- Japan

- /

- Real Estate

- /

- TSE:1878

Does Daito Trust Construction's ¥140 Billion Syndicated Loan Signal a Shift in Growth Ambitions for TSE:1878?

Reviewed by Simply Wall St

- Daito Trust Construction Co., Ltd. has approved entering into a syndicated loan agreement totaling ¥140.0 billion, arranged by Sumitomo Mitsui Banking Corporation with co-arrangers MUFG Bank and Mizuho Bank, to refinance existing debt and fund expansion of its real estate development business.

- This financing, structured into four tranches and featuring interest rates tied to TIBOR, highlights a major capital commitment and signals active growth ambitions within the company.

- We'll explore how this significant move to secure large-scale financing for business expansion may influence Daito Trust Construction's investment story.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Daito Trust ConstructionLtd's Investment Narrative?

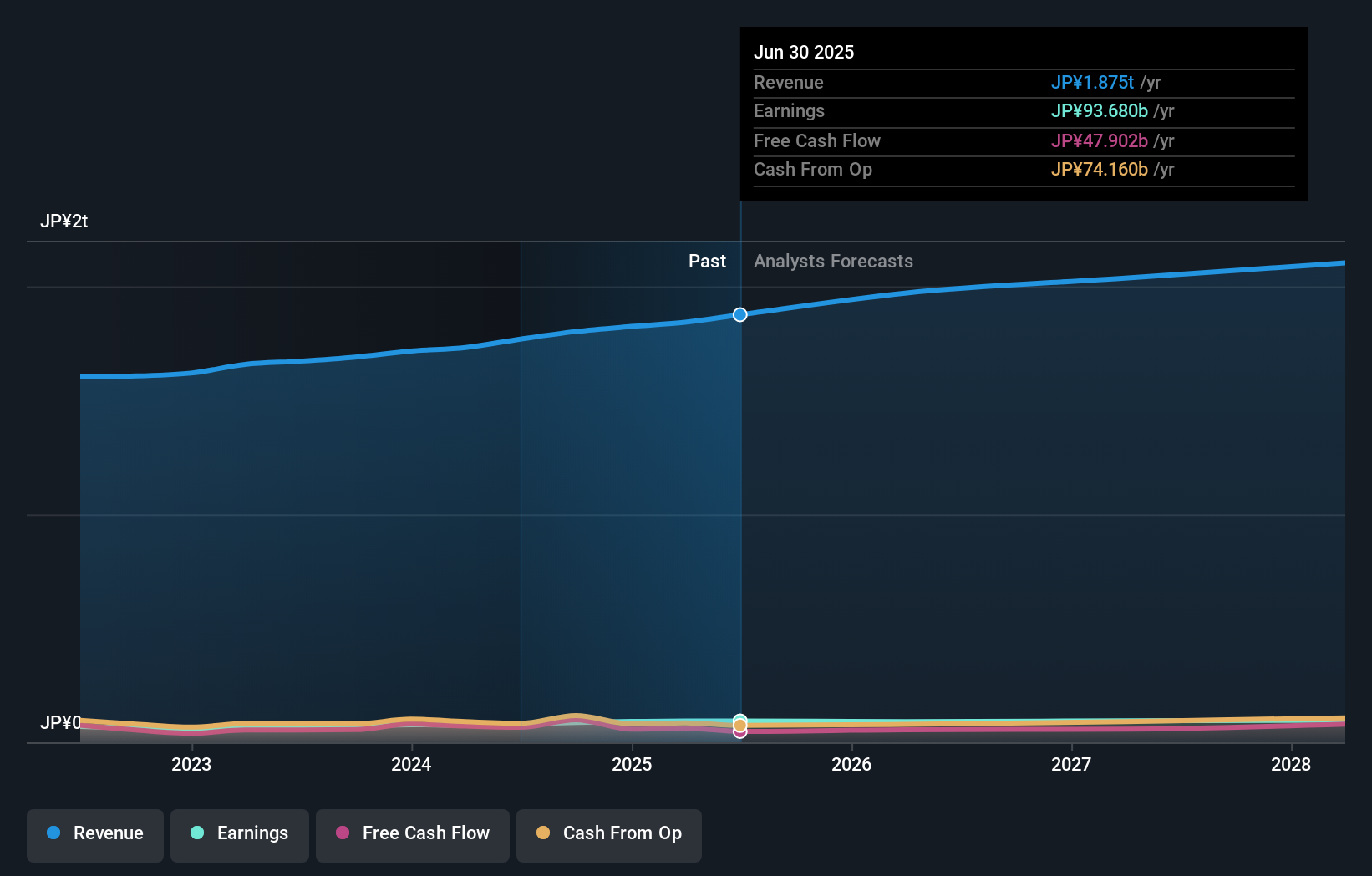

To be a shareholder in Daito Trust Construction, you need to believe in the company's ability to leverage both its stable fundamentals and new growth ambitions. The recently approved ¥140 billion syndicated loan highlights a tangible capital commitment intended to both refinance previous debt and support real estate development expansion. Before this announcement, Daito Trust's key catalysts centered on moderate revenue and earnings growth, strong return on equity, and undervaluation relative to fair value estimates. The company’s past steady profit growth and shareholder returns signal resilience, but slow forecasted profit growth and the recent dividend guidance cut were key risks. Now, the substantial new financing introduces fresh short-term catalysts: accelerated project development and potential for enhanced competitiveness. However, it also raises the stakes on execution risk and debt management, making future results and financial discipline more important than ever in the investment thesis. On the other hand, rising debt could limit flexibility if business conditions turn.

Daito Trust ConstructionLtd's shares have been on the rise but are still potentially undervalued by 29%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Daito Trust ConstructionLtd - why the stock might be worth as much as ¥16804!

Build Your Own Daito Trust ConstructionLtd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Daito Trust ConstructionLtd research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Daito Trust ConstructionLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Daito Trust ConstructionLtd's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1878

Daito Trust ConstructionLtd

Designs, constructs, and rents apartments and condominiums in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives