- Japan

- /

- Auto Components

- /

- TSE:7296

3 Leading Dividend Stocks Offering Up To 3.8% Yield

Reviewed by Simply Wall St

In a week marked by heightened economic activity and cautious earnings reports, global markets experienced fluctuations, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. Amidst this backdrop of busy earnings seasons and mixed economic signals, investors are increasingly turning their attention to dividend stocks as a strategy to navigate market volatility while seeking stable income streams. A good dividend stock in such conditions typically offers consistent payouts and robust financial health, providing a measure of stability in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.84% | ★★★★★★ |

| Globeride (TSE:7990) | 4.08% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.91% | ★★★★★★ |

| Innotech (TSE:9880) | 4.83% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.21% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.55% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.16% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.64% | ★★★★★★ |

Click here to see the full list of 2037 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

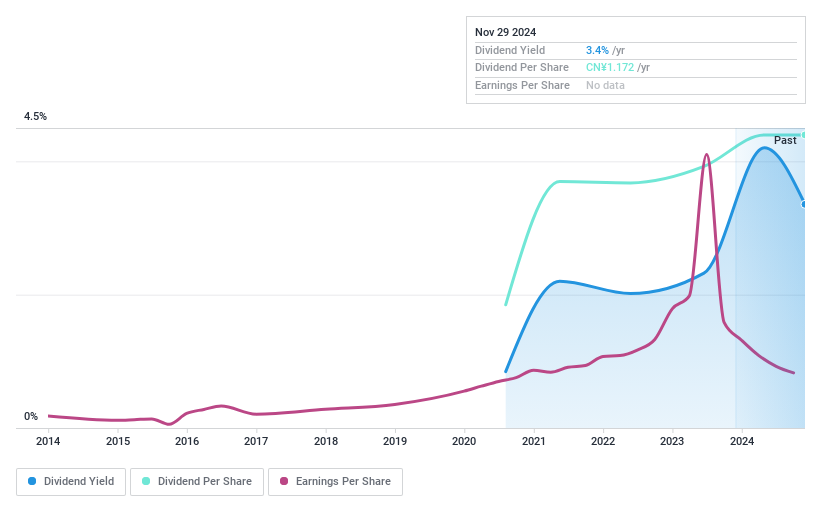

Three's Company Media Group (SHSE:605168)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Three's Company Media Group Co., Ltd. offers integrated and digital marketing services with a market capitalization of CN¥6.78 billion.

Operations: Three's Company Media Group Co., Ltd. generates its revenue from providing integrated and digital marketing services.

Dividend Yield: 3.5%

Three's Company Media Group offers a dividend yield in the top 25% of the CN market, supported by a payout ratio of 55.9%, indicating earnings coverage. However, its dividend history is under a decade, and recent financial results show declining sales (CNY 3.08 billion) and net income (CNY 181.66 million) year-over-year. Despite this, dividends remain covered by cash flows with a cash payout ratio of 52.1%. The company has also engaged in share buybacks worth CNY 5.53 million recently.

- Click here and access our complete dividend analysis report to understand the dynamics of Three's Company Media Group.

- According our valuation report, there's an indication that Three's Company Media Group's share price might be on the cheaper side.

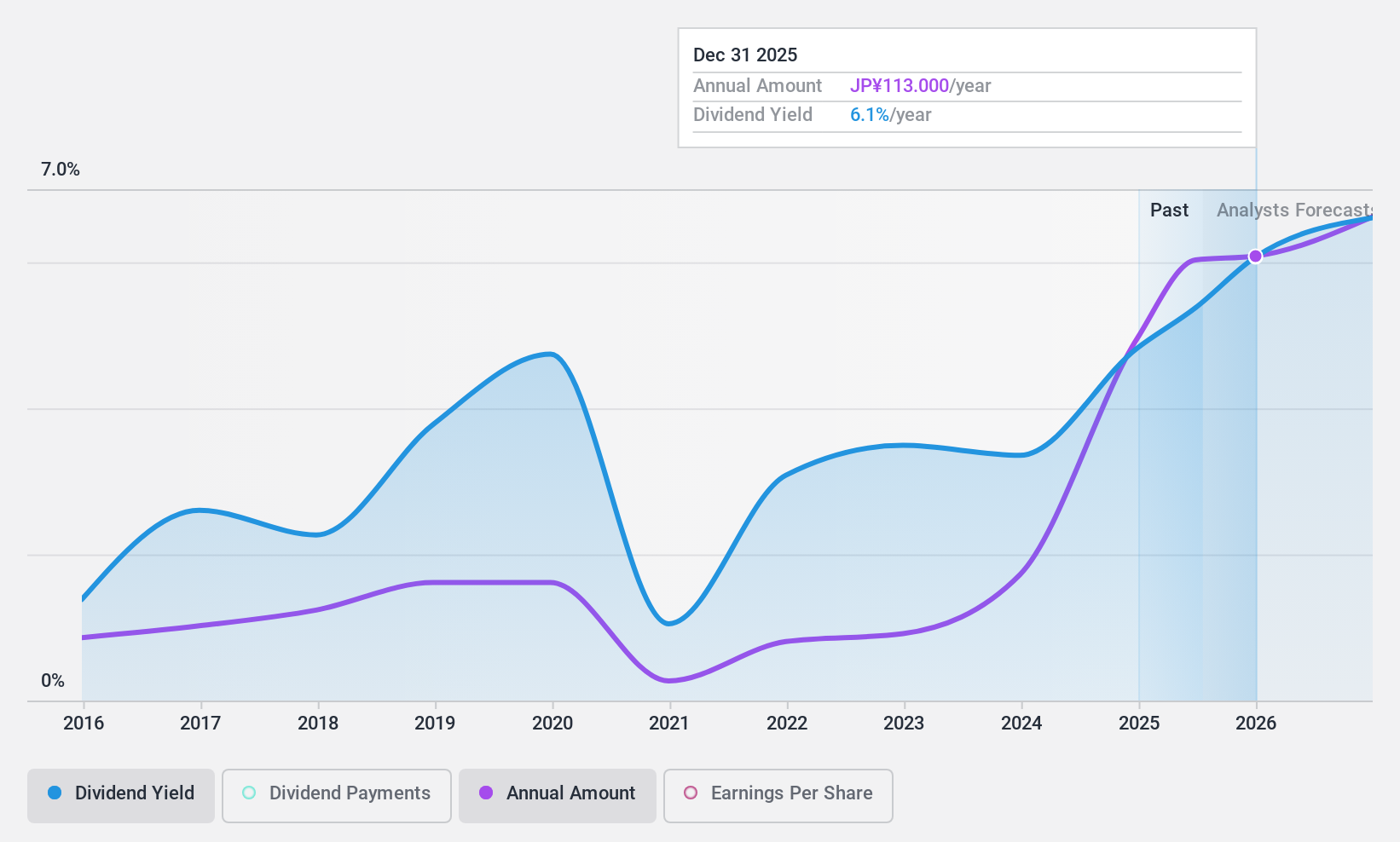

MUGEN ESTATELtd (TSE:3299)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MUGEN ESTATE Co., Ltd. is involved in purchasing and reselling used real estate properties in Japan, with a market cap of ¥36.60 billion.

Operations: MUGEN ESTATE Ltd generates revenue primarily through its Real Estate Sales Business, which accounts for ¥54.55 billion, and its Leasing and Other Business segment, contributing ¥2.38 billion.

Dividend Yield: 3.8%

MUGEN ESTATE Ltd. offers a dividend yield of 3.84%, placing it in the top 25% of JP market payers, yet its dividends have been volatile over the past decade. Despite a low payout ratio of 31%, indicating coverage by earnings, dividends are not well covered by free cash flow due to a high cash payout ratio (306.2%). Recent strategic expansions and index inclusion may influence future performance, though earnings are forecast to decline slightly.

- Unlock comprehensive insights into our analysis of MUGEN ESTATELtd stock in this dividend report.

- Our expertly prepared valuation report MUGEN ESTATELtd implies its share price may be too high.

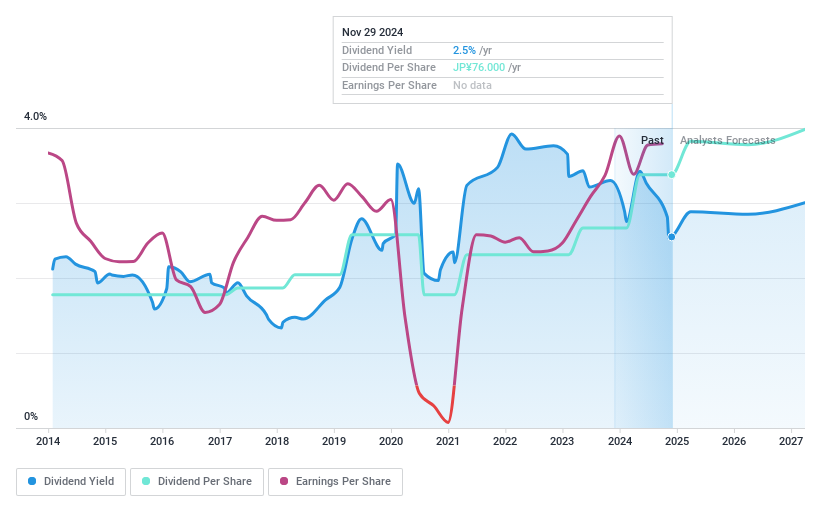

F.C.C (TSE:7296)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: F.C.C. Co., Ltd. manufactures and sells clutches and material parts for automobiles, motorcycles, and general-purpose machinery in Japan and internationally, with a market cap of ¥117.68 billion.

Operations: F.C.C. Co., Ltd.'s revenue is derived from the production and sale of clutches and material parts for a range of vehicles, including automobiles and motorcycles, as well as general-purpose machinery, serving both domestic and international markets.

Dividend Yield: 2.7%

F.C.C. Co., Ltd. maintains a sustainable dividend with a low payout ratio of 15.6%, indicating strong earnings coverage, and a cash payout ratio of 16.4%, ensuring dividends are well supported by free cash flows. The company's dividend yield is 2.67%, below the top tier in Japan, but it has shown stability and growth over the past decade. Recent buyback plans aim to enhance capital efficiency, while upcoming board decisions may revise dividend forecasts amid stable earnings growth last year at 14.7%.

- Click here to discover the nuances of F.C.C with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that F.C.C is priced higher than what may be justified by its financials.

Seize The Opportunity

- Click here to access our complete index of 2037 Top Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7296

F.C.C

Manufactures and sells clutches and material parts for automobiles, motorcycles, and general-purpose machinery in Japan and internationally.

Flawless balance sheet established dividend payer.