan and internationally.

Reasonable growth potential with adequate balance sheet.