- Japan

- /

- Real Estate

- /

- TSE:3496

Uncovering Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic indicators signal both challenges and opportunities, investors are increasingly looking beyond the major indices to uncover potential in smaller-cap stocks. With the S&P 500 closing another strong year despite recent volatility, attention is turning towards lesser-known companies that may offer unique growth prospects amid shifting economic landscapes. In this context, identifying a good stock often involves assessing its ability to thrive in uncertain conditions and capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Sichuan Zigong Conveying Machine Group (SZSE:001288)

Simply Wall St Value Rating: ★★★★☆☆

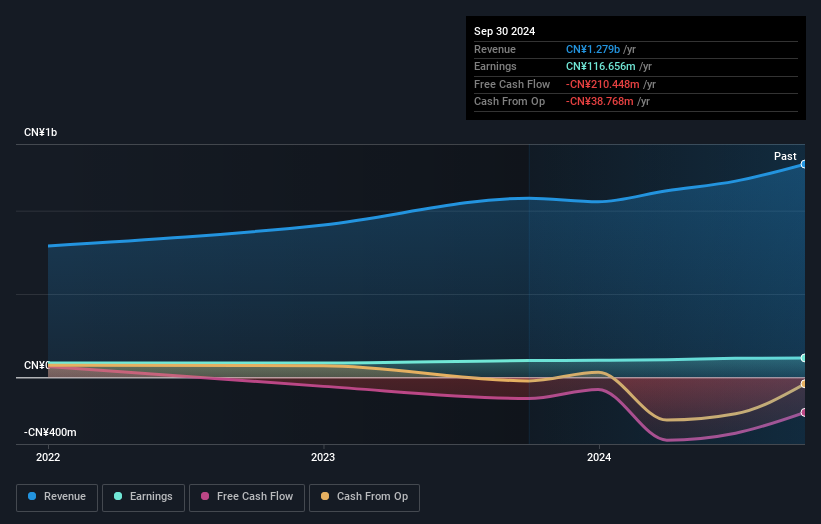

Overview: Sichuan Zigong Conveying Machine Group Co., Ltd. designs and manufactures conveying machinery for material handling solutions in China and internationally, with a market cap of CN¥5 billion.

Operations: The company generates revenue primarily through the sale of conveying machinery. It experiences fluctuations in its net profit margin, which is a critical indicator of its financial performance.

Sichuan Zigong Conveying Machine Group, a smaller player in its industry, has shown impressive earnings growth of 15.5% over the past year, outpacing the machinery sector's -0.06%. Despite a rising debt-to-equity ratio from 3.5% to 31.6% over five years, the company maintains strong interest coverage with EBIT covering interest payments 8.8 times over. Recent buybacks saw the repurchase of approximately 4.74 million shares for CNY 110.55 million, reflecting confidence in its market position and potential value enhancement for shareholders amidst ongoing strategic financial maneuvers like credit line expansions and capital management initiatives.

AzoomLtd (TSE:3496)

Simply Wall St Value Rating: ★★★★☆☆

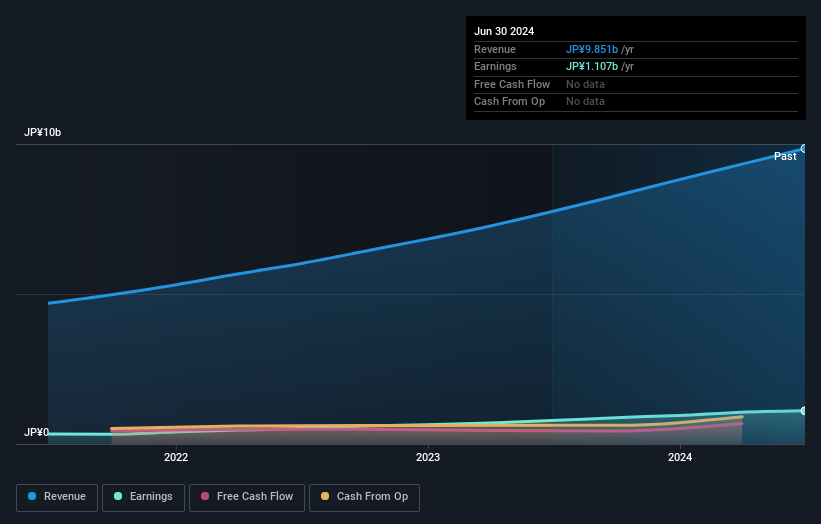

Overview: Azoom Ltd (TSE:3496) is a company that offers a range of real estate services in Japan, with a market capitalization of ¥42.78 billion.

Operations: Azoom Ltd generates revenue primarily from its Visualization Business, which contributes ¥213.74 million, and the Idle Asset Utilization Business, adding ¥10.34 billion.

Azoom Ltd, a small cap player, is trading at 14.4% below its estimated fair value, suggesting potential undervaluation. The company boasts high-quality earnings with significant non-cash components and has more cash than total debt, indicating a sound financial position. Over the past year, Azoom's earnings surged by 46.7%, outpacing the Real Estate industry's growth of 22.1%, reflecting robust performance in its sector. Despite this growth, its share price has been highly volatile recently. With positive free cash flow and profitability not being an issue, Azoom seems well-positioned within its industry context for future opportunities.

- Click to explore a detailed breakdown of our findings in AzoomLtd's health report.

Understand AzoomLtd's track record by examining our Past report.

Senshu Ikeda Holdings (TSE:8714)

Simply Wall St Value Rating: ★★★★☆☆

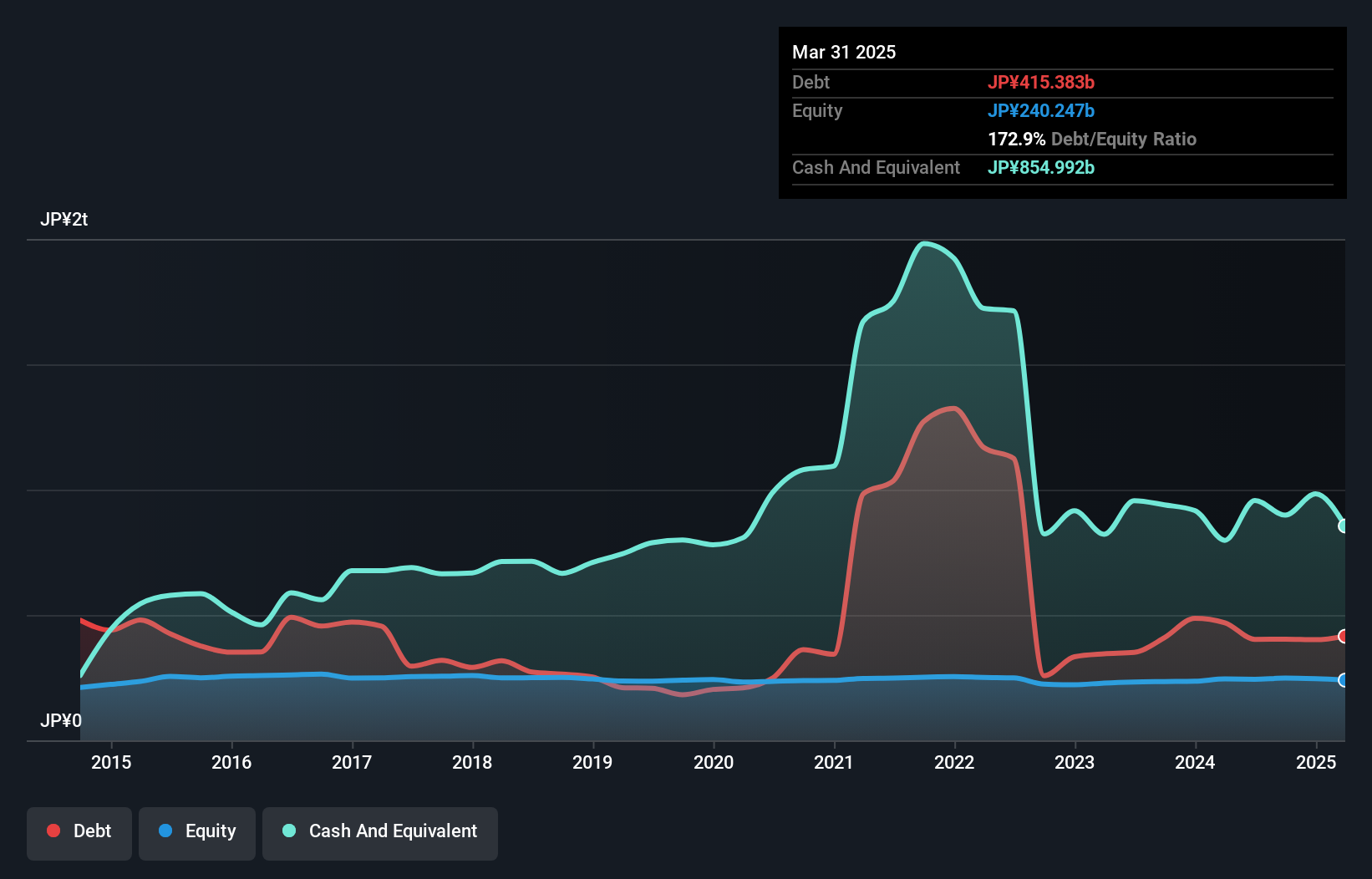

Overview: Senshu Ikeda Holdings, Inc. is a financial services company offering banking products and services to small and medium-sized enterprises as well as individuals in Japan and internationally, with a market cap of ¥112.74 billion.

Operations: Senshu Ikeda Holdings generates revenue primarily from its banking segment, contributing ¥70.46 billion, followed by the leasing business at ¥11.65 billion. The company's financial performance is impacted by these core segments, with the banking segment being the dominant source of income.

Senshu Ikeda Holdings, a financial entity with total assets of ¥6.34 trillion and equity of ¥248.1 billion, is trading at 38.7% below its estimated fair value, suggesting potential undervaluation. With customer deposits making up 92% of liabilities, it relies on low-risk funding sources. The bank's allowance for bad loans stands at 1.1%, which is considered appropriate within the industry context. Over the past year, earnings surged by 42%, outpacing the industry's growth rate of 22.6%. Recently announced dividends increased to ¥7.50 per share from ¥6.25 last year, reflecting positive financial momentum and shareholder returns expectations for fiscal year ending March 2025.

- Delve into the full analysis health report here for a deeper understanding of Senshu Ikeda Holdings.

Key Takeaways

- Delve into our full catalog of 4659 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3496

Solid track record with adequate balance sheet.