As global markets navigate an exceptionally busy earnings season with mixed economic signals, small-cap stocks have shown resilience, holding up better than their large-cap counterparts amidst cautious investor sentiment. In this context, identifying promising opportunities often involves looking beyond the obvious to uncover lesser-known companies that demonstrate strong fundamentals and potential for growth despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Macnica Galaxy | 47.16% | 10.05% | 20.58% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

cBrain (CPSE:CBRAIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: cBrain A/S is a software company that delivers software solutions to government, private, education, and non-profit sectors both in Denmark and internationally, with a market cap of DKK3.62 billion.

Operations: cBrain generates revenue primarily from its software and programming segment, amounting to DKK246.58 million. The company has a market cap of DKK3.62 billion.

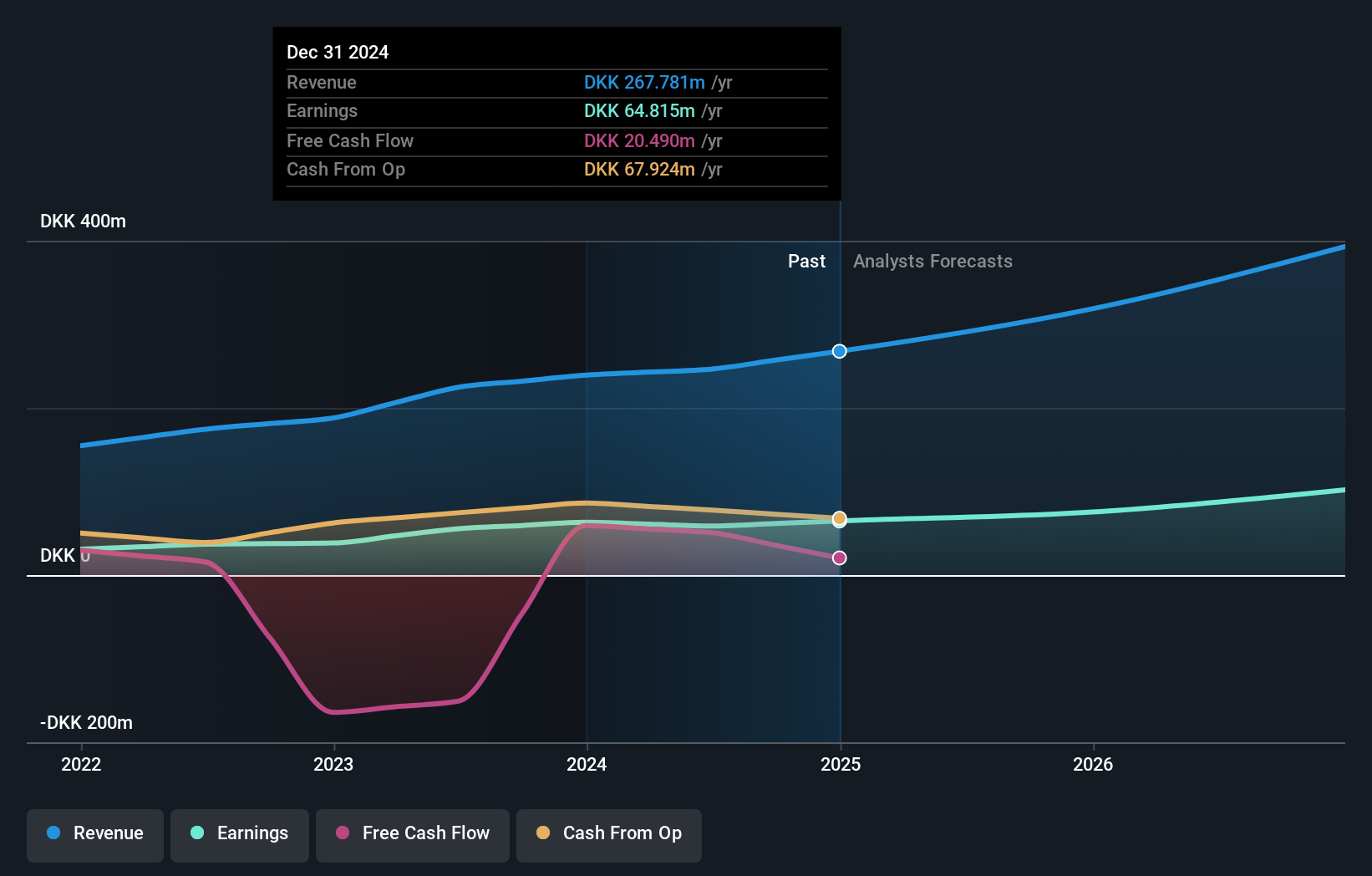

cBrain, a nimble player in the software sector, showcases a promising yet nuanced profile. Over the past five years, earnings have surged annually by 39.3%, although last year's growth of 5.9% lagged behind the industry average of 10.9%. The company maintains high-quality earnings and boasts a robust interest coverage ratio with EBIT covering interest payments 26 times over. Despite recent share price volatility, cBrain's financial health remains sound with a satisfactory net debt to equity ratio of 18.8%. Recent guidance projects revenue growth between 10%-15% for this year, hinting at steady expansion ahead.

- Take a closer look at cBrain's potential here in our health report.

Gain insights into cBrain's historical performance by reviewing our past performance report.

Suzhou Longway Eletronic Machinery (SZSE:301202)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Longway Electronic Machinery Co., Ltd specializes in the research, development, production, sale, and service of various data center cabinets and integrated wiring products in China with a market cap of CN¥4.77 billion.

Operations: Suzhou Longway Electronic Machinery generates revenue primarily from the sale of server cabinets and integrated wiring products. The company's net profit margin has shown variability over recent reporting periods.

Suzhou Longway Electronic Machinery, a smaller player in the tech sector, has shown notable financial resilience. Over the past five years, its debt-to-equity ratio impressively dropped from 83.5% to 10.4%, indicating stronger financial health. Despite a volatile share price recently, the company reported sales of CNY 896 million for the first nine months of 2024, up from CNY 646 million last year. Net income also rose to CNY 56 million compared to CNY 43 million previously. With positive free cash flow and high-quality earnings, it seems poised for continued stability despite industry challenges.

Leopalace21 (TSE:8848)

Simply Wall St Value Rating: ★★★★★★

Overview: Leopalace21 Corporation, with a market cap of ¥184.58 billion, operates in Japan through its construction, leasing, and sale of apartments, condominiums, and residential housing.

Operations: Leopalace21 generates revenue primarily from its Leasing Business, including development, which accounts for ¥410.12 billion. The Elderly Care Business contributes ¥13.88 billion to the overall revenue stream.

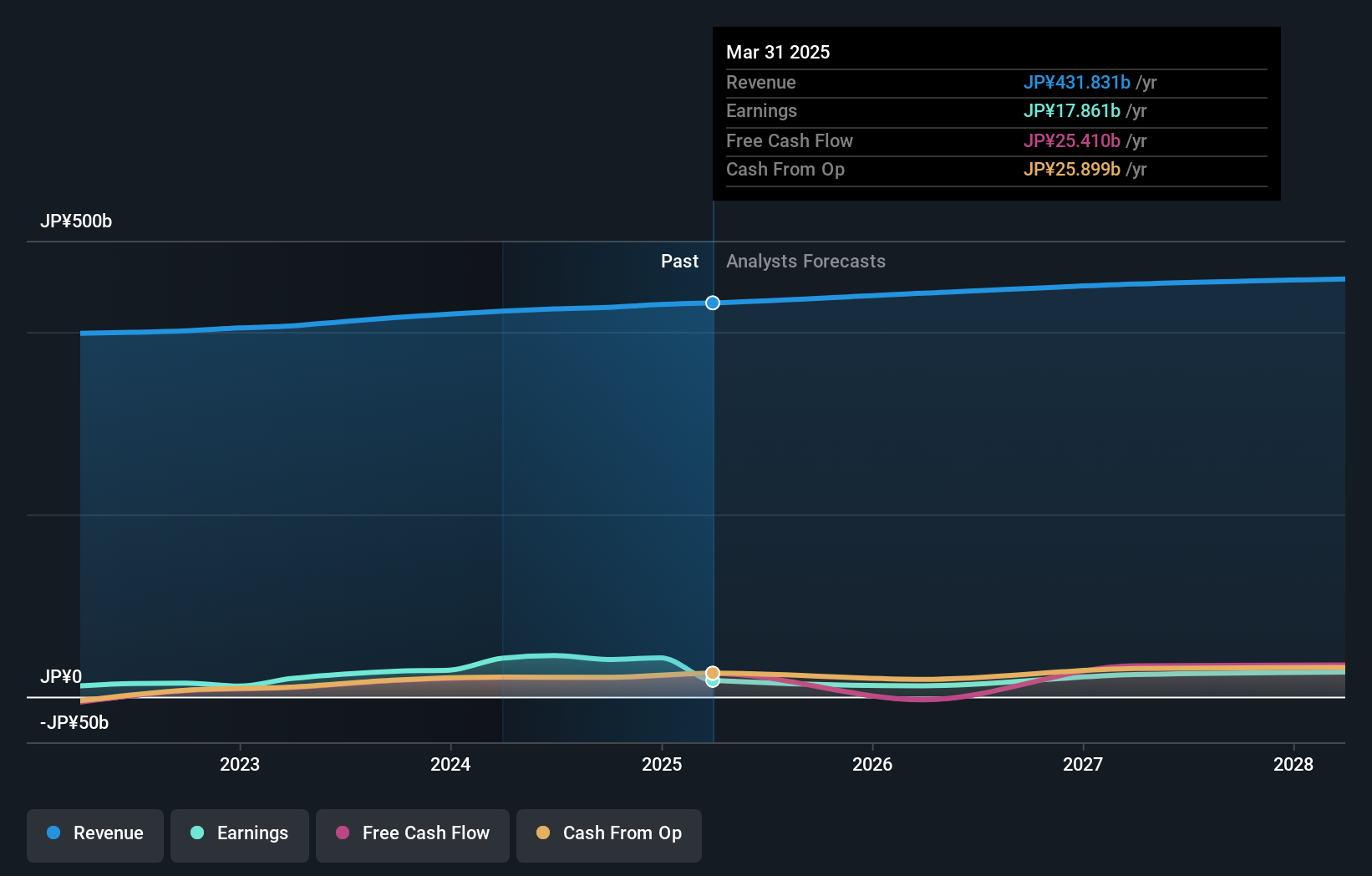

Leopalace21 is navigating a complex landscape, with recent legal challenges including a shareholder derivative lawsuit claiming JPY 3.52 billion in damages. Despite these hurdles, the company announced an interim dividend of JPY 5.00 per share, reflecting its commitment to shareholder returns. For the fiscal year ending March 2025, Leopalace21 projects net sales of JPY 428.6 billion and operating profit of JPY 26.6 billion, highlighting robust operational expectations amidst ongoing legal proceedings. The company's strategic focus on stable dividends and growth targets underscores its resilience in managing both financial performance and external pressures effectively.

- Click here to discover the nuances of Leopalace21 with our detailed analytical health report.

Examine Leopalace21's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Click here to access our complete index of 4706 Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if cBrain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:CBRAIN

cBrain

A software company, provides software solutions for government, private, education, and non-profit sectors in Denmark, rest of the European Union, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion