Otsuka Holdings (TSE:4578): Is the Recent Uptrend Backed by Strong Valuation?

Reviewed by Simply Wall St

Otsuka Holdings (TSE:4578) has been catching the eye of investors lately, with its share price nudging upward over the past month. There doesn’t appear to be a single dramatic announcement moving the market. Still, this steady climb always raises a question: are we seeing the start of something more substantial, or is this just a breather before another shift? When a stock quietly gains ground without a clear catalyst, it often sparks conversations about what the market might know or think it knows.

Looking at the broader picture, Otsuka Holdings has put up a respectable performance. Shares are up over 6% in the past year with a stronger push of 16% in the past three months, building on an impressive three-year run. That positive momentum persists even as annual revenue saw only modest growth and net income dipped, showing there is more to the story than bottom-line results alone.

So the big question for investors: with gains stacking up this year, is Otsuka Holdings undervalued at these levels, or is the market already anticipating the company’s next phase of growth?

Most Popular Narrative: 8% Undervalued

The most widely followed valuation narrative sees Otsuka Holdings as undervalued, building its case on future growth drivers that could push profits higher than current market expectations.

Otsuka's pharmaceutical segment is benefiting from strong growth in CNS and specialty drug franchises like REXULTI and JYNARQUE, supported by rising global healthcare demand for mental health and chronic disorder therapies. This sets the foundation for sustained revenue growth and high net margins as the patient pool expands.

Want to know the growth blueprint driving this bullish price target? The secret is a mix of fast-growing franchises, targeted expansion bets, and bold profit forecasts the market may not expect. Curious about which assumptions analysts believe will unlock big value? The real story lies in the aggressive future profit multiple and ambitious margin targets that underpin this model.

Result: Fair Value of ¥9,282 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, elevated research spending and potential patent expirations on key drugs still loom as possible challenges that could quickly shift the current outlook.

Find out about the key risks to this Otsuka Holdings narrative.Another View: Discounted Cash Flows Take the Spotlight

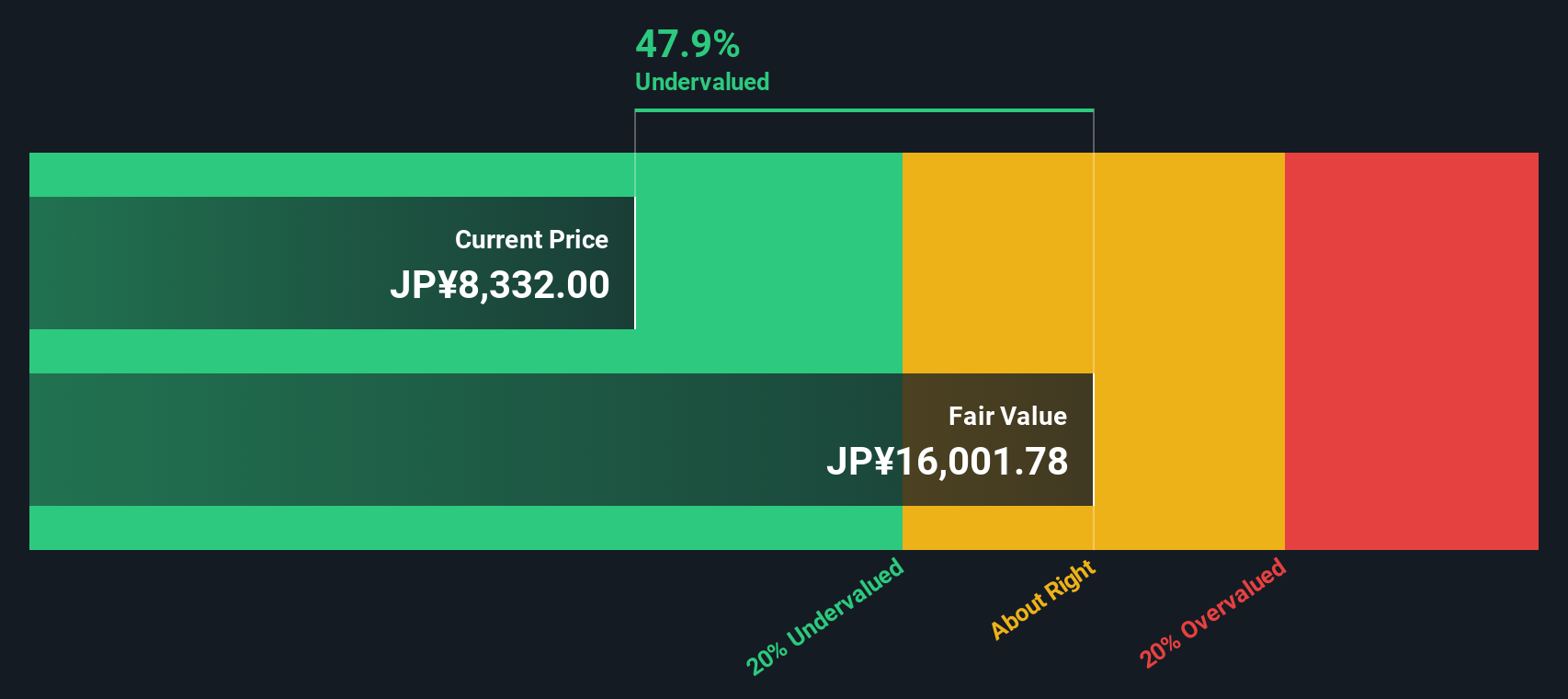

Our DCF model also points to Otsuka Holdings being undervalued, even after factoring in projected future cash flows and risks. Does this second perspective signal deeper opportunity, or are markets ignoring subtle pitfalls?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Otsuka Holdings Narrative

If you want a fresh perspective or like to dig into the numbers on your own terms, you can quickly craft your own analysis in just a few minutes. Do it your way

A great starting point for your Otsuka Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Open up a world of fresh opportunities by putting the Simply Wall Street Screener to work for you. Don’t let potential winners pass you by. Your next great pick could be just one click away.

- Capture the upside of tomorrow’s most promising tech by starting your search among AI innovators at AI penny stocks.

- Tap into reliable returns by focusing on companies offering above-average yields with dividend stocks with yields > 3%.

- Seize value opportunities others may overlook and pinpoint stocks trading below their cash flow worth at undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:4578

Otsuka Holdings

Engages in the pharmaceuticals, nutraceuticals, consumer products, and other businesses worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives