- Japan

- /

- Real Estate

- /

- TSE:3498

How Kasumigaseki Capital's Expansion Into Foreign Worker Services May Shift Its Investment Narrative (TSE:3498)

Reviewed by Sasha Jovanovic

- Kasumigaseki Capital Co., Ltd. recently announced that its Board of Directors resolved to propose amendments to the Articles of Incorporation at the upcoming shareholders meeting, suggesting the addition of fee-charging employment placement and support services for foreign workers as new business activities.

- This proposed expansion highlights the company's intent to diversify its operations and participate in sectors linked to workforce management and international labor mobility.

- We'll explore how the move to expand into employment placement and foreign worker support could influence Kasumigaseki Capital's investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Kasumigaseki CapitalLtd's Investment Narrative?

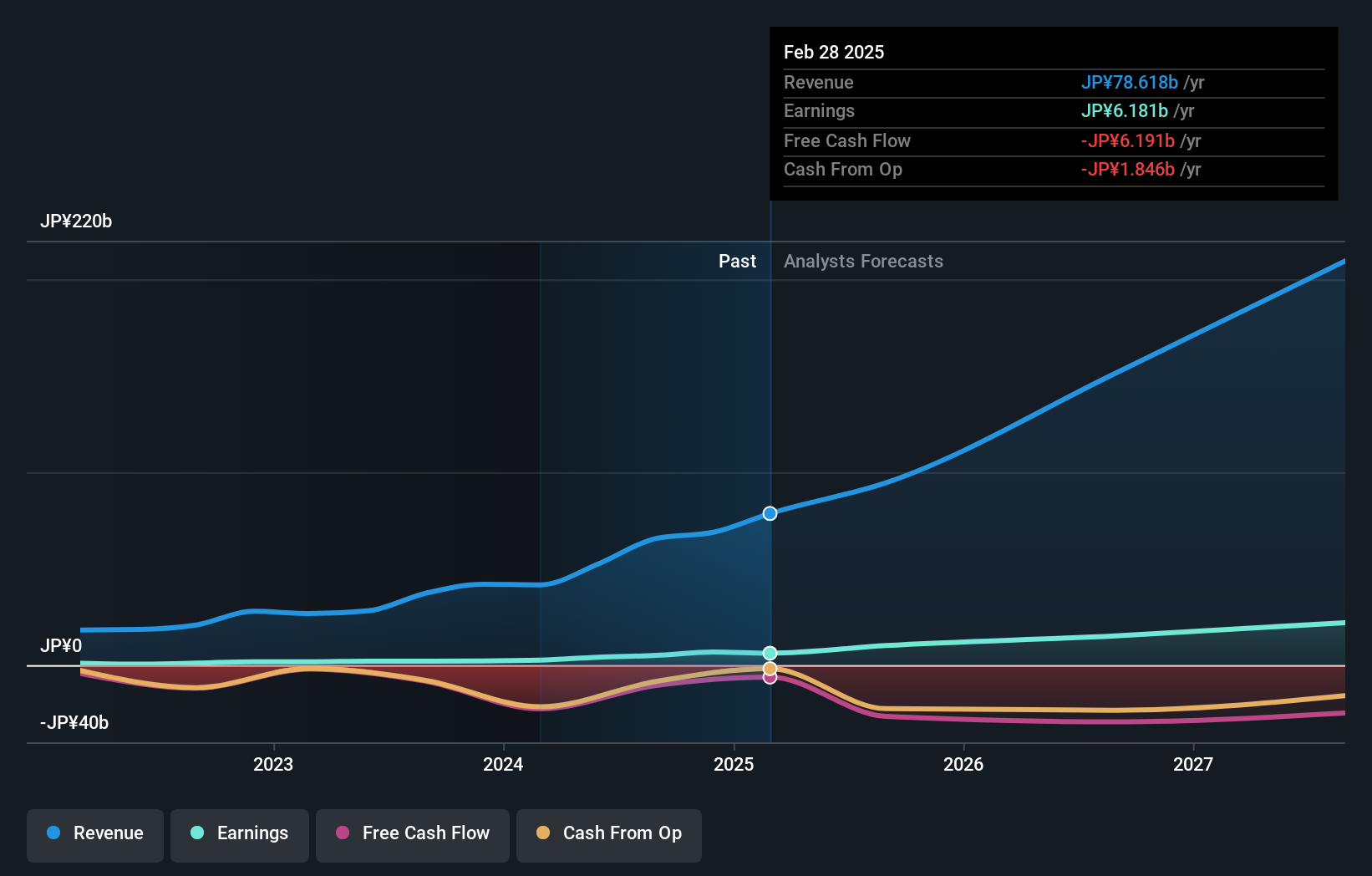

To be a shareholder in Kasumigaseki Capital Ltd., you’d need to believe in its ability to deliver rapid profit growth and sustain strong returns on equity, even as it faces volatile share price swings and a pricey valuation compared to peers. The company’s new proposal to enter fee-charging employment placement and foreign worker support services could reshape the biggest short-term catalysts and risks. Before this news, key drivers included expected high earnings growth, active business expansions, and upcoming earnings releases, offset by concerns about its dividend coverage and reliance on debt-financed growth. If the new focus on foreign labor services takes hold, it adds a fresh growth avenue but could heighten near-term execution risk and stretch management resources. Right now, the proposed move feels ambitious, but its material impact may hinge on how quickly the company can scale and monetize these new initiatives. On the other hand, high debt and dividend coverage still stand out as issues investors should be aware of.

Kasumigaseki CapitalLtd's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 2 other fair value estimates on Kasumigaseki CapitalLtd - why the stock might be worth as much as 62% more than the current price!

Build Your Own Kasumigaseki CapitalLtd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kasumigaseki CapitalLtd research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kasumigaseki CapitalLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kasumigaseki CapitalLtd's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 34 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kasumigaseki CapitalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3498

Kasumigaseki CapitalLtd

Engages in real estate consulting businesses in Japan.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives