- Japan

- /

- Real Estate

- /

- TSE:3482

A Piece Of The Puzzle Missing From Loadstar Capital K.K.'s (TSE:3482) 29% Share Price Climb

Loadstar Capital K.K. (TSE:3482) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 76%.

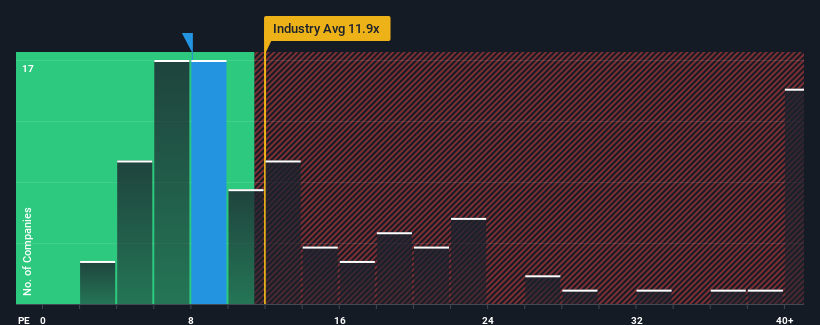

In spite of the firm bounce in price, Loadstar Capital K.K's price-to-earnings (or "P/E") ratio of 8x might still make it look like a buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 15x and even P/E's above 24x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Loadstar Capital K.K hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Loadstar Capital K.K

Is There Any Growth For Loadstar Capital K.K?

The only time you'd be truly comfortable seeing a P/E as low as Loadstar Capital K.K's is when the company's growth is on track to lag the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Although pleasingly EPS has lifted 95% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 41% as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 11% growth forecast for the broader market.

With this information, we find it odd that Loadstar Capital K.K is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Loadstar Capital K.K's P/E

Despite Loadstar Capital K.K's shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Loadstar Capital K.K's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Loadstar Capital K.K (at least 1 which can't be ignored), and understanding them should be part of your investment process.

You might be able to find a better investment than Loadstar Capital K.K. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3482

Loadstar Capital K.K

Engages in the real estate investment business in Japan.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives