3 Growth Stocks With High Insider Ownership Growing Earnings At 18%

Reviewed by Simply Wall St

Amidst global market fluctuations driven by policy uncertainties and economic data releases, investors are navigating a landscape marked by sector-specific gains and losses. As the financial world grapples with these shifts, identifying growth stocks with high insider ownership can offer insights into companies potentially poised for robust performance. In this context, understanding the alignment between company insiders and shareholders becomes crucial as it may signal confidence in a company's future prospects amidst evolving market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 84.9% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.8% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 103.6% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

Let's explore several standout options from the results in the screener.

Guangdong Shenling Environmental Systems (SZSE:301018)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Shenling Environmental Systems Co., Ltd. operates in the environmental systems industry and has a market capitalization of approximately CN¥6.24 billion.

Operations: I'm unable to provide a summary of the company's revenue segments as the specific details were not included in the text provided. Please ensure that all relevant information is available for an accurate summary.

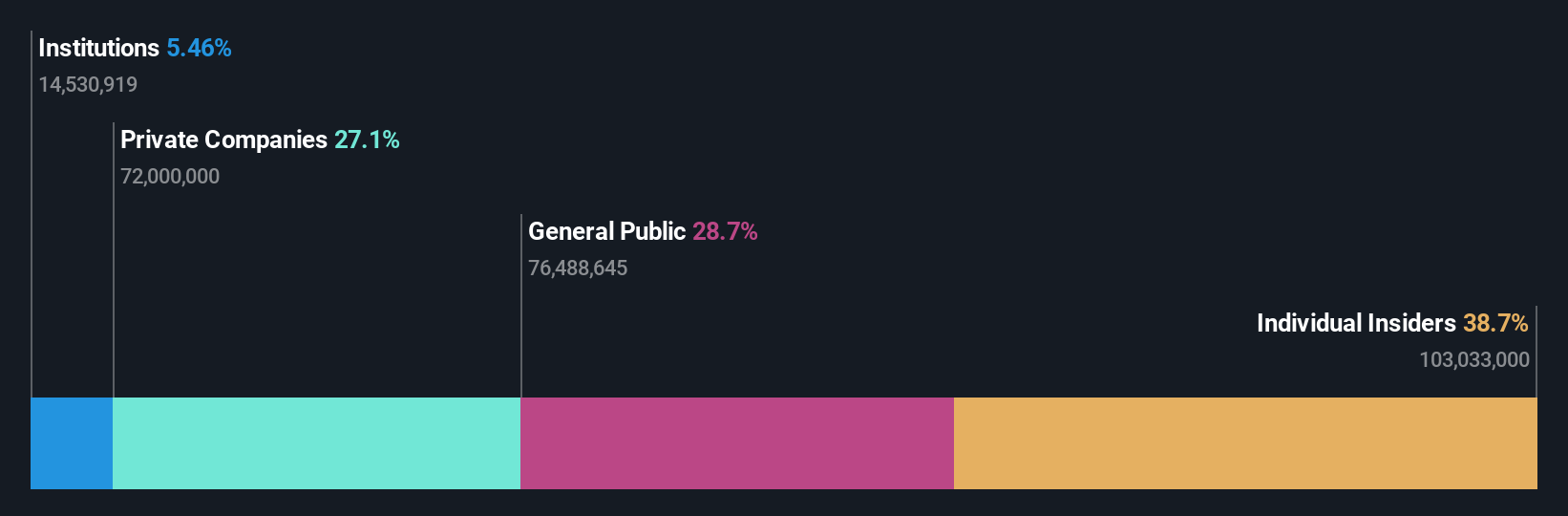

Insider Ownership: 38.7%

Earnings Growth Forecast: 40.6% p.a.

Guangdong Shenling Environmental Systems demonstrates high growth potential with expected annual earnings growth of 40.6%, surpassing the broader Chinese market's 26%. Despite a forecasted revenue increase of 23.4% annually, profit margins have declined from last year's 7.1% to 3.8%. Recent earnings show sales rising to CNY 1,976.99 million, but net income fell slightly to CNY 142.87 million, highlighting challenges in sustaining profitability amidst rapid expansion efforts and recent business scope amendments.

- Take a closer look at Guangdong Shenling Environmental Systems' potential here in our earnings growth report.

- According our valuation report, there's an indication that Guangdong Shenling Environmental Systems' share price might be on the expensive side.

Relo Group (TSE:8876)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Relo Group, Inc. provides property management services in Japan and has a market cap of ¥250.73 billion.

Operations: The company's revenue is primarily derived from its Relocation Business at ¥97.34 billion, followed by the Welfare Program at ¥26.52 billion and the Tourism Business at ¥15.17 billion.

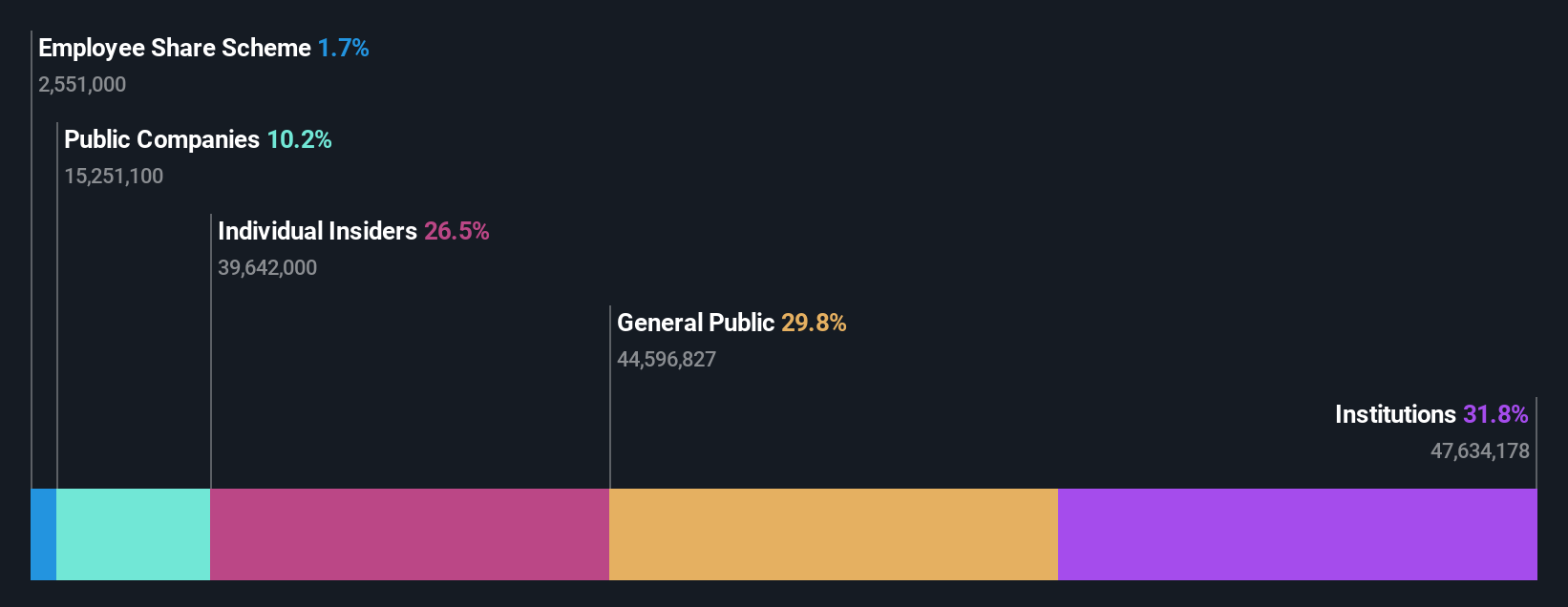

Insider Ownership: 28.1%

Earnings Growth Forecast: 18.8% p.a.

Relo Group is positioned for growth with a forecasted annual earnings increase of 18.82%, outpacing the Japanese market's average. Revenue is expected to rise by 6.1% annually, exceeding the market's 4.1% growth rate, though it remains below high-growth thresholds. The company recently completed a significant share buyback totaling ¥5,499.88 million, enhancing shareholder value while trading at a discount of 30.7% to its estimated fair value despite an unsustainable dividend yield of 2.24%.

- Unlock comprehensive insights into our analysis of Relo Group stock in this growth report.

- The analysis detailed in our Relo Group valuation report hints at an deflated share price compared to its estimated value.

Micro-Star International (TWSE:2377)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Micro-Star International Co., Ltd. manufactures and sells motherboards, interface cards, notebook computers, and other electronic products across Asia, Europe, the United States, and internationally with a market capitalization of approximately NT$145.74 billion.

Operations: The company generates revenue primarily from its Computer and Peripherals Segment, which amounts to NT$195.51 billion.

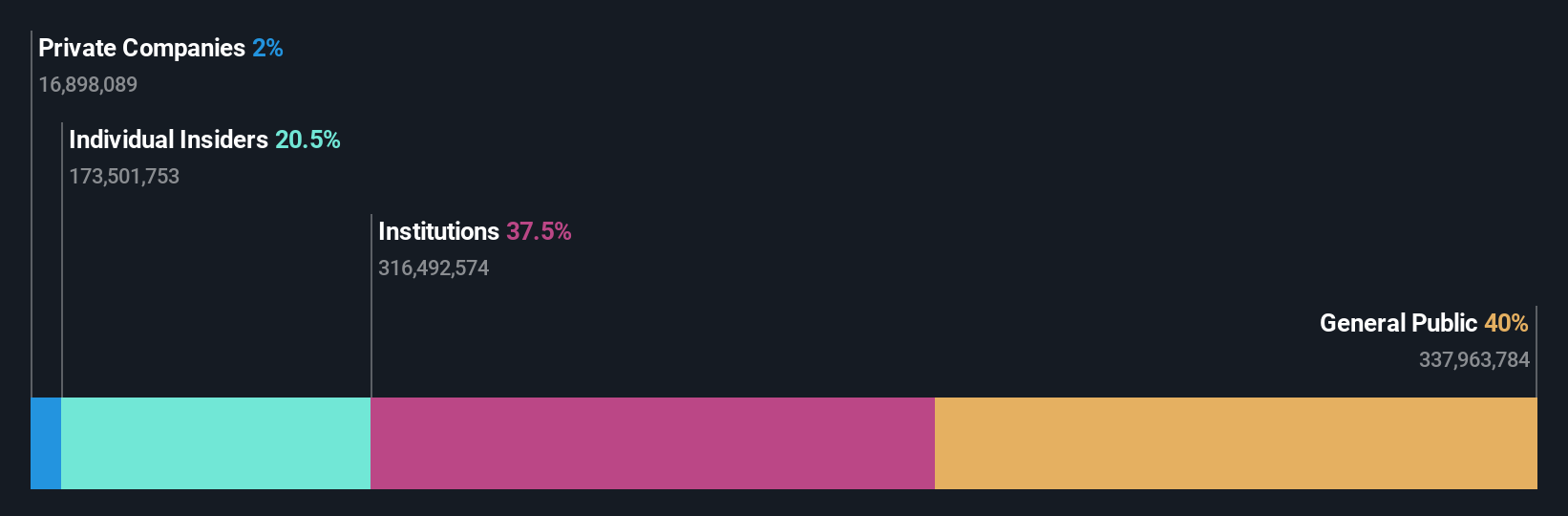

Insider Ownership: 20.5%

Earnings Growth Forecast: 26.2% p.a.

Micro-Star International is forecasted to achieve significant earnings growth of 26.2% annually, surpassing the Taiwan market's average. Despite slower revenue growth at 9.3%, its high insider ownership aligns with strong internal confidence in strategic initiatives like AI server expansion using NVIDIA MGX architecture and Intel Xeon processors, enhancing its position in high-performance computing markets. However, recent financials show declining net income despite increased sales, indicating challenges in profit margins amidst competitive pressures.

- Click here to discover the nuances of Micro-Star International with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Micro-Star International's share price might be too pessimistic.

Seize The Opportunity

- Get an in-depth perspective on all 1533 Fast Growing Companies With High Insider Ownership by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301018

Guangdong Shenling Environmental Systems

Guangdong Shenling Environmental Systems Co., Ltd.

High growth potential with excellent balance sheet.