- Japan

- /

- Real Estate

- /

- TSE:3498

Kasumigaseki Capital (TSE:3498) Is Down 9.2% After Announcing 4.6 Million New Share Offering

Reviewed by Sasha Jovanovic

- Kasumigaseki Capital Co., Ltd. recently announced it has filed for a follow-on equity offering, planning to issue 4,610,000 new shares of common stock.

- This move increases the company's outstanding share count, a step that can influence perceptions of future capital needs and potential shareholder dilution.

- We'll examine how the planned share issuance could reshape Kasumigaseki Capital's investment narrative, particularly around capital structure and growth plans.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is Kasumigaseki CapitalLtd's Investment Narrative?

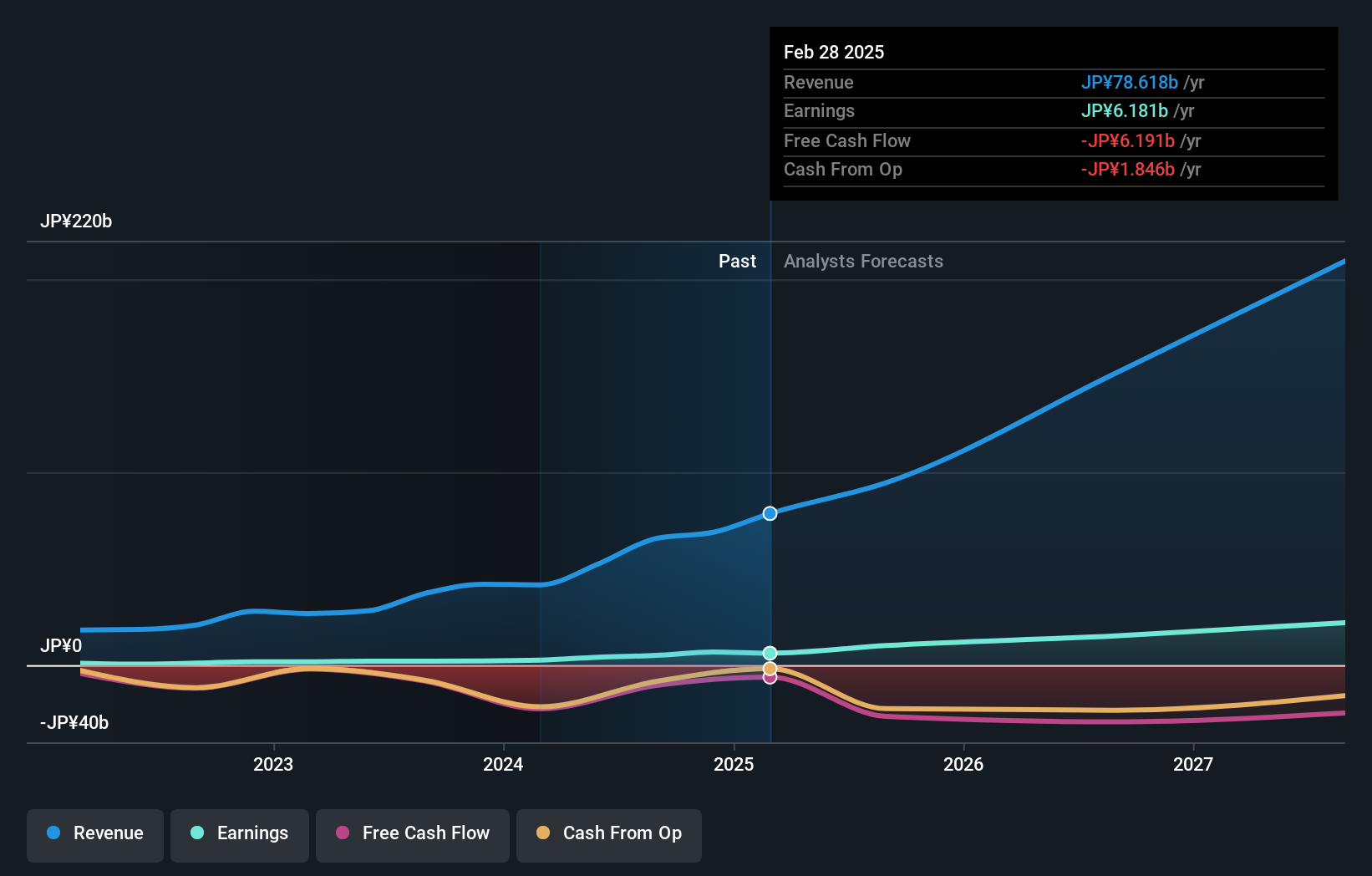

Being a shareholder in Kasumigaseki Capital Ltd. has largely been about believing in its strong earnings momentum and robust revenue growth, plus an experienced management team driving value. Yet, the recent announcement of a large follow-on equity offering, adding 4.61 million new shares, could shift near-term dynamics. While Kasumigaseki’s previous catalysts centered on high profit growth and ambitious expansion in hospitality, this equity raise raises questions about capital needs and shareholder dilution. With the share price under some pressure and dividend forecasts reduced for the coming year, investor focus may now tilt toward how efficiently new capital is deployed and whether high growth rates can be maintained. Short-term, the offering introduces risk of dilution and could affect sentiment, but depending on how proceeds are used, it could also fund further growth.

However, the risk of share dilution from the new offering cannot be ignored.

Exploring Other Perspectives

Explore 2 other fair value estimates on Kasumigaseki CapitalLtd - why the stock might be worth as much as 48% more than the current price!

Build Your Own Kasumigaseki CapitalLtd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kasumigaseki CapitalLtd research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kasumigaseki CapitalLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kasumigaseki CapitalLtd's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kasumigaseki CapitalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3498

Kasumigaseki CapitalLtd

Engages in real estate consulting businesses in Japan.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives