- Japan

- /

- Real Estate

- /

- TSE:3003

Should Hulic’s (TSE:3003) Upgraded Earnings and Dividend Guidance Prompt a Closer Look by Investors?

Reviewed by Sasha Jovanovic

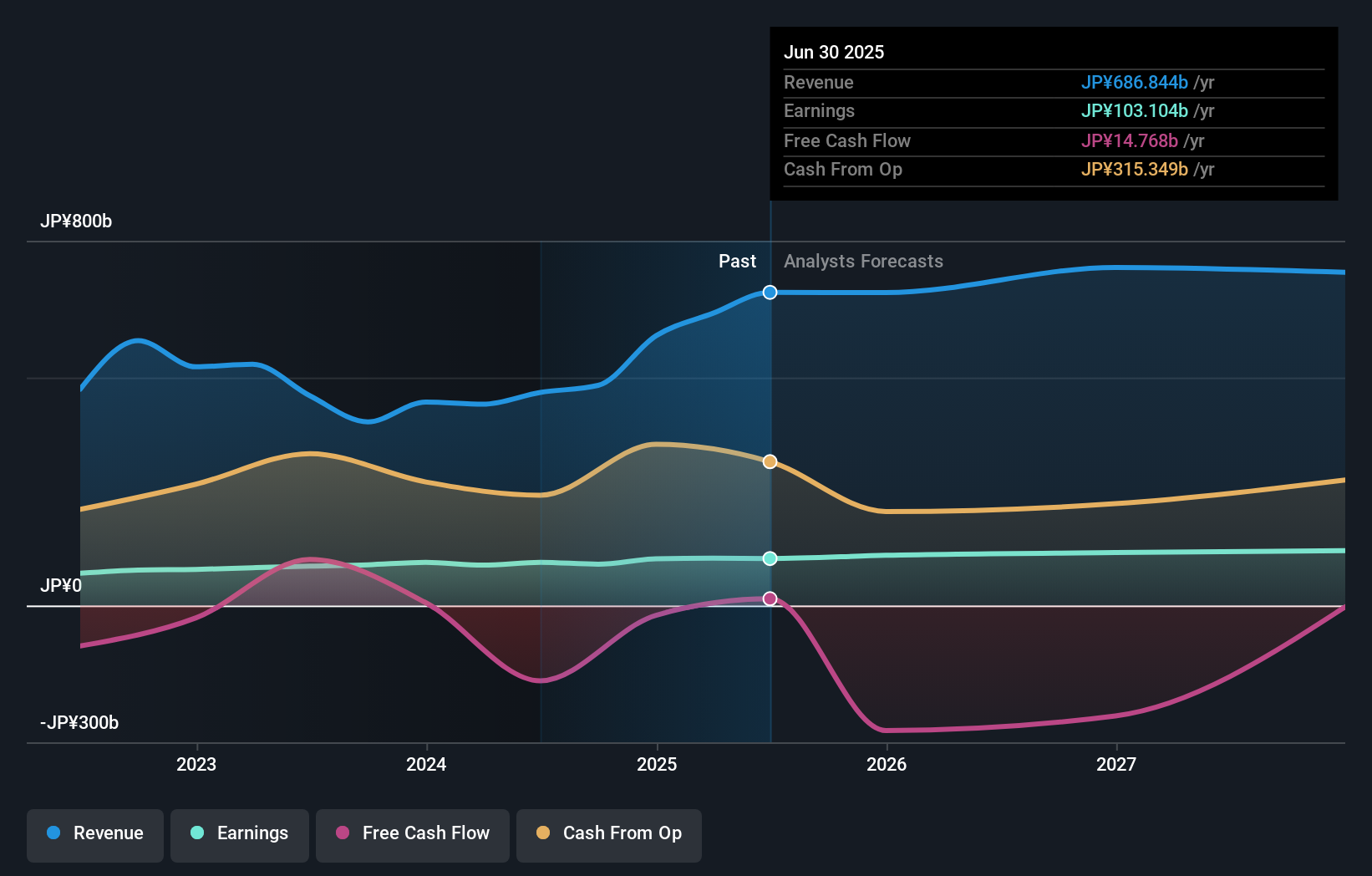

- Hulic Co., Ltd. recently announced an upward revision to its fiscal 2025 earnings guidance, projecting operating revenue of ¥710 billion and a profit attributable to owners of parent of ¥112 billion, alongside an increase in full-year dividend guidance to ¥31.50 per share from ¥28 per share previously.

- This move highlights the company's focus on optimizing its property portfolio, booking anticipated record-high profits by selling assets that do not meet its real estate holding criteria.

- We'll explore how Hulic's commitment to higher dividend payouts shapes its investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Hulic's Investment Narrative?

For anyone considering Hulic as an investment, the core belief has to be in its disciplined approach to portfolio management and commitment to shareholder returns, particularly through its dividend policy. The recent upward revision in earnings and dividend guidance for fiscal 2025 signals a focus on profitability and capital recycling, with management capitalizing on asset sales to drive record-high profit projections. This news meaningfully updates the short-term outlook, as higher anticipated profits and increased dividends could support positive sentiment and potentially act as a catalyst for the share price. At the same time, the company’s slow revenue and earnings growth versus the broader Japanese market, coupled with thin cash flow coverage of the dividend, remain important risks. With these profit upgrades, the near-term risk/reward calculus has shifted, but cautious eyes may still linger on sustainability and leverage.

However, investors should not overlook concerns around Hulic’s dividend coverage and reliance on asset sales.

Exploring Other Perspectives

Explore another fair value estimate on Hulic - why the stock might be a potential multi-bagger!

Build Your Own Hulic Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hulic research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hulic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hulic's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hulic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3003

Hulic

Engages in the holding, leasing, brokerage, and sale of real estate properties in Japan.

Established dividend payer and good value.

Market Insights

Community Narratives