In recent weeks, global markets have experienced a surge in optimism, with smaller-cap indexes outperforming their larger counterparts as U.S. initial jobless claims hit a seven-month low and major stock indexes approached record highs. This positive sentiment is reflected in the S&P MidCap 400 and Russell 2000 indices, both showing significant year-to-date gains, suggesting that investors are increasingly looking towards small-cap stocks for potential growth opportunities amidst broader economic stability. In this promising environment, identifying undiscovered gems within the small-cap sector requires a keen eye for companies with solid fundamentals and unique market positions that can thrive despite geopolitical uncertainties and shifting monetary policies.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| All E Technologies | NA | 34.23% | 31.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| PAN Group | 143.29% | 15.75% | 23.10% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

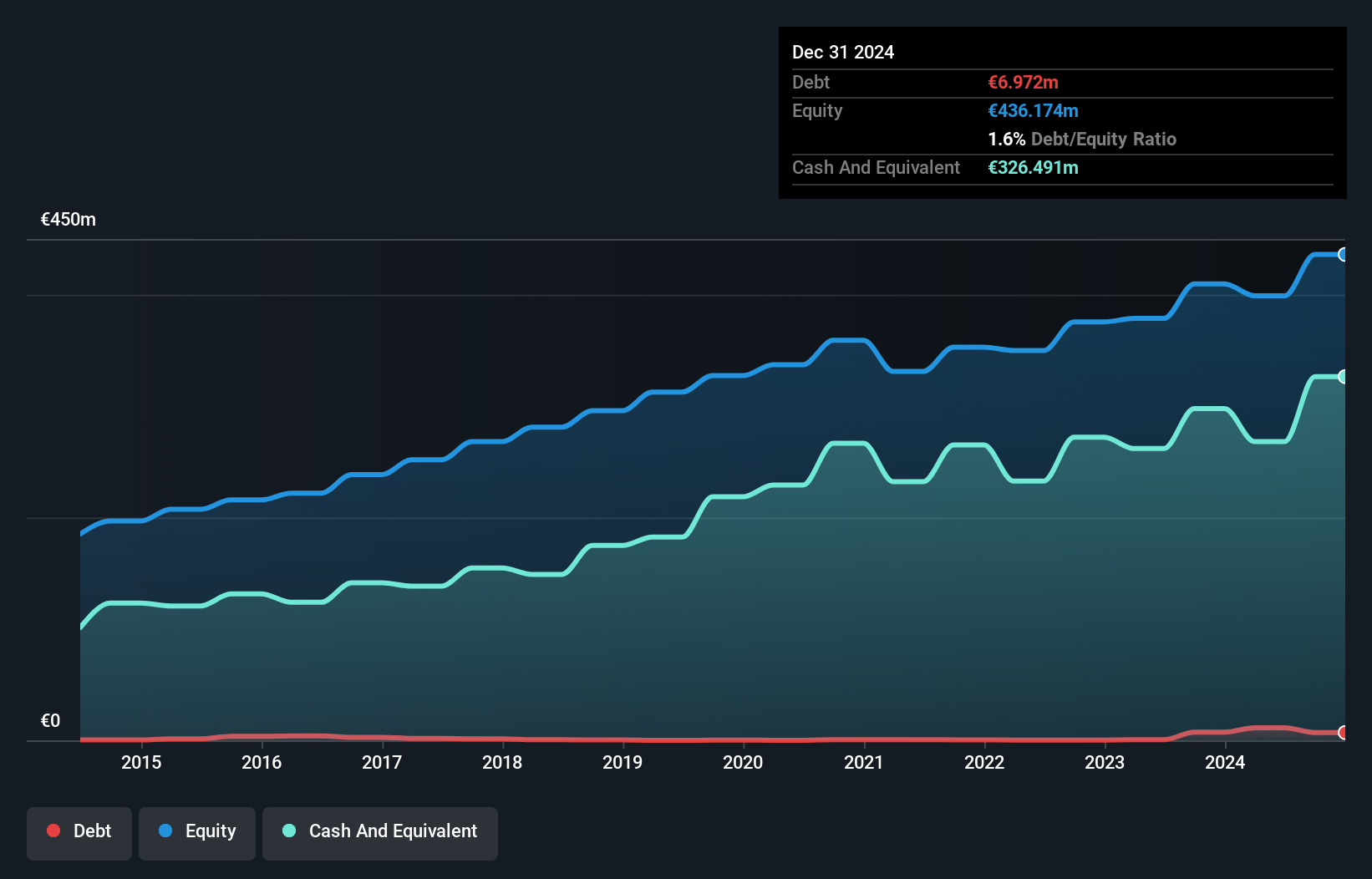

Overview: Neurones S.A. is an IT services company offering infrastructure, application, and consulting services both in France and internationally, with a market cap of €1.11 billion.

Operations: Neurones generates revenue primarily from infrastructure services (€483.86 million), followed by application services (€236.52 million) and council services (€54.53 million).

Neurones, a nimble player in the tech sector, has shown resilience with earnings growth of 1.8% over the past year, outpacing the IT industry's -5.6%. Despite a slight increase in its debt to equity ratio from 0% to 2.8% over five years, it remains financially sound with more cash than total debt and positive free cash flow. Recent half-year results revealed revenue of €402 million (up from €369 million) while net income dipped slightly to €24.5 million from €25.42 million last year, reflecting stable performance amidst industry challenges and high-quality earnings that bolster investor confidence.

- Take a closer look at Neurones' potential here in our health report.

Understand Neurones' track record by examining our Past report.

GOLDCRESTLtd (TSE:8871)

Simply Wall St Value Rating: ★★★★★☆

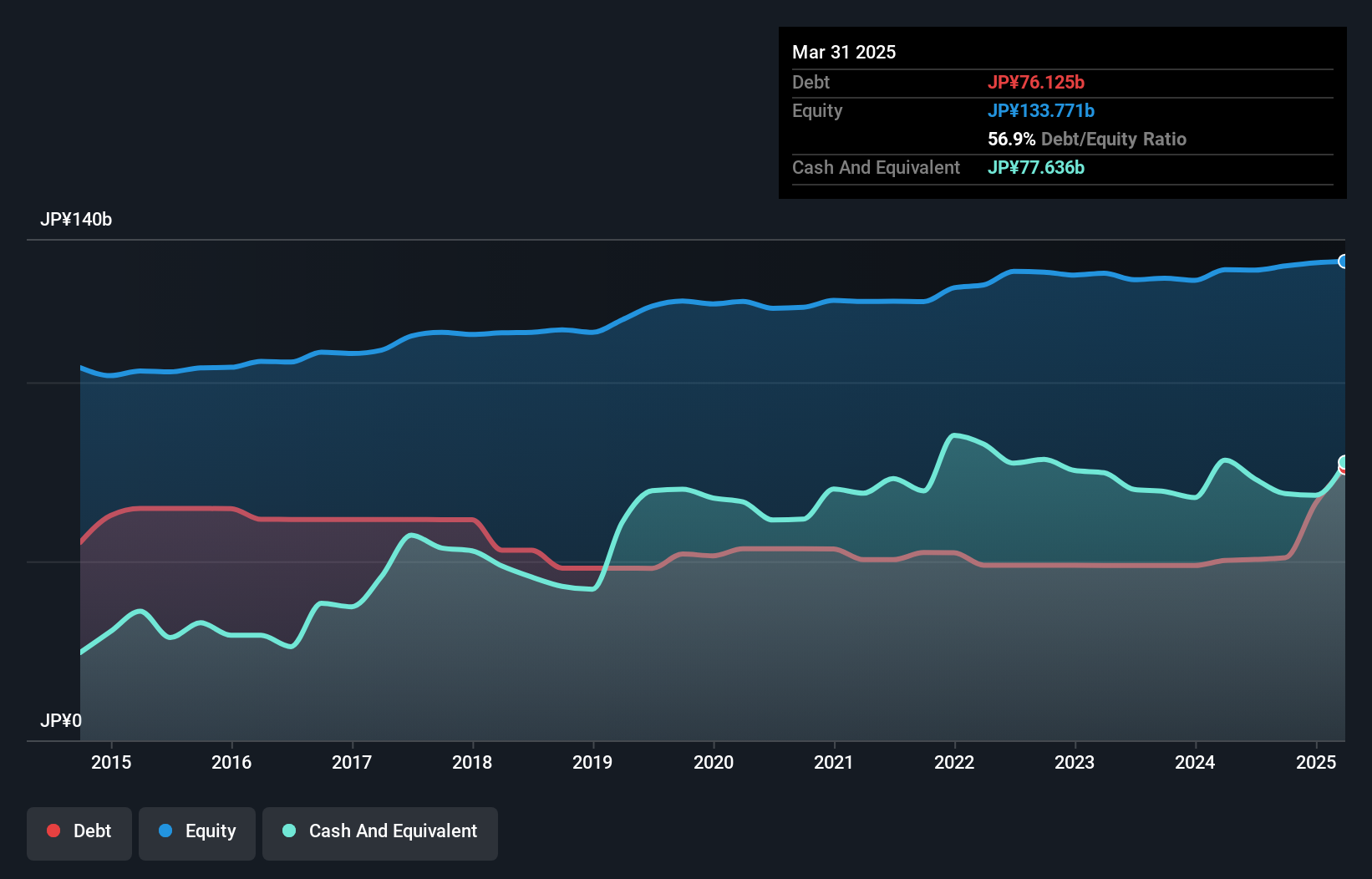

Overview: GOLDCREST Co., Ltd. is involved in the planning, development, and sale of new condominiums in Japan with a market capitalization of ¥100.87 billion.

Operations: The company generates revenue primarily through the sale of newly developed condominiums in Japan. Cost structures include land acquisition, construction expenses, and marketing costs. The net profit margin is noted at 8%, reflecting profitability after accounting for all operational expenses.

GOLDCREST Ltd. stands out with a notable reduction in its debt to equity ratio from 42.4% to 38.5% over five years, reflecting prudent financial management. The company's earnings have surged by an impressive 463%, significantly outpacing the Real Estate industry's growth of 18%. This is coupled with high-quality earnings and robust interest coverage, as EBIT covers interest payments 27 times over, indicating strong operational performance. However, free cash flow remains negative, suggesting potential liquidity challenges despite profitability being unaffected by cash runway concerns. Looking ahead, earnings are projected to grow at nearly 3% annually.

- Navigate through the intricacies of GOLDCRESTLtd with our comprehensive health report here.

Assess GOLDCRESTLtd's past performance with our detailed historical performance reports.

Transcom (TWSE:5222)

Simply Wall St Value Rating: ★★★★★★

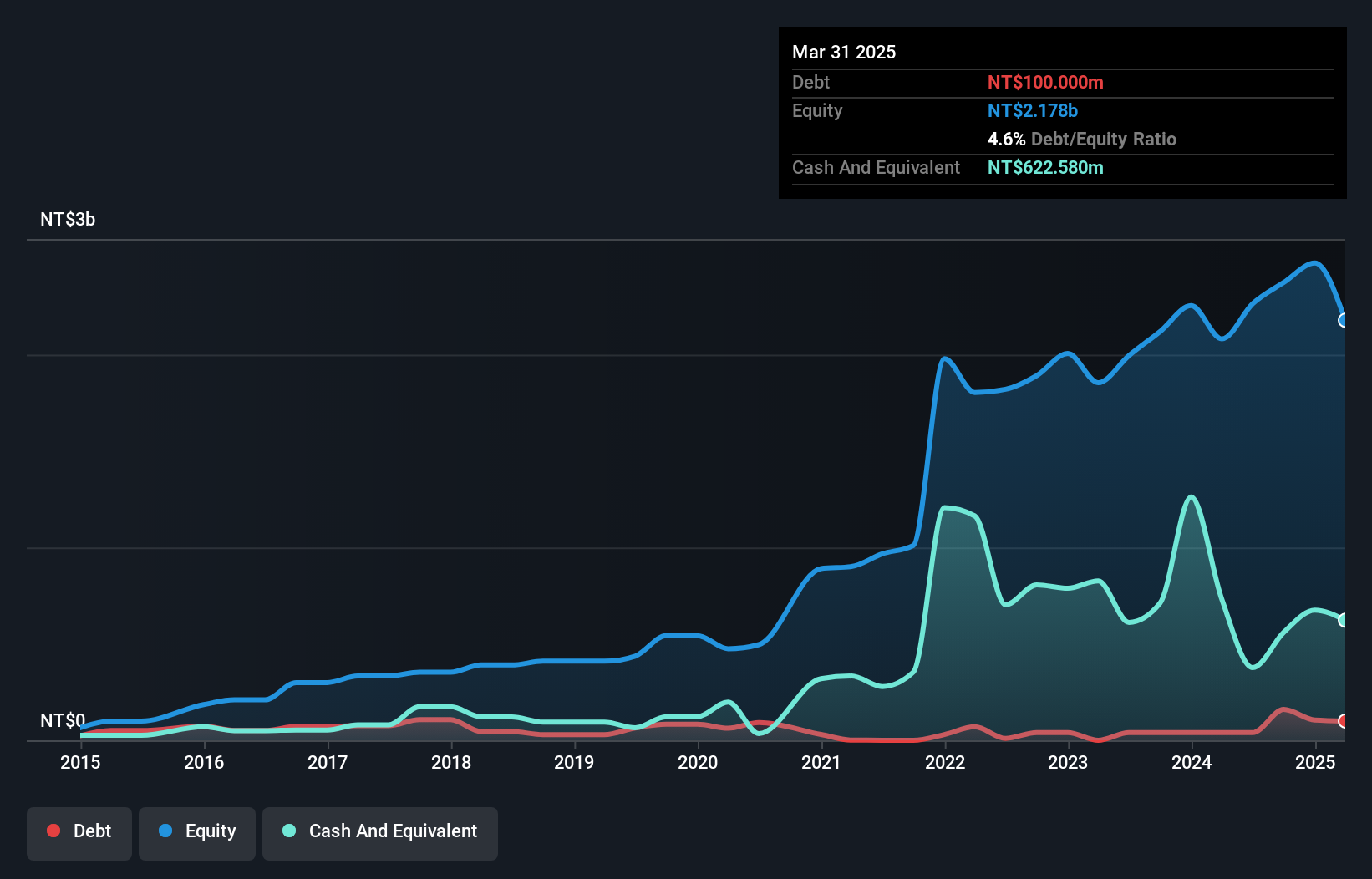

Overview: Transcom, Inc. operates as a microwave device and subsystem company in Taiwan and internationally, with a market capitalization of NT$10.86 billion.

Operations: The primary revenue stream for Transcom comes from its wireless communications equipment segment, generating NT$1.35 billion.

Transcom seems to be making strides in the semiconductor world, with its earnings growth of 6.5% outpacing the industry's 5.9%. The company has managed to reduce its debt-to-equity ratio from 15.3% to 6.7% over five years, indicating improved financial health. Its price-to-earnings ratio of 25.9x is attractive compared to the industry average of 31.7x, suggesting potential value for investors seeking opportunities in this sector. Recent sales figures show a rise from TWD 309 million to TWD 330 million year-on-year for Q3, although net income slightly dipped from TWD 122 million to TWD 120 million during the same period.

- Delve into the full analysis health report here for a deeper understanding of Transcom.

Evaluate Transcom's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 4639 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neurones might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:NRO

Neurones

An information technology (IT) services company, provides infrastructure, application, and consulting services in France and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives