- Japan

- /

- Real Estate

- /

- TSE:8802

Share Buyback and Dividend Hike Could Be a Game Changer for Mitsubishi Estate (TSE:8802)

Reviewed by Sasha Jovanovic

- Mitsubishi Estate recently completed a significant share buyback program totaling approximately ¥100 billion and raised its second quarter dividend to ¥23 per share, following strong financial results for the second quarter of FY2025.

- This combination of enhanced shareholder returns and higher operating profits highlights the company’s focus on rewarding investors and strengthening its market position.

- We’ll explore how Mitsubishi Estate’s completion of a large-scale share buyback shapes its investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Mitsubishi Estate's Investment Narrative?

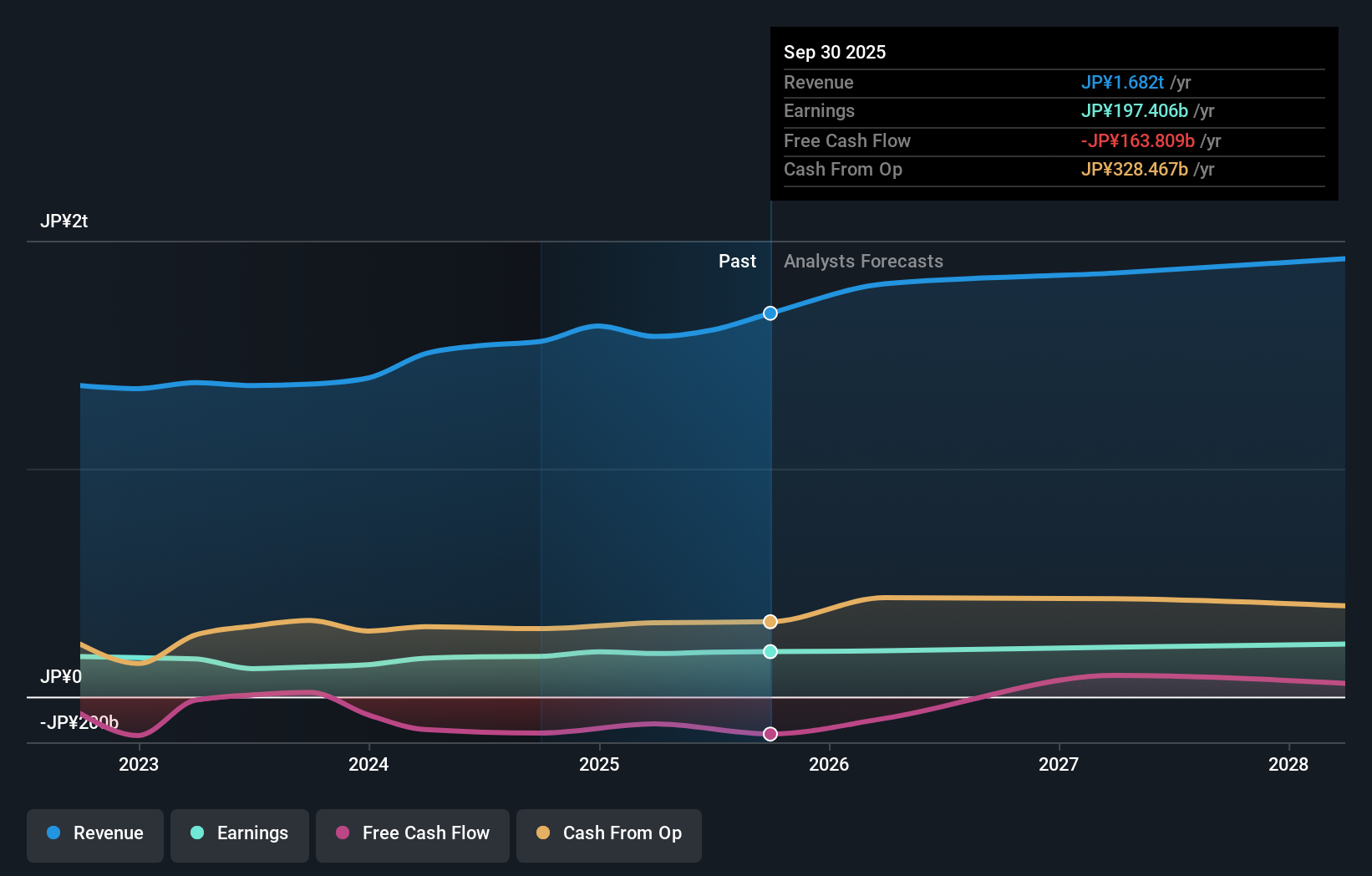

At its core, a bullish view on Mitsubishi Estate hinges on confidence in Japan’s long-term urban property demand, stable recurring income from high-quality assets, and management’s willingness to distribute capital back to shareholders. The just-completed ¥100 billion share buyback and a rising dividend policy signal a push to enhance shareholder value, which could amplify short-term interest and renew focus on capital allocation discipline. These moves may reshape immediate catalysts, especially as the buyback’s completion coincides with strong Q2 earnings and a substantial hike in dividend guidance through to 2030. Short-term upside drivers could now tilt more toward ongoing property performance and signs of further capital returns. Still, the flip side remains: Mitsubishi Estate’s shares trade at a premium to industry peers, and debt coverage by operating cash flow is a concern, so any deterioration in property markets or access to affordable capital could become more pressing risks. Contrast this with the debt-to-cash flow concern investors shouldn’t ignore.

Mitsubishi Estate's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 3 other fair value estimates on Mitsubishi Estate - why the stock might be worth less than half the current price!

Build Your Own Mitsubishi Estate Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi Estate research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mitsubishi Estate research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi Estate's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8802

Mitsubishi Estate

Engages in the real estate activities in Japan and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives